- Get link

- X

- Other Apps

Paying cash for a house enables you to use that money for your home purchase and nothing more. Theyll typically offer 50 to 70 of a homes fair market value.

14 Benefits Of Accepting A Cash Offer On Your House Homego

14 Benefits Of Accepting A Cash Offer On Your House Homego

The opportunity cost of spending cash Whether or not you pay cash for a large purchase or finance it there are costs in addition to the price of the asset.

Cash financing for house. While its true that all transactions lead to cash in the end the realities of financing place obstacles between buyers. One option is to save 70000 as a 20 down payment for your dream home and use the rest of your cash to purchase an investment home in a nearby neighborhood. 1 Borrow from Hard Money Lenders The first option for financing an auctioned property is to borrow the cash from hard money lenders in your area.

Remember even if you take out a 30-year mortgage it doesnt mean you are obligated to spend the entire 30 years paying it off. A cash offer refers to an all-cash offer made by a purchaser to the seller of a real estate property. Its a good move to.

The first step to purchasing a house with cash is to make sure you have the cash together in one place. If the cash required to buy a home outright represents most of. Once you lock in the purchase of the home that money is inaccessible unless you decide to refinance the property or take out a home equity loan.

If it will take you a decade or longer to save enough money to pay cash for a home you may want to consider financing so that you can become a homeowner sooner. An all-cash offer is one way to stand out and speed up the process. But if your cash is socked away in various places like stocks or money market.

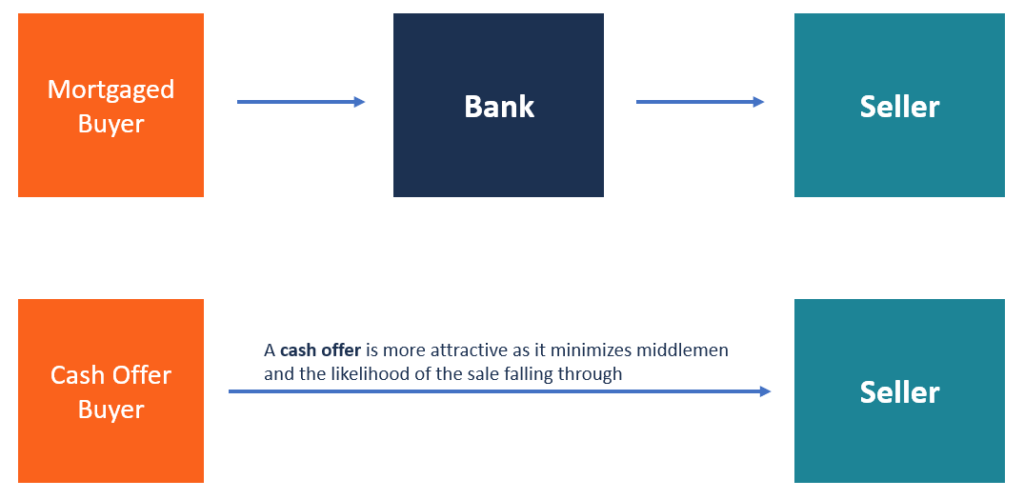

The purchaser does not need a mortgage or any other type of financing to complete the transaction. Disadvantages of Paying All Cash for Your Home 1. A cash offer is simply a sale in which the buyer offers the seller the entire cost of the house without using financing such as a mortgage loan.

The home-buying process can be slow and cumbersome especially if youre trying to buy in a hot market and competing with other buyers. A cash offer is when a home buyer offers a seller the entire cost of the house with no mortgage or any other type of financing involved. When you finance the cost is obvious.

But is the cash offer always the right answer for your home sale. From the sellers point of view it doesnt make much difference whether the cash comes from the buyers personal bank account or from a mortgage loan. A hard money loan is a specific type of loan through which a borrower receives funds secured by a real estate property.

