- Get link

- X

- Other Apps

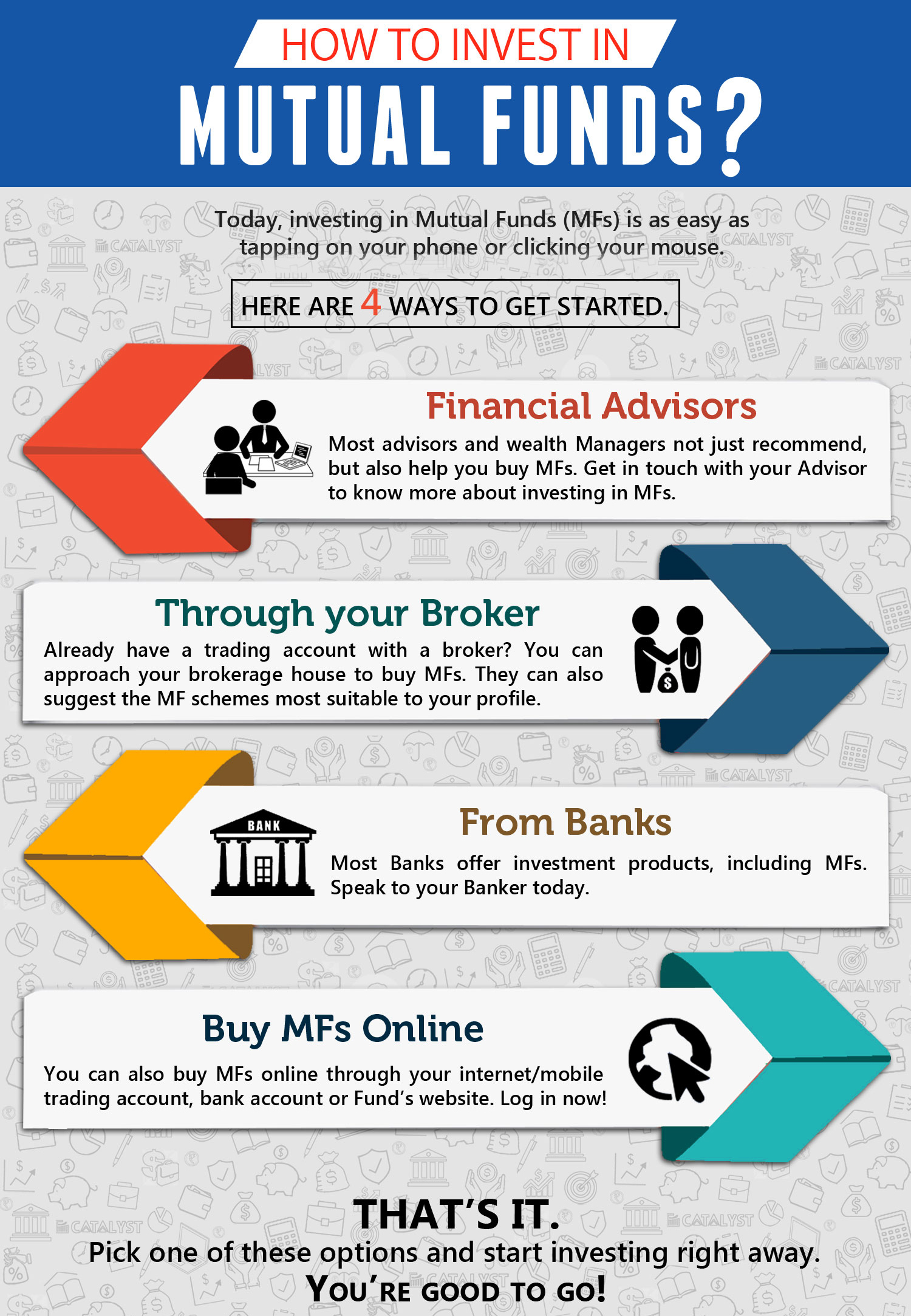

The fact is that mutual fund investments still havent become as mainstream an investment as they can be and that is because investors are worried about the risks involved. Investing through mobile apps is relatively easy and convenient.

How To Invest In Mutual Funds Ramseysolutions Com

How To Invest In Mutual Funds Ramseysolutions Com

If you are a retiree and looking to invest your money then Mutual Funds can give you lots of variety in comparison to sole investments in FD.

