- Get link

- X

- Other Apps

The Social Security number associated with your account. Letter of instruction for sending gifts outside of Fidelity Name address and Depository Trust Company DTC number of the bank The name of the banks contact person and the department handling the account Bank account number if applicable Full name and address.

Fidelity Rewards Visa Signature Card

Fidelity Rewards Visa Signature Card

Your e-gift card will be emailed to you via the email address that you have provided for your Fidelity account.

Fidelity gift account. With more money in the account to invest and earn returns your savings have the potential to grow faster to help you reach your goals. They may also be mailed or faxed to us. Contact Fidelity for a prospectus or if available a summary prospectus containing this information.

Your e-gift card will be sent to you within 90 days after the closure of the Offer 20th April 2020. Fidelity Charitable will never ask you for any personal information other than your username and password when logging into your Giving Account. Gifts sent to Fidelity accounts take one to four days to process.

Gifts sent to an account at a bank. High Fidelity is the perfect place to host your virtual gathering and getting set up is easy. Support the same charities you do now.

Wir kümmern uns mit einigen der besten Anlageexperten der Welt von Anfang bis Ende um Ihre Geldanlage - mit dem Ziel Ihr Geld langfristig zu. Fidelity is offering a 200 Apple Store Gift Card 500 commission-free trades good for 2 years and access to Active Trader Pro when you deposit 100000 into a non-retirement brokerage account good through December 31 2016. Usage of Fidelitys online trading services constitutes agreement of the Electronic Services Customer Agreement and License Agreement.

Zero account fees and minimums are available for retail brokerage accounts only. Fidelity representatives will not be able to assist you with a return of a gift. Below are links to helpful articles on using High Fidelity and to managing your space.

For Corporate Giving Accounts company-established organizational Giving Accounts for corporate philanthropy the minimum is 100000. If the account owner chooses to make a withdrawal from a 529 account for purposes other than qualified higher education expenses they will be subject to income taxes and a 10 federal penalty tax on any earnings. Gifts to a 529 account are considered completed gifts.

You can even donate the rewards from your Fidelity Visa Signature Card. Log in to GivingCentral. Gift Cards can be.

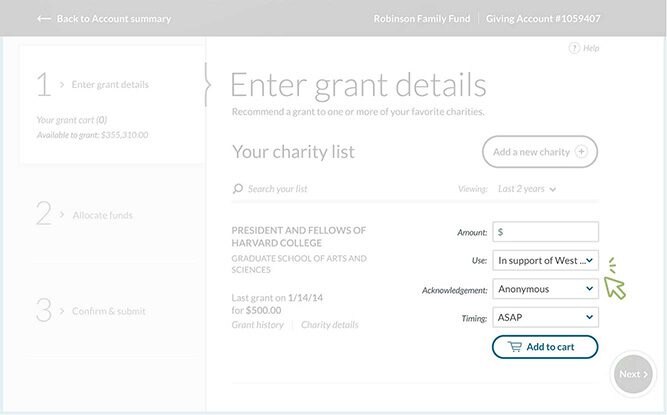

The Giving Account is a low-cost tax smart way to support charities while maximizing your impact. Fidelity Wealth Expert. Successor information if you choose to add it.

