- Get link

- X

- Other Apps

Why is my federal tax so high. The United States has a pay as you go federal income tax.

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Its called a payroll tax because it takes money out of employees paychecks every pay cycle.

Why is federal tax so high. Taxpayers can avoid a surprise at tax time by checking their withholding amount. Why is so much taken out of my paycheck. Is it better to claim 1 or 0.

So it will be something new that. The taxable income is just for the regular income tax on line 16. Tax refunds are a return of the money you overpaid in taxes.

Even if tax rates havent changed your withholding might go up when you get a raise. Relatively speaking the income taxes in the US are not high. The federal income tax is a pay-as-you-go tax.

There might be a couple of reasons contributing to an extremely high tax bill. The more allowances you take the less federal income tax the government will take out of your paycheck. You also owe self employment tax of about 4683 on the Net Profit on Schedule C.

Taxpayers pay the tax as they earn or receive income during the year. The inflation adjustments of the IRS are meant to keep federal taxes in line with inflation so it pays to know the latest figures which you can use to thoughtfully plan for the 2020 tax. Why is my federal income tax withheld so high.

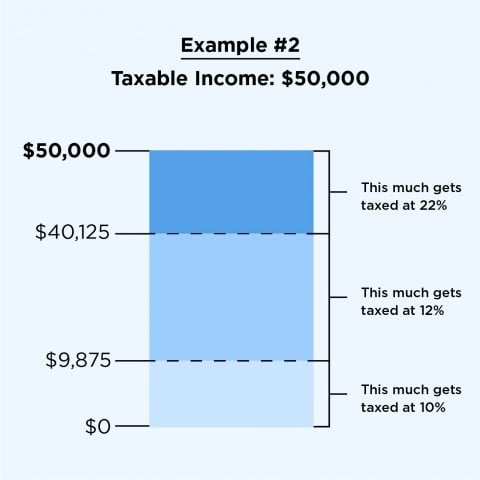

At the Urban-Brookings Tax Policy Center. The federal income tax is a progressive tax which means that as you earn more you pay a higher rate. Heres an overview of the percentage of your paycheck withheld for federal taxes why so much comes out of your pay where that money goes and what can be done to change the deducted amount.

The largest withholding is usually for federal income tax. But if you were significantly off the mark on your tax payments youll likely owe money to the IRS. Even if tax rates havent changed your withholding might go up when you get a raise.

Even so the rest of the tax spectrum was still rather high compared to today -- for example a married couple earning an inflation-adjusted 255000 in 1963 was in the 50 tax bracket. This means you must pay your income taxes to the IRS throughout the year instead of paying the whole amount due on April 15. If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the.

For example underpaying throughout the year can result in a tax underpayment penalty. The federal income tax is a progressive tax which means that as you earn more you pay a higher rate. If you paid at least 90 of your taxes the fee is waived.

28 with the average refund check totaling 3064. This includes anyone who receives a pension or annuity. The IRS issued 455 million refunds through Feb.

SE tax is on the 1040 Schedule 2 line 4 which goes to 1040 line 23. Many will owe taxes to the federal government and their state this spring. When it comes time to filing your taxes at the end of each year the amount already taken out will go towards the total you owe.

FICA taxes are currently more than 75 percent of everyones paycheck until you reach a cap. The IRS urges everyone to do a Paycheck Checkup in 2019 even if they did one in 2018. It is the Federal Insurance Contributions Act Tax which is comprised of Social Security and Medicare taxes.

Why bonuses are taxed so high It comes down to whats called supplemental income Although all of your earned dollars are equal at tax time when bonuses are issued theyre considered.

