- Get link

- X

- Other Apps

What does FINRA do when it comes to background checks. PrintScan is an approved fingerprint channeler to handle all of both inks fingerprinting on.

/48126619532_f99720960b_k-4440c9ca18eb40d39353e807e7cd56ba.jpg) Finra Vs The Sec What S The Difference

Finra Vs The Sec What S The Difference

What Does FINRA Do With Fingerprints.

What does finra do. Finra recently launched a marketing campaign to address investor concerns. The organization handles specific compliance issues that bolster the SECs operations including developing rules investigations and education for securities pros and the public. A FINRA 8210 request is the method by which FINRA begins an investigation into alleged violations of.

FINRAs Roles in Protecting the Publics Money. Every investor receives the basic protections they deserve. What Does FINRA Do.

FINRA or the Financial Industry Regulatory Authority was created as a national organization that writes rules and regulations for professionals in the financial industry licenses these individuals and organizations and provides avenues for compensation and complaints for victims of negligent financial advising. FINRA also acts as a forum for arbitration or as an intermediary when disagreements between investors occur. A background check for FINRA is essentially a traditional FBI Background Check with the results being entered into Central Registration Depository CRD.

Although FINRA expressly disclaims any requirement to obtain credit reports on applicants FINRA does include the review of credit reports among the ways the rule can be satisfied along with 1 fingerprint checks 2 searching a reputable national public records database such as LexisNexis and 3 reviewing a consolidated report from a specialized provided such as Business. NASD and the member regulation enforcement and arbitration operations of the New York Stock Exchange. As a private non-profit agency it mandates how investors and securities participants can behave and interact.

FINRA helps resolve disputes handling almost 100 percent of the industries arbitrations and mediations from more than 70 hearing locations. Wall Streets self-regulator Finra is fully cognizant of investor concerns on this front. Write and enforce rules governing the ethical activities of all registered broker-dealer firms and registered brokers in the US.

FINRA is the successor to the National Association of Securities Dealers Inc. FINRA plays a critical role in ensuring the integrity of Americas financial systemall at no cost to taxpayers. FINRA is a non-governmental organization that regulates brokerage firms broker-dealers and their registered representative employees financial brokers trading in equities corporate bonds securities futures and options.

And the member regulation enforcement and arbitration operations of the New York Stock Exchange. In its continuing efforts to combat fraud and provide the public with accurate information on investment professionals the Financial Industry Regulatory Authority FINRA implemented changes to its background check requirements for registered individuals in 2015. Working under the supervision of the Securities and Exchange Commission we.

When people are required to submit their U4 forms to FINRA they often what exactly FINRA does with their fingerprints. It is a non-governmental organization that regulates member brokerage firms and exchange markets. FINRA works under the auspices of the SEC.

FINRA is the successor to the National Association of Securities Dealers Inc. Our recent financial past has been filled with pitfalls and frauds. We work every day to ensure that everyone can participate in the market with confidence.

FINRA oversees and regulates brokerage firms stock brokers and exchange markets. They oversee background checks for brokers which goes a long way towards keeping the financial services industry safe and trustworthy. Since FINRA controls licenses and certification every professional within the financial industry must follow its rules or else risk losing their.

FINRA has locations in all 50 states and also has offices in London and Puerto Rico. When fingerprints are submitted electronically to FINRA it allows for fingerprint information to be exchanged with the FBI via FINRAs Electronic Fingerprint Processing EFP. To protect investors and ensure the markets integrity FINRA is a government-authorized not-for-profit organization that oversees US.

Sometimes even employees who are not involved in investment decisions need to be fact-checked as well. The SEC oversees FINRA and allows it to make its own certification procedures and exams for the financial industry. FINRA is not a government agency but it is authorized by the government to regulate and enforce rules that apply across the country.

The Financial Industry Regulatory Authority FINRA is an independent nongovernmental organization that writes and enforces the rules governing registered brokers and broker-dealer firms in the. From Finras own website Finra Launches Enhanced Investor Protection and Education Programs.

