- Get link

- X

- Other Apps

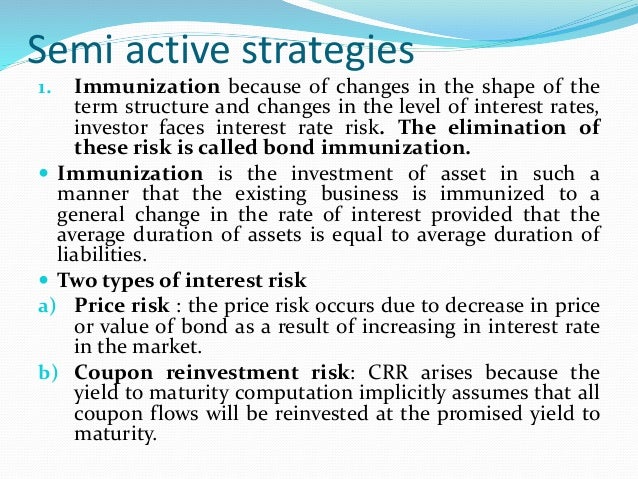

An investment style is the portfolio managers approach or objective when making choices in the selection of securities for a portfolio. The belief that excess returns can be achieved by correctly timing changes in yields andor yield spreads motivates active bond portfolio management strategies.

Though passive fixed income strategies have increased their share within certain market segments active portfolio management historically has outperformed across the bond spectrum and across a.

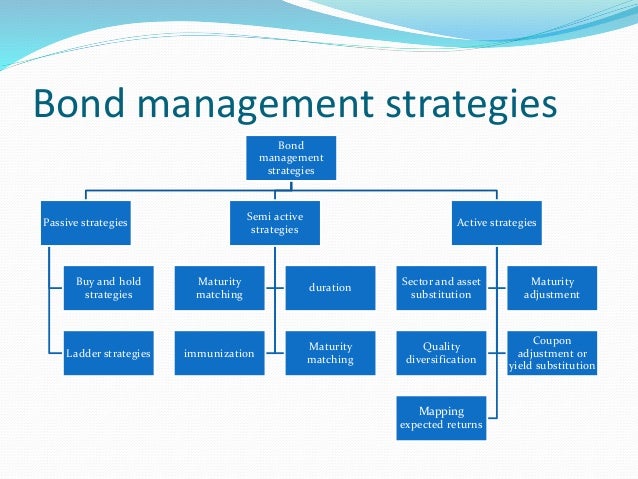

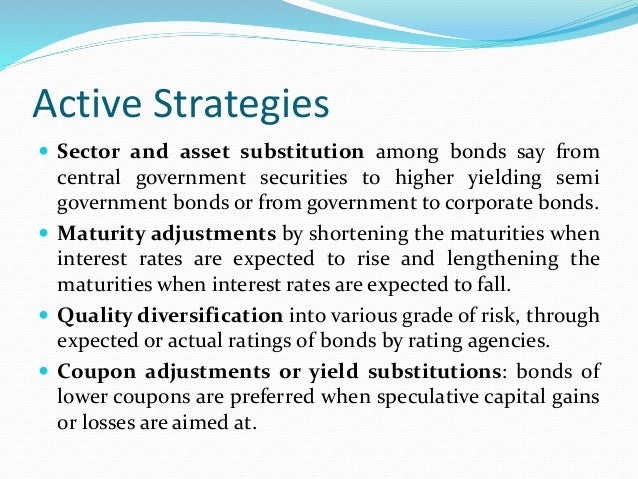

Active bond portfolio management. Active Strategies Sector and asset substitution among bonds say from central government securities to higher yielding semi government bonds or from government to corporate bonds. Taxable fixed-income markets governments corporates and mortgage- and asset-backed. Affects portfolios of bonds and can decide how to manage your bond portfolio given your objectives.

The belief that excess returns can be achieved by correctly timing changes in yields andor yield spreads motivates active bond portfolio management strategies. Bond Laddering in Passive Investing. The passive buy-and-hold investor is typically looking to maximize the.

Western Asset Active Bond GovernmentCorporate portfolios are discretionary fixed-income portfolios that offer to individual and taxable institutional investors tailored bond management that utilizes sector rotation between the major areas of the US. Taxable fixed-income markets governments corporates and mortgage- and asset. Within credit and duration parameters active managers seek to deliver a different risk and return profile.