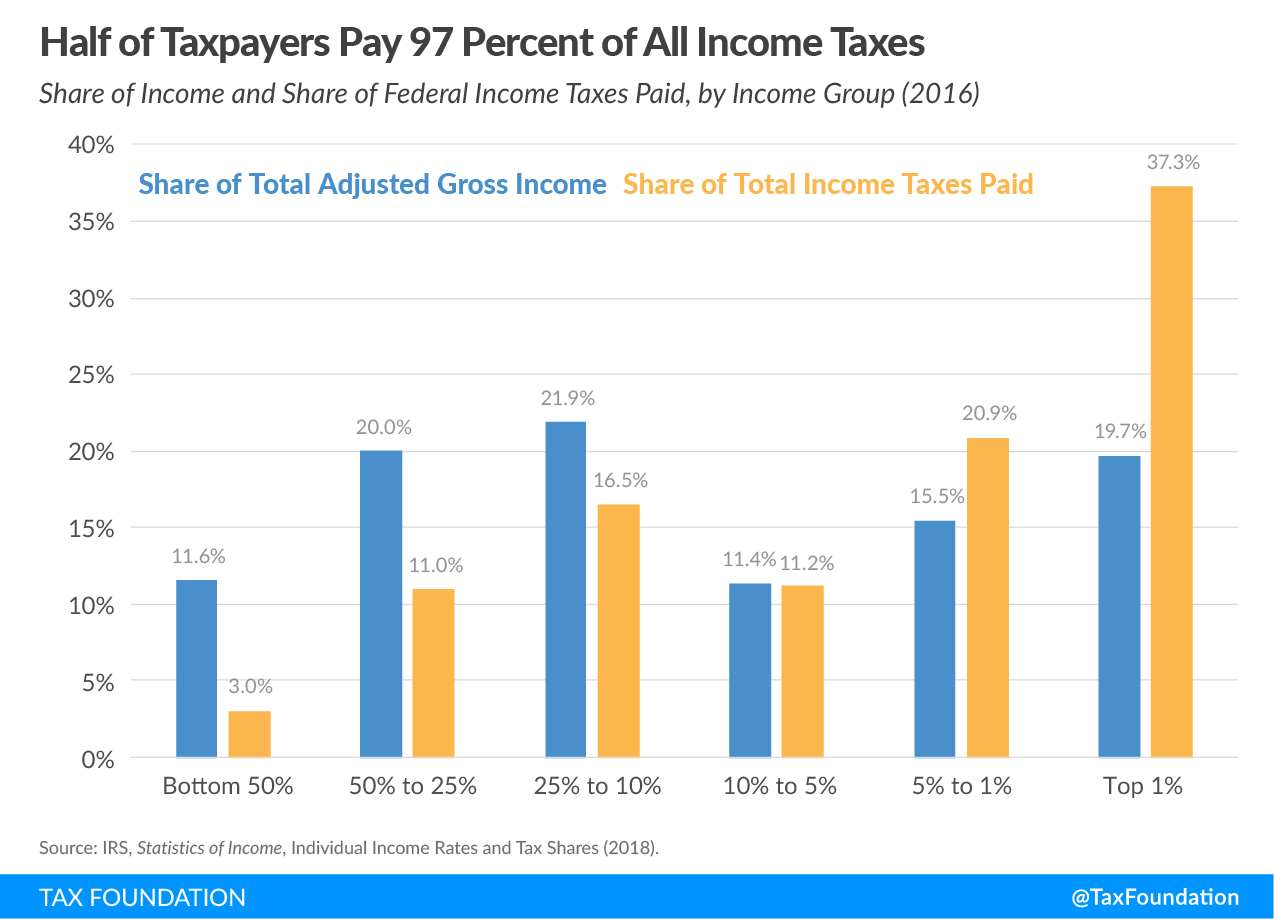

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

The History Of Taxes Here S How High Today S Rates Really Are

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

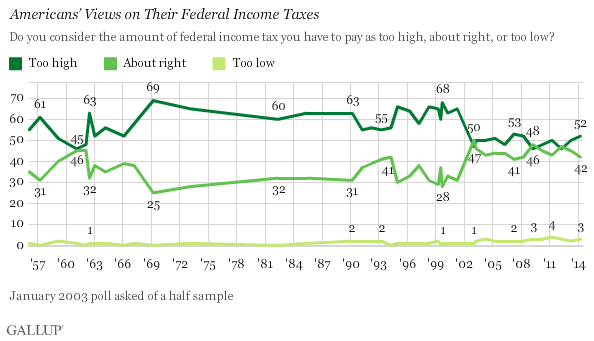

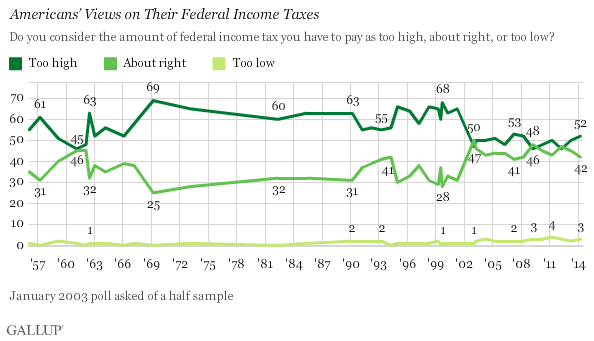

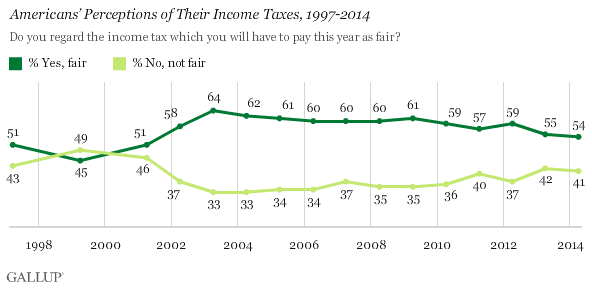

More Than Half Of Americans Say Federal Taxes Too High

More Than Half Of Americans Say Federal Taxes Too High

Federal Income Taxes East High School

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

More Than Half Of Americans Say Federal Taxes Too High

More Than Half Of Americans Say Federal Taxes Too High

Why Are Taxes So High In The Us Quora

Who Pays Income Taxes Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

Are Federal Taxes Progressive Tax Policy Center

Are Federal Taxes Progressive Tax Policy Center

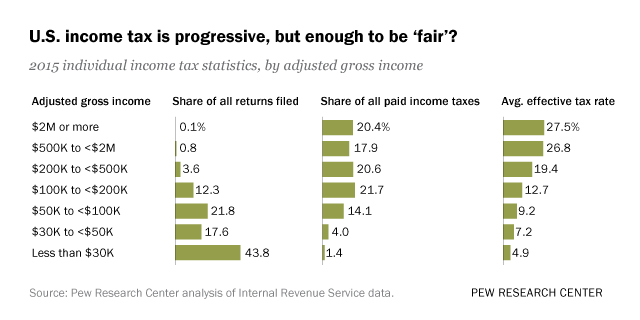

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

Why Are Taxes So High In The Us Quora

Comments

Post a Comment