%20(19).png)

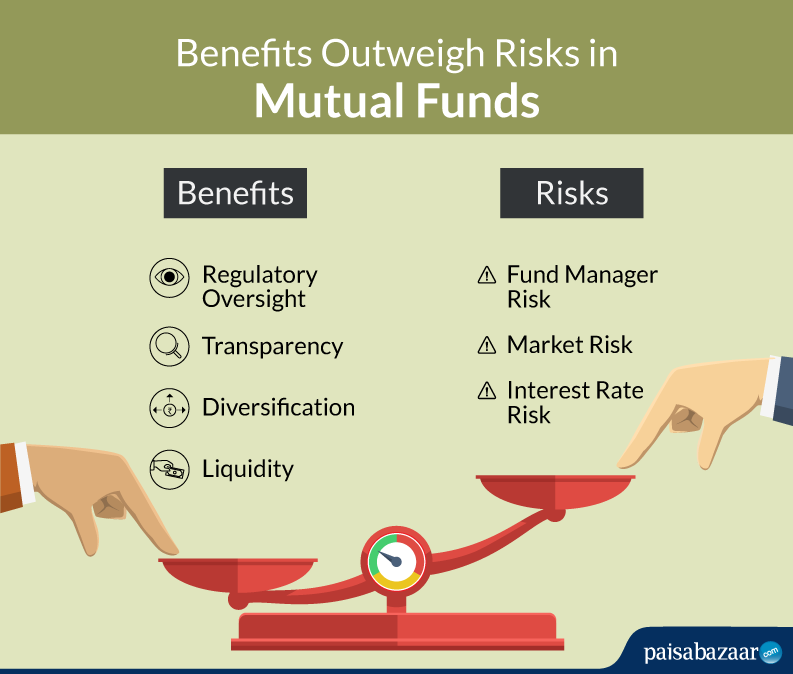

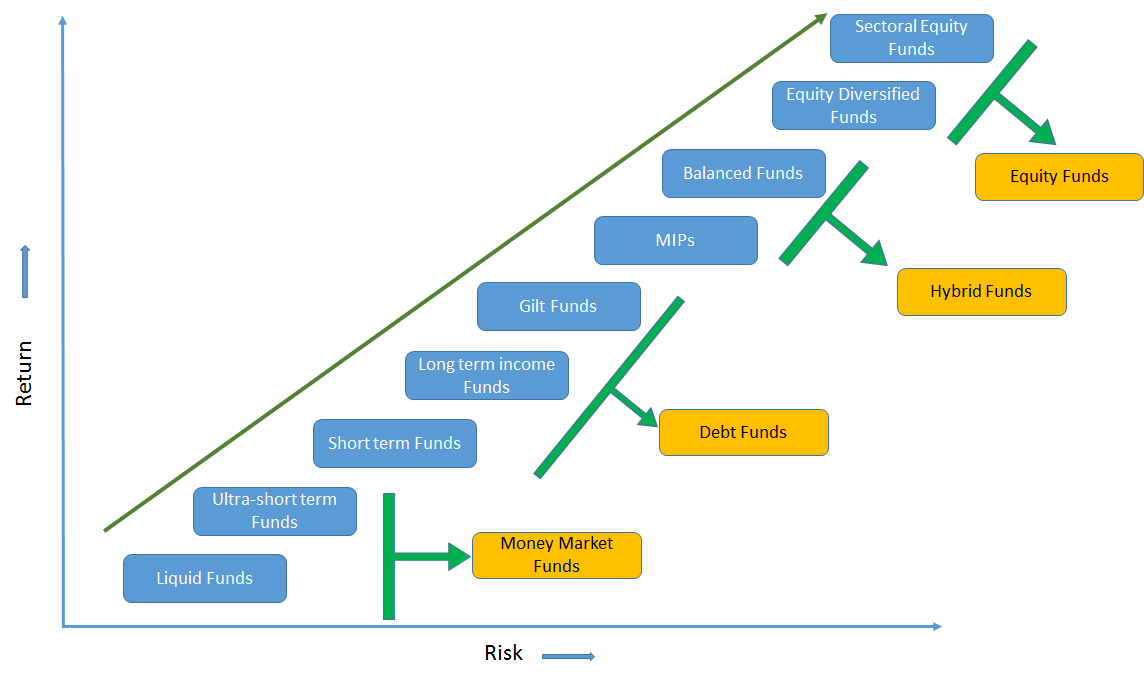

Is it safe to invest in mutual funds. Thus they help to minimize the losses in a down trending market. But mutual funds are still riskier as an asset category than government bonds and cash-equivalents such as certificates of deposit and money market accounts. Bond funds are generally less risky than stock mutual funds.

Thus you can invest in mutual funds with a small amount of capital. Mutual funds are considered relatively safe investments. Yes is a great investment method to grow and double out current your money.

Mutual funds are a safe investment if you understand them. You should choose the right mutual fund which is in sync with your investment goals and invest with a. Inexperienced people who directly enter the stock market may lose heavily at such times.

The best idea for investors is to find suitable bond funds hold them for the long term and try not to pay much attention to fluctuations. You do not need to go through the hassle of understanding foreign. Is mutual fund a safe investment.

