- Get link

- X

- Other Apps

The 20 that OnlyFans taxes is a business expense that can be claimed when you file your taxes. OnlyFans Tax Premium Subscription Friendly Tax Services Premium Content Certified Public Accountants Over just the past few months OnlyFans has blasted into the mainstream culture with rocketing user rates.

Onlyfans Taxes How To Do Taxes For Onlyfans Roula Mindbodylife Youtube

Onlyfans Taxes How To Do Taxes For Onlyfans Roula Mindbodylife Youtube

I made an only fans a few months ago I dont have an abn or want to make one do I need to be paying tax on the money Im making and if I.

Only fans tax. OnlyFans will keep the W-9 and use it to set up their tax reporting they dont send it to anyone else. You may also qualify for tax deductions so that your tax bill can be reduced. I have informed him that this income will be subject to income tax but he says hes been told by someone at OnlyFans that is should not be.

Answers are correct to the best of my ability at the time of posting but do not constitute legal or tax advice 0. Once you know that profit you find your Social Security and Medicare taxes. Yes set aside at least 20-30 of your earnings to start with because you WILL have to pay tax on this income.

Income From OnlyFans and Patreon What are the Tax Issues. Onlyfans - do I have to pay taxes. Ask questions share your knowledge and discuss your experiences with us and our Community.

The potential for huge income has encouraged some people to leave their jobs to become full-time content creators with. Form that you will use to file your taxes. Save ALL receipts both offline and online.

Unless onlyfans or Snapchat withholds taxes from your payments then its considered self employment and taxed at 153 at the end of the year. For you itll be your profit 09235 0153 which is about 141 of your profit. Tax Memo OnlyFans Content Creator Income Is Taxable Include It On Your Tax Returns.

It would lower your taxable income. A potential artist client has come to me who makes most of his money from art commissions but he also posts his art on OnlyFans and has made a reasonable amount of money from subscribers. By Tax Blog In Federal Filings Finance Accounting International Taxes IRS Audits LLCs and Corporations Taxation Posted September 25 2019.

If it was in 2020 you can prepare a 2020 tax return in early 2021. Self-employed persons in the UK will pay a rate of 20 percent if you earn between the minimum amount and 50000. If playback doesnt begin shortly try restarting your device.

As a premium content creator you will be receiving income from a source other than earned wages or salaries through the OnlyFans platform which will issue you a Form 1099-MISC Miscellaneous Income. Many OnlyFans Content Creators have contacted me with tax questions. You only made a small amount so you will not owe much--if anything.

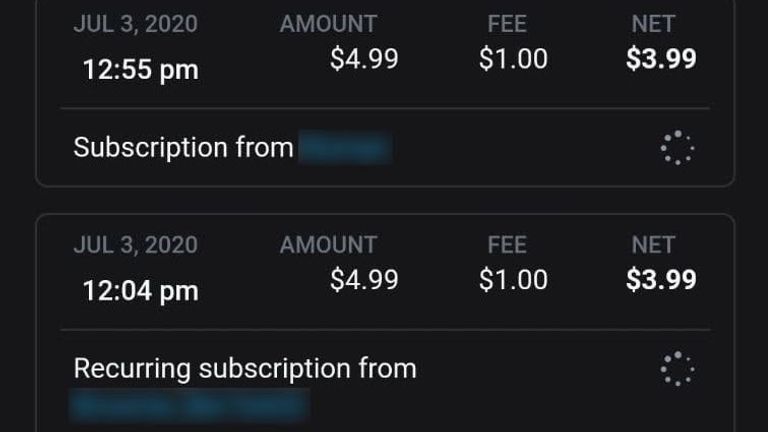

This is something that people often miss and so their tax bills are higher than they expected. Save 20-30 of your earnings to cover your tax bill. OnlyFans already takes 20 in commission and fees from performers earnings.