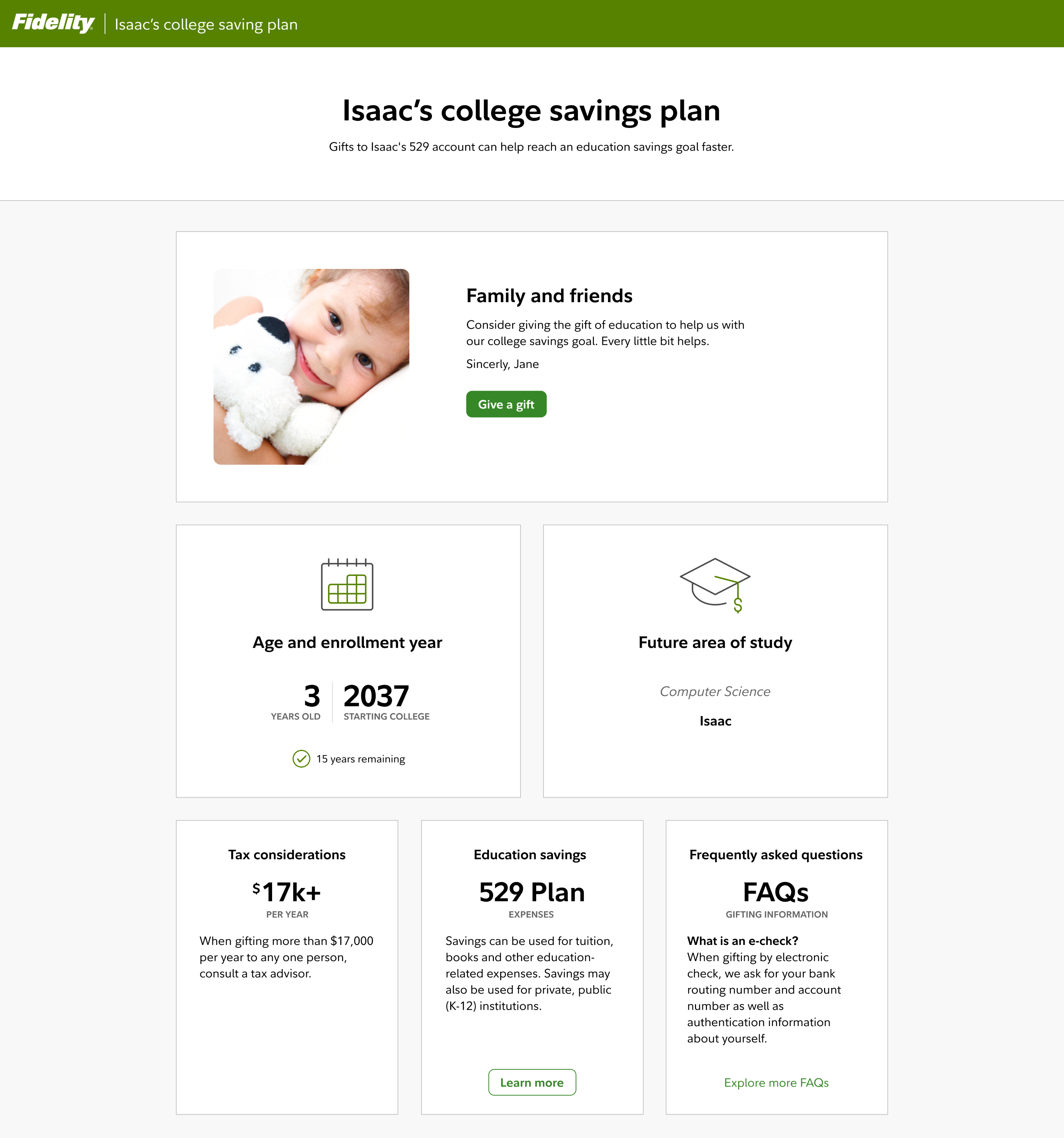

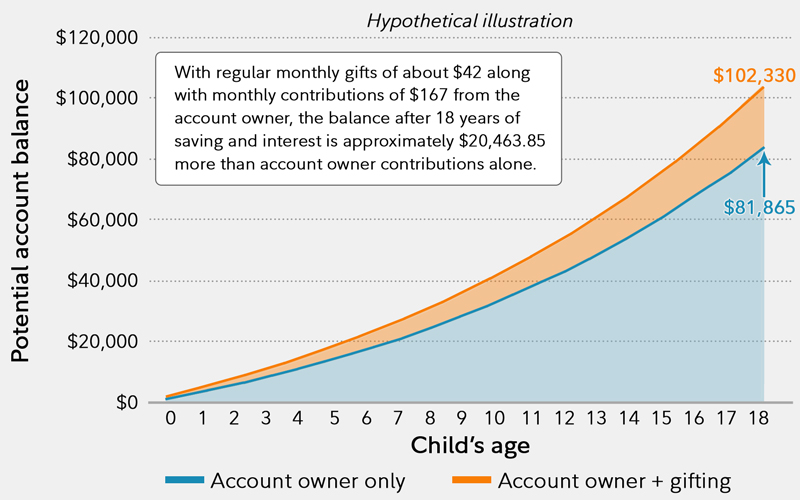

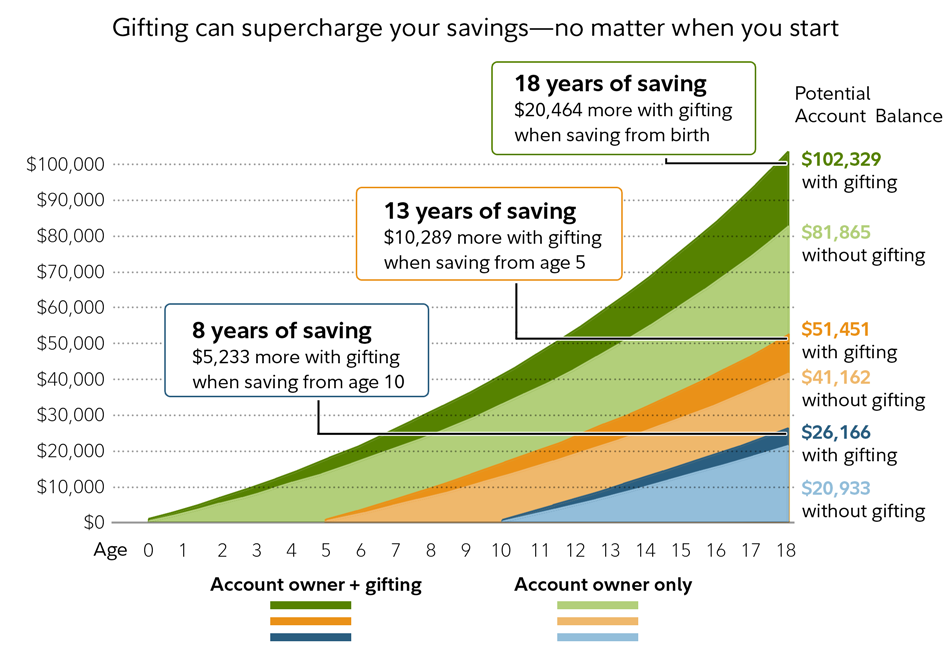

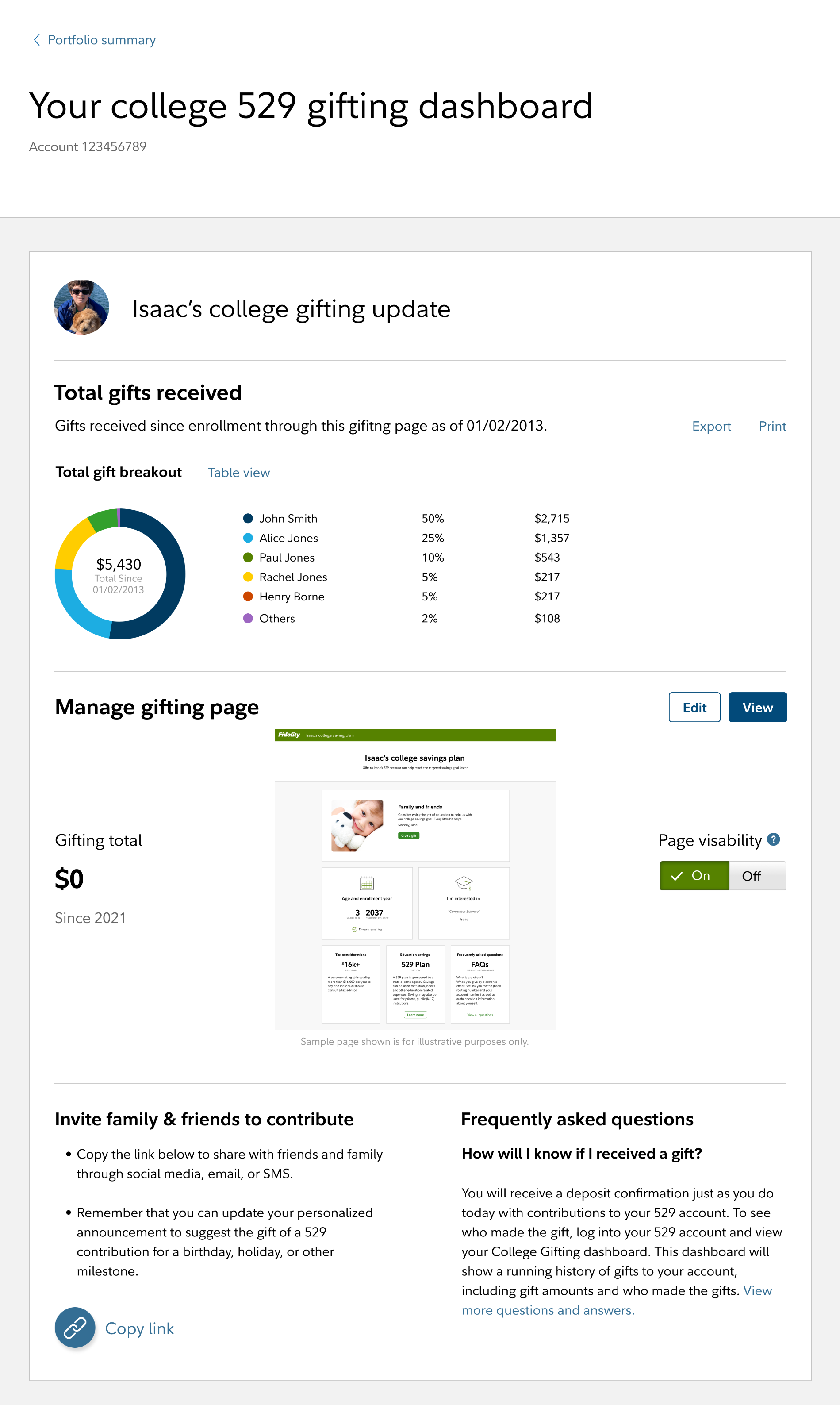

Get just one tax receipt. Gifts make a difference Your savings could get a boost when friends and family give gifts to your 529 account. Accounts the minimum initial contribution is 25000.

The Fidelity account number of the recipient. It is the perfect gift for people of all ages because the choice is up to the recipient as to how they spend the money. For companies looking to use the Giving Account to facilitate corporate philanthropy.

