- Get link

- X

- Other Apps

If the overwhelming opinion among investors is that a stock is going to fall that opinion becomes a self-fulfilling prophecy as investors sell shares. When you build a portfolio one of the first decisions to make is choosing how much of your money you want to invest in stocks vs.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

Somebody with 40 years to go before retirement will likely.

When to invest in bonds vs stocks. Bonds could be used to help you maintain potential stability as well as receive regular income. Bonds are not nearly as. If you think stocks are expensive you can hold some money in bonds and protect it until stocks are a better value and youll earn a higher interest rate than what youd get from savings.

Investing in certain sectors of the bond market such as US. We will also compare bonds with stocks and look through. Pros and Cons of Investing in Stocks vs.

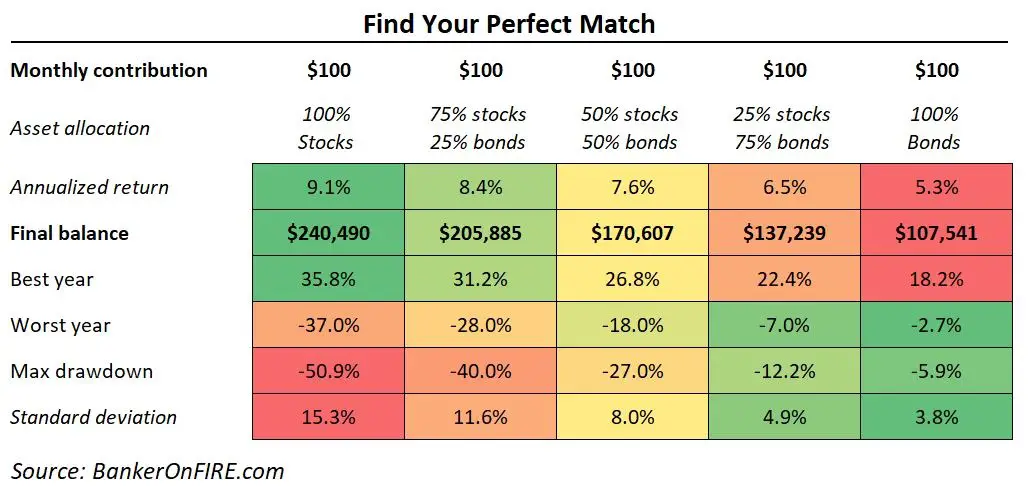

The right answer depends on many things including your experience as an investor your age and the investment philosophy you plan on using. The allocation between stocks and bonds typically changes as your investing horizon draws closer. In general both stocks and bonds can be used in a diversified investment portfolio.

Bonds have become more popular in recent years thanks to the past volatility of the market and ensuing apprehension about investing. Each has its own purpose in your portfolio. Stocks could potentially help you grow your wealth and boost your portfolio value.

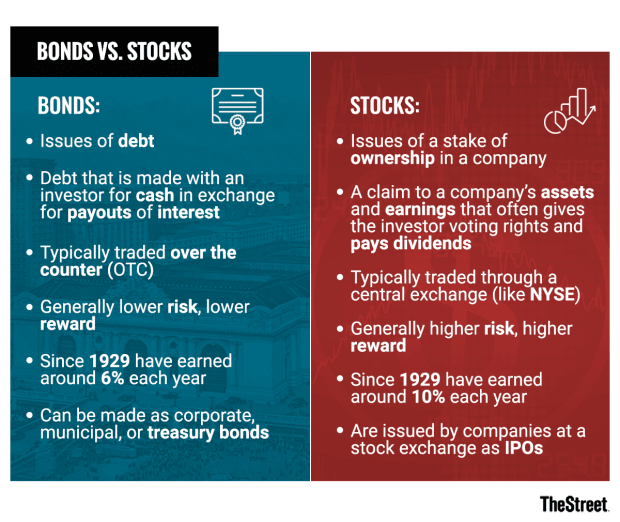

You have three main choices when it comes to investments in a brokerage account or retirement plan. Pros and Cons of Stocks The biggest pro of investing in stocks over bonds is that history shows stocks tend to earn more than bonds - especially long term. Thats because stock values are at the mercy of investor opinion.