Its important to consider keeping your personal and business expenses separate if the goal is to pay a lesser tax bill. ATO Community is here to help make tax and super easier. If you earn a high income via OnlyFans youll want to set aside more.

The income made from OnlyFans is subject to income tax and maybe national insurance if you are not working through a company and content creators should be filing personal income tax returns with HMRC for the profit they make from. I highly doubt they withhold any taxes by the way would cost them time and money. You figure your profit from the OnlyFans business by taking your revenue and subtracting deductible business expenses involved in making that money.

Videos you watch may be added to the TVs watch history and influence TV recommendations. Thr 25 I suggest you set aside is specifically for paying taxes. OnlyFans is required to report to the IRS how much money they pass through to you using your tax number.

There are many aspiring entrepreneurs that earn a living running an account on OnlyFans Snapchat Patreon and many others. Generally the income on this form is subject to federal income tax and state income tax. If you are an OnlyFans content creator who resides in the United Kingdom youll need to earn at least 12500 before you need to pay any taxes.

Your OnlyFans net income will be subject to ordinary tax as well as self-employment tax. Well try your destination again in 15 seconds. If you have tax and accounting questions call me on 732-673-0510.

Self-employment tax is how business owners pay their FICA tax. You are an independent contractor to the IRS. Onlyfans will not send you any sort of income document so you just use your own records of how much you made.

OnlyFans does NOT withdraw taxes from your pay. OnlyFans Just a moment. 2021 OnlyFans Help About Contact Blog Branding Store Terms of Service DMCA Privacy How it works Referrals USC 2257 Acceptable Use Policy Complaints Policy Standard Contract between Fan and Creator.

OnlyFans will issue you a 1099 Misc. Since March OnlyFans has registered more than 35 million accounts according to Forbes.

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Is My Onlyfans Income Taxable Ocelot Accounting

Is My Onlyfans Income Taxable Ocelot Accounting

Onlyfans Could Be Hit With Bill For More Than Three Years Worth Of Unpaid Taxes Science Tech News Sky News

Onlyfans Could Be Hit With Bill For More Than Three Years Worth Of Unpaid Taxes Science Tech News Sky News

Onlyfans Is Fighting Against A Tax Bill Of More Than 10m Science Tech News Sky News

Onlyfans Is Fighting Against A Tax Bill Of More Than 10m Science Tech News Sky News

Onlyfans Could Be Hit With Bill For More Than Three Years Worth Of Unpaid Taxes Science Tech News Sky News

Onlyfans Could Be Hit With Bill For More Than Three Years Worth Of Unpaid Taxes Science Tech News Sky News

Whistleblower741 در توییتر Holbanel Just Reported Julia Holbanel To Revenueie No Issue With Her Using Her Sexuality To Earn Just Gotta Make Sure She S Paying Tax That Couple Of Grand In Onlyfans

Whistleblower741 در توییتر Holbanel Just Reported Julia Holbanel To Revenueie No Issue With Her Using Her Sexuality To Earn Just Gotta Make Sure She S Paying Tax That Couple Of Grand In Onlyfans

How To Use Onlyfans And Fill Out The W9 Form Youtube

How To Use Onlyfans And Fill Out The W9 Form Youtube

Onlyfans Do I Have To Pay Taxes Youtube

Onlyfans Do I Have To Pay Taxes Youtube

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Onlyfans Qa Taxes What My Bf Family Thinks Creepy Men How Much I Ve Made Big Announcement Youtube

Is My Onlyfans Income Taxable Ocelot Accounting

Is My Onlyfans Income Taxable Ocelot Accounting

Onlyfans Responds To Viral Tweet No We Re Not Stealing From Users

Onlyfans Responds To Viral Tweet No We Re Not Stealing From Users

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Memo Onlyfans Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

How To Complete A W 9 Tax Form 9 Steps With Pictures Wikihow

How To Complete A W 9 Tax Form 9 Steps With Pictures Wikihow

Comments

Post a Comment