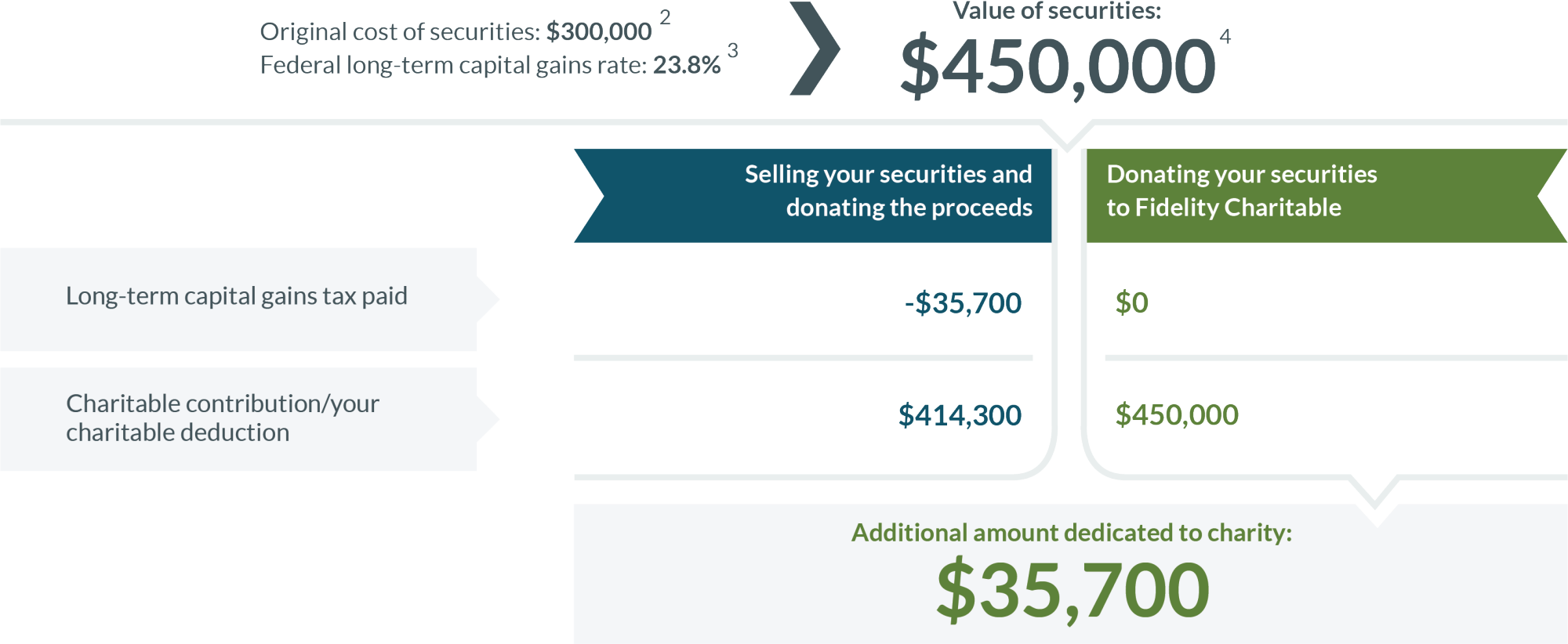

You can give stocks mutual funds and more for an immediate tax deduction and the potential to reduce capital gains. VISA GIFT CARDS. Start making more of a difference Giving guidance for the coronavirus Fidelity Charitable has identified three critical areas where giving can make the greatest difference to support the people and communities impacted by COVID-19.

The Fidelity Bank Gift Card is a prepaid card that can be used everywhere that VISA is accepted. For gifts to accounts within Fidelity please provide. Letter of Authorization PDF Open a Corporate Giving Account.

No minimum balance to maintain. If your transfer has not completed by then we will send within 90 days after the completion of your last eligible transfer. No minimum contribution to open.

Before investing consider the funds investment objectives risks charges and expenses. You can even use a prepaid Fidelity Bank gift card to shop online use it just like you would a credit card. Expenses charged by investments eg funds and managed accounts and certain HSAs and commissions interest charges or other expenses for transactions may still apply.

All Fidelity funds that previously required investment minimums of 10k or less and in stock and bond. Donations are invested and investing involves risk. If you are ever prompted for additional personal information upon attempting to log in please contact us immediately at 1-800-952-4438.

Fidelity Brokerage Customers complete this to make contributions from your non-retirement Fidelity brokerage account. The value of an invested donation will fluctuate over time and may gain or lose money. Because your contributions are invested your donations have the potential to grow tax-free and provide.

With the Fidelity Charitable Giving Account you can give more than cash. If you are sending your gift to another Fidelity account and the total amount is 10000 or less no signature guarantee is required. Using Your Online Audio Space What Should I Expect.

Applications for corporations or other business entities must be. Benefits of the Giving Account. Consider this hypothetical illustration showing the power of gifting over time.

A name for your Giving Account. We will not be responsible for any loss you suffer as a. Organizational Giving Account Application PDF Open an Organizational Giving Account.

Donate cash stocks private business interests and more. New and existing accounts can choose from stocks bonds ETFs options and mutual funds to easily build the portfolio of your choice. As the host of your space you have access to the tools youll need to set up and administer your gatherings.