What Does Finra Do When It Comes To Background Checks Alliance Risk Group Inc

What Does Finra Do When It Comes To Background Checks Alliance Risk Group Inc

/finra_335499773.jpg_-5bfc32f2c9e77c0026b65f35.jpg) Financial Industry Regulatory Authority Finra

Financial Industry Regulatory Authority Finra

Customer Case Study Finra Databricks

Customer Case Study Finra Databricks

The Importance Of Complying With Finra And How To Best Do So Employment Background Check Blog Hireright

The Importance Of Complying With Finra And How To Best Do So Employment Background Check Blog Hireright

Finra And Finra Investor Education Foundation Promote World Investor Week 2018 Finra Org

Finra And Finra Investor Education Foundation Promote World Investor Week 2018 Finra Org

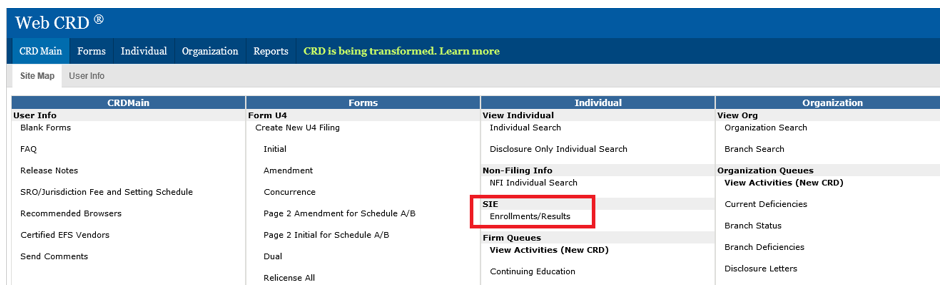

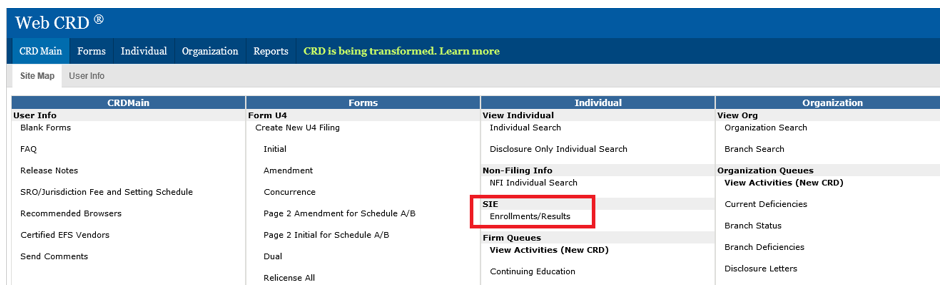

User Guide For Enrolling Individuals For The Securities Industry Essentials Sie Exam Non Form U4 Finra Org

User Guide For Enrolling Individuals For The Securities Industry Essentials Sie Exam Non Form U4 Finra Org

Finra Financial Industry Regulatory Authority

Finra Financial Industry Regulatory Authority

What Does Finra Do Mi Securities Law Firm Stockbroker Securities Fraud Attorney Helping Investors Recover Losses

What Does Finra Do Mi Securities Law Firm Stockbroker Securities Fraud Attorney Helping Investors Recover Losses

Finra Interview Questions Glassdoor

Finra Interview Questions Glassdoor

What Does Finra S Chief Economist Do Finra Org

What Does Finra S Chief Economist Do Finra Org

Financial Industry Regulatory Authority Finra What Is Finra And What Do They Do Tookitaki Tookitaki

Financial Industry Regulatory Authority Finra What Is Finra And What Do They Do Tookitaki Tookitaki

What Is Finra How Financial Industry Regulatory Authority Works

What Is Finra How Financial Industry Regulatory Authority Works

Comments

Post a Comment