Stocks carry greater risk and higher possibility of return while bonds carry less risk and less return. We will look at understanding bonds for beginners and how to make money with bonds notes and bills. Stocks and bonds are both suitable for investors who want to build a nest egg for retirement but their suitability and the appropriate allocation in investment portfolios largely depend on the age.

Some of the benefits youll enjoy when investing in bonds include. Bonds are safer investments than stocks. Your Allocation Will Change Over Time.

For instance in Pages model portfolios youd allocate 15 to bonds in the 20 years before retirement 45 at retirement and 69 some. Both bonds and stocks are important elements of a diversified investment portfolio. Bonds Bonds give you a better rate of return than a savings account.

Pros of bond investing also include protecting a part of your portfolio from a stock crash so you can take advantage of lower stock prices when they come along. Feb 20 2018 at 354PM. Stocks bonds or cash.

There is no one-size-fits-all answer to. Theyre considered a more conservative investment than stocks because unless the lending company goes completely bankrupt youll get the interest rate that you agreed to when you bought the bond. Additionally stocks can offer better.

Most people will benefit from a long-term investing strategy. Treasury securities is said to be less risky than investing in stock markets which are prone to greater volatility.

Stocks Vs Bonds What S The Difference

Stocks Vs Bonds What S The Difference

Bonds Vs Stocks Overview Characteristics Example

Bonds Vs Stocks Overview Characteristics Example

Stocks V S Bonds Money Management Advice Investing Real Estate Investment Trust

Stocks V S Bonds Money Management Advice Investing Real Estate Investment Trust

Bonds Vs Stocks What S The Difference Thestreet

Bonds Vs Stocks What S The Difference Thestreet

Investing In Bonds Vs Stocks Echelon Im

Investing In Bonds Vs Stocks Echelon Im

Coronavirus Crash Should You Buy Bonds Right Now The Motley Fool

Coronavirus Crash Should You Buy Bonds Right Now The Motley Fool

Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

Bonds Vs Stocks Which Is The Safest Type Of Investment Investing Investing Money Loan Money

Bonds Vs Stocks Which Is The Safest Type Of Investment Investing Investing Money Loan Money

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

Bonds Vs Stocks Where To Invest In 2021

Bonds Vs Stocks Where To Invest In 2021

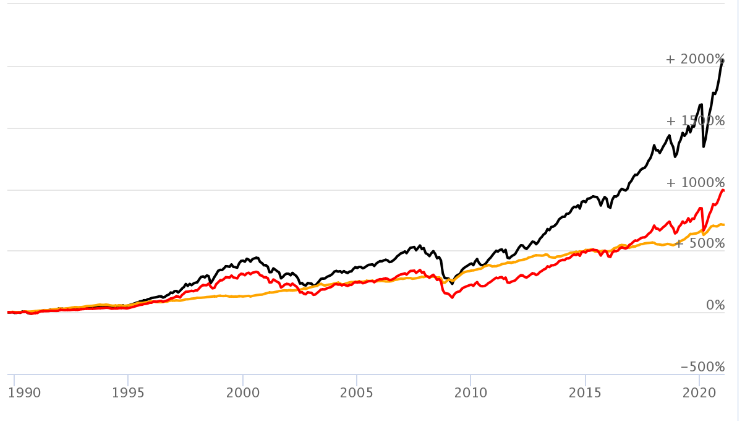

Bonds Vs Stocks What 30 Years Of Performance Means For Your Portfolio

Bonds Vs Stocks What 30 Years Of Performance Means For Your Portfolio

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

Comments

Post a Comment