Giving Account Benefits Fidelity Charitable

Giving Account Benefits Fidelity Charitable

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

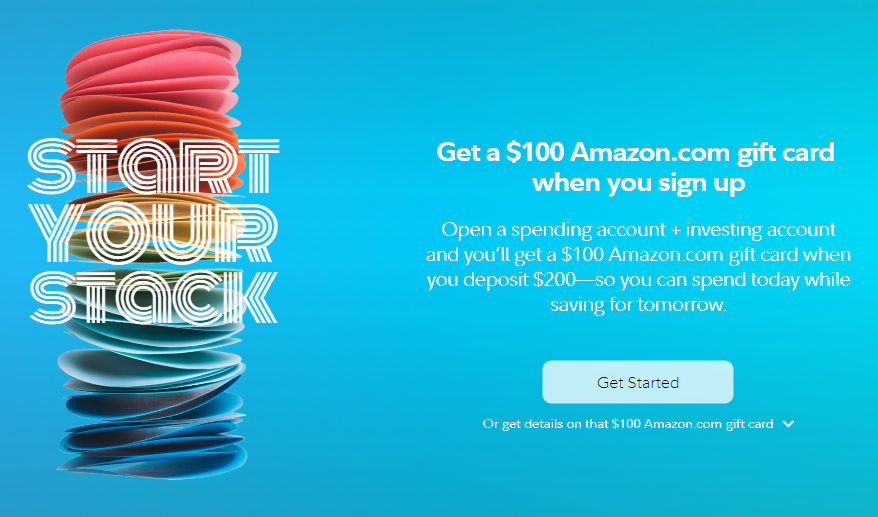

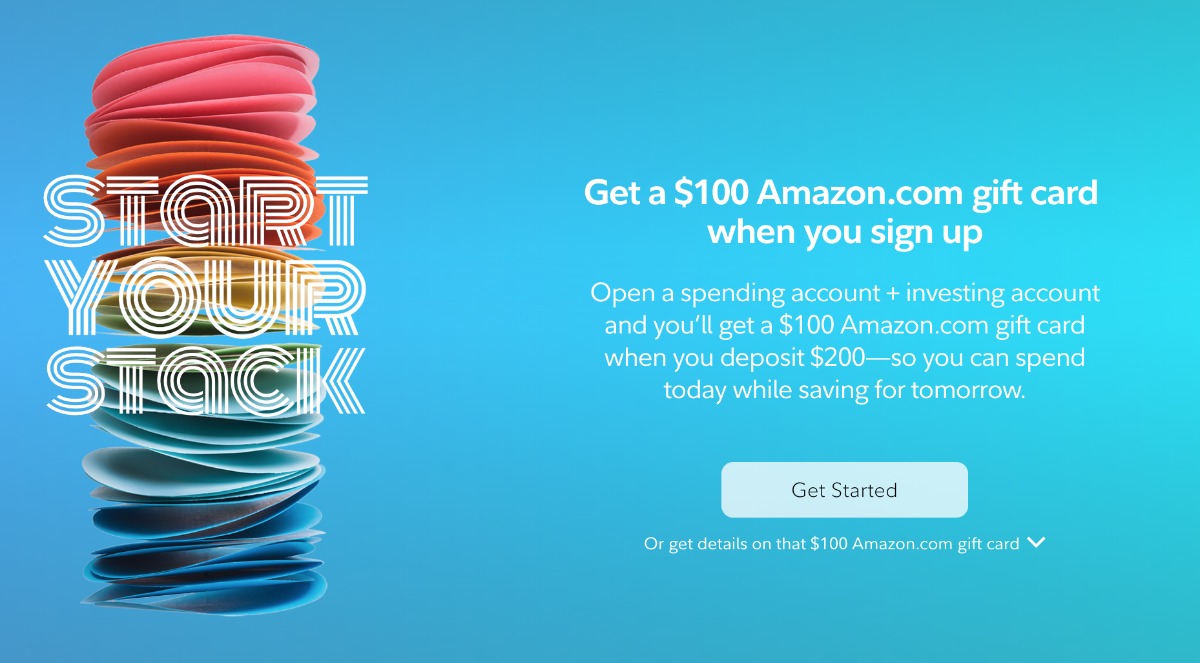

It S Back Earn A 100 Amazon Gift Card With New Fidelity Accounts Miles To Memories

It S Back Earn A 100 Amazon Gift Card With New Fidelity Accounts Miles To Memories

Donating Stock To Charity Fidelity Charitable

Donating Stock To Charity Fidelity Charitable

Giving Account Benefits Fidelity Charitable

Giving Account Benefits Fidelity Charitable

Fidelity Investments On Twitter Looking For A Last Minute Gift Idea Give The Gift Of Education By Contributing To A Loved One S 529 College Savings Account Here S How Https T Co Wsgpjybvis Https T Co Nmpwljdgf4

Fidelity Investments On Twitter Looking For A Last Minute Gift Idea Give The Gift Of Education By Contributing To A Loved One S 529 College Savings Account Here S How Https T Co Wsgpjybvis Https T Co Nmpwljdgf4

529 Contribution The Gift Of Education Fidelity

529 Contribution The Gift Of Education Fidelity

Stockpile Gift Cards For Stock Stockpile Gifts

Stockpile Gift Cards For Stock Stockpile Gifts

Fidelity Charitable Giving Account Fidelity

Fidelity Charitable Giving Account Fidelity

Unique College Investing Plan Fidelity

Unique College Investing Plan Fidelity

Fidelity Debit Card Free Atm Debit Card Fidelity

Fidelity Debit Card Free Atm Debit Card Fidelity

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

College Gifting Program 529 Savings Plan Fidelity

100 Amazon Gift Card With New 200 Fidelity Account Southern Savers

100 Amazon Gift Card With New 200 Fidelity Account Southern Savers

Comments

Post a Comment