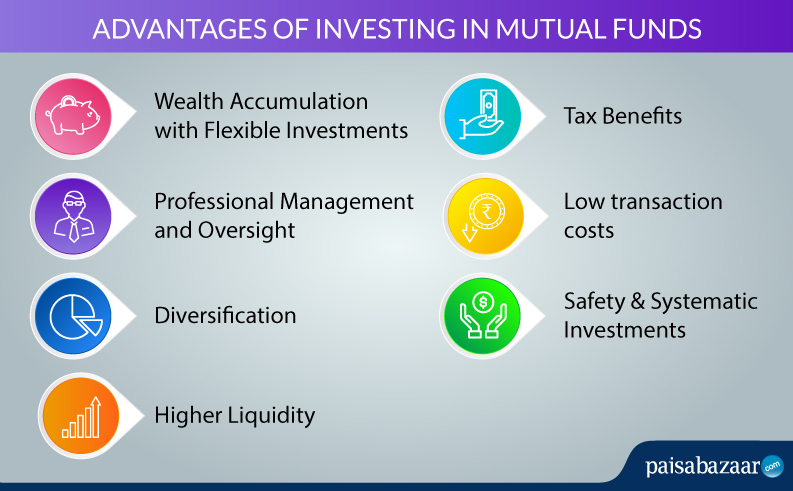

Generally Mutual Fund investment is an investment that buys and sells large volumes of securities allowing investors to avail benefits from the lower trading cost. There are numerous apps available in the market through which you can easily install and undeviatingly invest in mutual funds without any hassle. Always consult an investment advisor before you invest in Mutual Funds.

You can plan the investment in a better way as per your financial objectives and tax obligation. It makes mutual funds a lot safe compared to direct equity investment in few stocks or putting all the savings in a single piece of land. Lately again Is mutual fund is safe to invest 2020.

Is it absolutely safe to invest in Mutual Funds. As discussed earlier a mutual fund investor will not lose the invested money by any scams or a mutual fund company flying away with the money or merging with other mutual fund company. However mutual funds are considered a bad investment when investors consider certain negative factors to be important such as high expense.

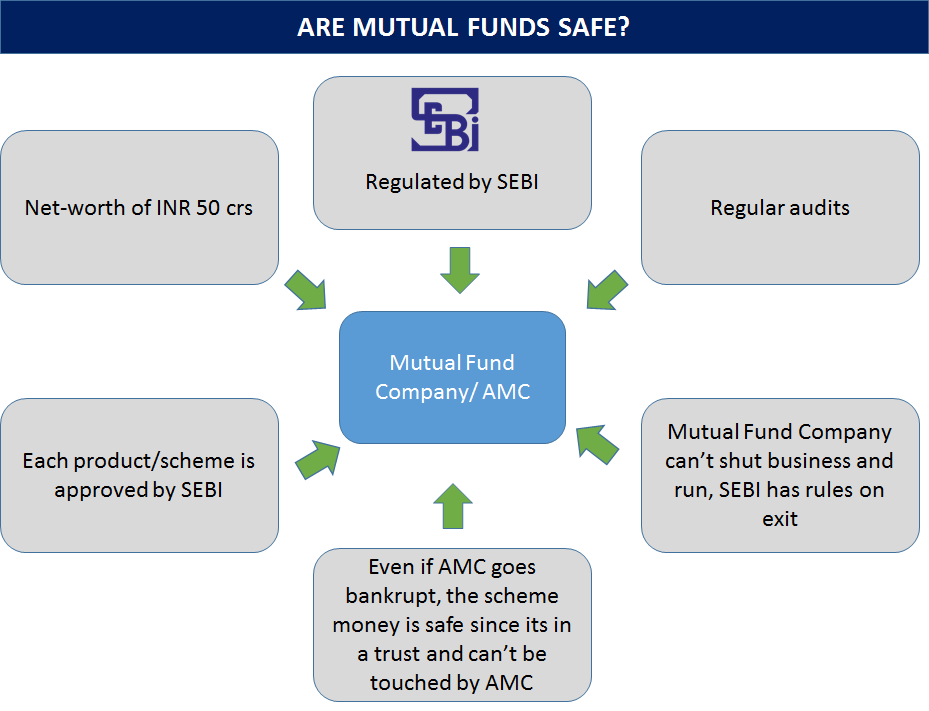

There is a possibility that the mutual funds. Mutual fund companies in India are regulated by the Securities and Exchange Board of India SEBI and the licence to run such as companies is accorded after the required due diligence by the. A Mutual Fund cannot invest more than 10 of its assets in a single stock.