In undertaking active strategies managers are motivated by the belief that they are able to. 000 2000 4000 6000 8000 10000 12000 02 4 6 8 10 Time Bond Price Price path if y5 for 10 years Price path if y unexpected shifts to. If an investor believes that future spot rates will be lower than corresponding.

Managers attempt to outperform the market by making predictions about how spot rates will change relative to the rates suggested by forward rate curves. Ladders are one of the most common forms of passive bond investing. Bond maturities are categorized as short- intermediate- and long-term.

Western Asset Active Bond Aggregate portfolios are discretionary fixed-income portfolios that offer to individual and taxable institutional investors tailored bond management that utilizes sector rotation between the major areas of the US. Active bond portfolio management often involves tactical shifts in allocations among different bond sectors or between long and short positions in maturity and credit spreads. Active bond portfolio management is built on the presumption that the current forward curve may not accurately predict future spot rates.

Optimal portfolio is chosen 15. The belief that excess returns can be achieved by correctly timing changes in yields andor yield spreads motivates active bond portfolio management strategies. In general their goal is to find bonds that are undervalued or to position the portfolio for anticipated changes in interest rates.

Actively managed portfolios also may offer a better fit with a clients objectives and risk tolerances than a passive approach can accomplish. Active portfolio management is simply that. Bond portfolio styles are classified according to the two most important characteristics of bond instruments.

Active Bond Portfolio Management Their objective is to outperform the bond markets return or to generate abnormal returns or preserve capital. The deck chairs but across currencies commodities precious metals thematic ETFs and other forms of alternative investment. Although not the first management company to introduce a bond ETF -- both iShares and Fidelity came to market earlier -- PIMCOs entry into active ETF management of a bond portfolio is significantFirst of all anything PIMCO does has a certain significance -- it is a huge company with well over 221 trillion under management as of December 31 2020.

Top 4 Strategies for Managing a Bond Portfolio Passive Bond Management Strategy. Active management strategies Take advantage of market scenario Requires major time to time adjustment or changes in portfolio The goal is to maximize total return but at increased risk Requires continuous analysis and observation on the part of portfolio manager. Our solution is relatively simple.

Active fixed-income portfolio managers work under the assumption that 1 market inefficiencies arbitrage opportunities exists and 2 they possess superior knowledge skills information The active management strategies. Maturity and credit quality. We focus on generating alpha in portfolios through active management.

Understandably this has investors questioning whether bonds are useful diversifiers in portfolios especially if bond yields have minimal airspace to fall. We go where the markets go long or short across not just stocks and bonds ie. Maturity adjustments by shortening the maturities when interest rates are expected to rise and lengthening the maturities when interest rates are expected to.

Actively Managed Funds Actively managed funds are those with portfolio managers who try to choose bonds that will outperform the index over time and avoid those they see as likely to underperform.

Chapter 19 Bond Portfolio Management Strategies Ppt Video Online Download

Chapter 19 Bond Portfolio Management Strategies Ppt Video Online Download

Pdf Gains From Active Bond Portfolio Management Strategies

Pdf Gains From Active Bond Portfolio Management Strategies

Bond Portfolio Management Strategies

Bond Portfolio Management Strategies

Bond Portfolio Management Strategies

Bond Portfolio Management Strategies

Bond Portfolio Management Ppt Video Online Download

Bond Portfolio Management Ppt Video Online Download

Active Bond Portfolio Management Overview Advantages Risks

Active Bond Portfolio Management Overview Advantages Risks

Bond Portfolio Management Strategies

Bond Portfolio Management Strategies

Ppt Active Bond Portfolio Management Strategies Powerpoint Presentation Id 374416

Ppt Active Bond Portfolio Management Strategies Powerpoint Presentation Id 374416

Chapter 23 Active Bond Portfolio Management Strategies Ppt Download

Chapter 23 Active Bond Portfolio Management Strategies Ppt Download

The Cfa Experience Bond Portfolio Management Strategies Fixed Income Level Iii

The Cfa Experience Bond Portfolio Management Strategies Fixed Income Level Iii

Active Bond Portfolio Management Strategies Security Analysis And Portfolio Management Solved Quiz Docsity

Active Bond Portfolio Management Strategies Security Analysis And Portfolio Management Solved Quiz Docsity

Comments

Post a Comment