Buyers often prefer cash offers even if theyre lower than an offer from a buyer with mortgage pre-approval. A cash buyer enjoys an advantage because the seller is interested in choosing a buyer who can close the transaction quickly without an uncertain underwriting. Get the cash together.

What makes a cash offer different. The transaction is faster and more straightforward than when a buyer is seeking financing. The strategy used by cash-for-homes companies is to negotiate the lowest price possible for your home.

If you live in a flat or declining real estate. Or when paying cash for a house will take too long. Other popular closing time frames are 45 and 60 days which are agreed upon by the buyer and seller and usually chosen to align with relocation plans or another real estate purchase.

The growth potential is therefore directly linked to your propertys ability to appreciate. 1 These buyers will sometimes take title subject to your existing loan meaning that theyll take over your mortgage payments. Youll be tying up a lot of money in one asset class.

The Advantage of Cash. Buying a house with cash. Paying cash for the full purchase price of a house is similar to investing in a bond that pays the same interest rate youd pay with a mortgage says James Bregenzer owner of Bregenzer Group.

Its the interest youll pay on the loan. A cash buyer will often receive a discount or be able to negotiate for one by paying up front for the home. When a buyer already has enough funds to purchase your home outright you can both avoid several long costly steps.

The typical closing time for a financed purchase one where the buyer is taking out a mortgage on the home theyre buying is at least 30 days. Weve all heard that cash is king but in any real estate transaction you need to determine the context of the offer and the ability of the home buyer to actually close. Maybe youve already got enough money sitting in a savings account waiting to spend on the perfect home.

As a rule a cash offer should always be considered because a failure to obtain financing is the main reason why most home. The associated contingencies which come with. A cash offer simply means that a buyer has the funds available to buy the house already in their bank and can pay for it without securing a mortgage loan.

These are typically issued by private investors or companies. A cash sale is more likely to go through as the house isnt subject to the red-tape and appraisal process that a lender will usually require. Depending upon the housing market you can likely get 1300 per month in rent which is almost the exact amount that youd need for your dream homes mortgage payments 130468.

You dont need an appraisal but you still might want one.

Delayed Financing An Uncommon Refinance Option For Cash Buyers Zing Blog By Quicken Loans

Delayed Financing An Uncommon Refinance Option For Cash Buyers Zing Blog By Quicken Loans

Financing An Investment Property Buying A Hotel

Buying An Investment Property Cash Or Mortgage Mashvisor

Buying An Investment Property Cash Or Mortgage Mashvisor

Financing Investment Properties Buying A House In Cash Vs Mortgage Mashvisor

Financing Investment Properties Buying A House In Cash Vs Mortgage Mashvisor

6 Proven Ways To Beat An All Cash Buyer American Financing

6 Proven Ways To Beat An All Cash Buyer American Financing

Cash Offer Overview How To Make An Offer Benefits And Drawbacks

Cash Offer Overview How To Make An Offer Benefits And Drawbacks

Buying A House With Cash Don T Forget These Expenses

Buying A House With Cash Don T Forget These Expenses

Down Payments Explained How Much Should You Pay Mint

Down Payments Explained How Much Should You Pay Mint

Maximize House Flipping Roi By Leveraging Cash On Hand With Hard Money Financing

Maximize House Flipping Roi By Leveraging Cash On Hand With Hard Money Financing

Mortgage Vs Cash Which Is The Better Option When Buying A Home The Truth About Mortgage

Mortgage Vs Cash Which Is The Better Option When Buying A Home The Truth About Mortgage

What Is Seller Financing Fortunebuilders

What Is Seller Financing Fortunebuilders

How To Buy A House With Cash Smartasset

How To Buy A House With Cash Smartasset

Finance A House Purchase In Australia Australia Property Guides

Finance A House Purchase In Australia Australia Property Guides

Buying A House With A Cash Offer And Simultaneously Getting Mortgage Financing Az Mortgage Brothers

Buying A House With A Cash Offer And Simultaneously Getting Mortgage Financing Az Mortgage Brothers

Comments

Post a Comment