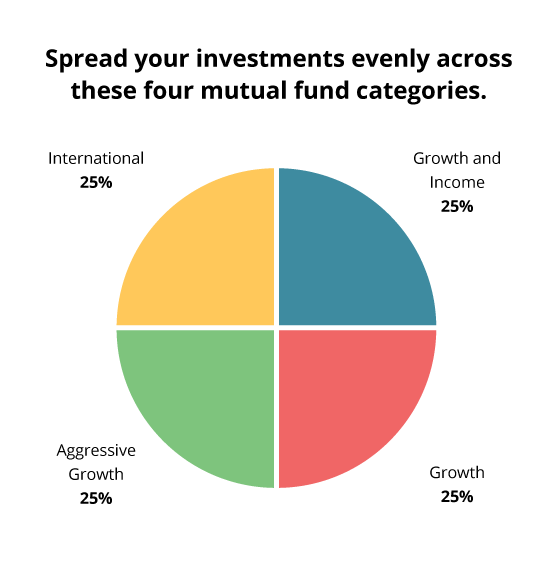

Mutual Funds are legal BUT The bitcoins and Crypto Currencies are illegal in India Till now. Investors should not be worried about the short-term fluctuation in returns while investing in equity funds. If You are investing in Mutual Funds then Diversified your investments such as in Large cap Mid Cap Small Cap Fund also.

But like Ive mentioned earlier several moments people get tense or stressing out from investing in Mutual Funds believing itll be lost or and to much of risky just because its directly linked to market so. In fact mutual funds and ETFs exchange-traded funds are probably the easiest way to gain exposure to foreign stocks from India. Choosing one Mutual Fund investment among these can be daunting for investors.

Whats important is to understand why mutual investment can be a better and a safer option as compared to the other investment vehicles. While you may be initially worried about where your money is going and if it has reached the intended recipient online mode of investment is as safe as any other mode. This is why it is smart to include both stocks and mutual funds in your investment portfolio.

5 Mutual Funds are legally required to reduce risk by investing in a diverse set of assets. Yestoinvestmentin this video you would get to know about the mutual fund and whom can invest in itand the returns of mutual fundindexfundsindia indexfu. Investing in Mutual Fundsonline is no different from that first flight.

Given below are the few reasons why it is safe to invest in Mutual Funds. There are several reasons to invest in a mutual fund. But investors are wise to understand that the value of a bond fund can fluctuate.

While mutual funds can never be separated from the risks involved in investing in them the returns offered by them will outweigh the risks involved. Mutual Funds are of three types- Equity Mutual Funds debt mutual fund and Balanced Mutual Funds. The beauty of investing in mutual funds is that you can buy one fund and obtain instant access to hundreds of individual stocks or bonds.

Mutual Funds hold diversified portfolios wherein a typical equity fund excluding sector funds will hold 20-40 stocks. Otherwise in order to diversify your portfolio you might have to buy individual securities which exposes you. But the question that comes to mind is which app is reliable and safe as you invest your hard-earned money in mutual funds.

However the mutual funds dont guarantee the capital protection and dont assure the returns.

Mutual Fund Investment Safe Or Not Invest In Best Mutual Fund

Mutual Fund Investment Safe Or Not Invest In Best Mutual Fund

Investing In Mutual Funds Vs Direct Equities 9 Differences You Shall Know

Investing In Mutual Funds Vs Direct Equities 9 Differences You Shall Know

Which Are The Safest Mutual Funds To Invest In From 2020 To 2021 Quora

Mutual Funds Best Investment Online Mutual Fund 14 May 2021

Mutual Funds Best Investment Online Mutual Fund 14 May 2021

How To Invest In Mutual Funds Jamapunji

How To Invest In Mutual Funds Jamapunji

Is It Safe To Invest In Mutual Funds How To Mitigate Risk In Mutual Funds

Is It Safe To Invest In Mutual Funds How To Mitigate Risk In Mutual Funds

How To Learn Mutual Funds Investment Quora

Know How To Choose Safe Mutual Funds Mutual Funds Sahi Hai

Know How To Choose Safe Mutual Funds Mutual Funds Sahi Hai

Is It Wise To Invest In A Mutual Fund Quora

Are Mutual Funds An Ideal Investment For The Small Investor

Are Mutual Funds An Ideal Investment For The Small Investor

%20(19).png) Are Mutual Funds Safe To Invest In

Are Mutual Funds Safe To Invest In

Mutual Fund Investment Safe Or Not Invest In Best Mutual Fund

Mutual Fund Investment Safe Or Not Invest In Best Mutual Fund

Mutual Funds Investment How Much Should I Invest In Mutual Funds To Build Rs 40 Lakh In 5 Years

Mutual Funds Investment How Much Should I Invest In Mutual Funds To Build Rs 40 Lakh In 5 Years

Advantages Of Investing In Mutual Funds Paisabazaar Com

Advantages Of Investing In Mutual Funds Paisabazaar Com

Comments

Post a Comment