- Get link

- X

- Other Apps

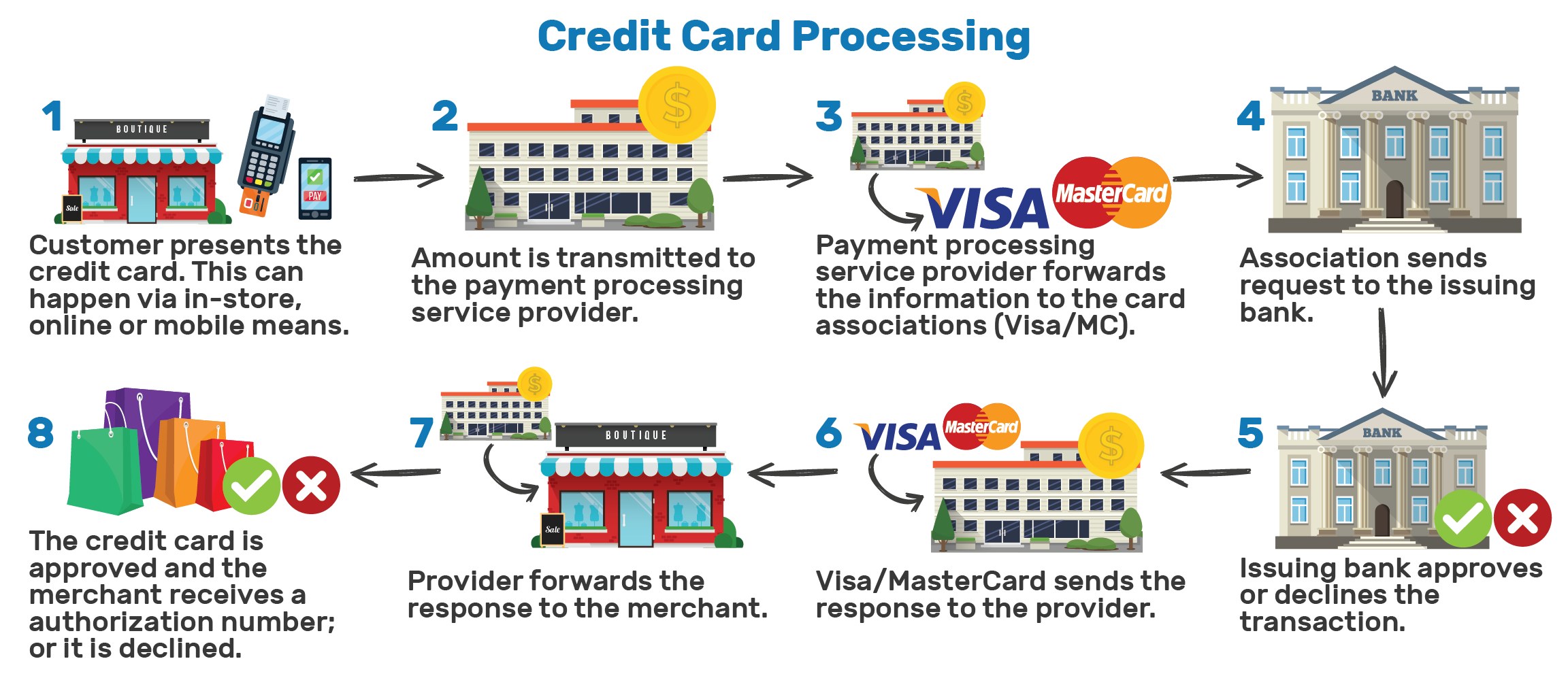

In simpler terms interchange is the wholesale cost that the processor has to pay on every credit card transaction. How Interchange Fees Are Changing In 2021.

Antitrust Regulation On Interchange Fees

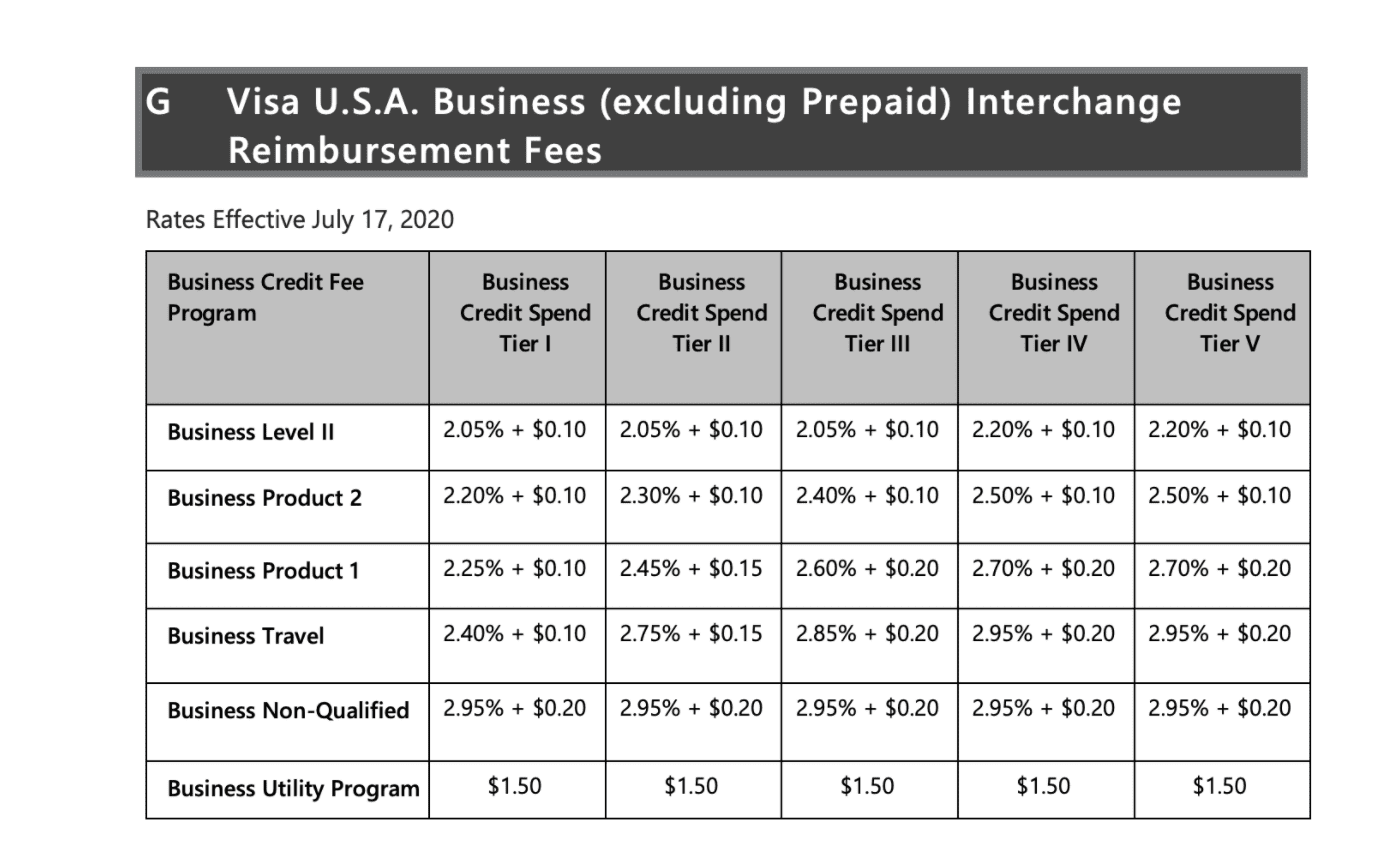

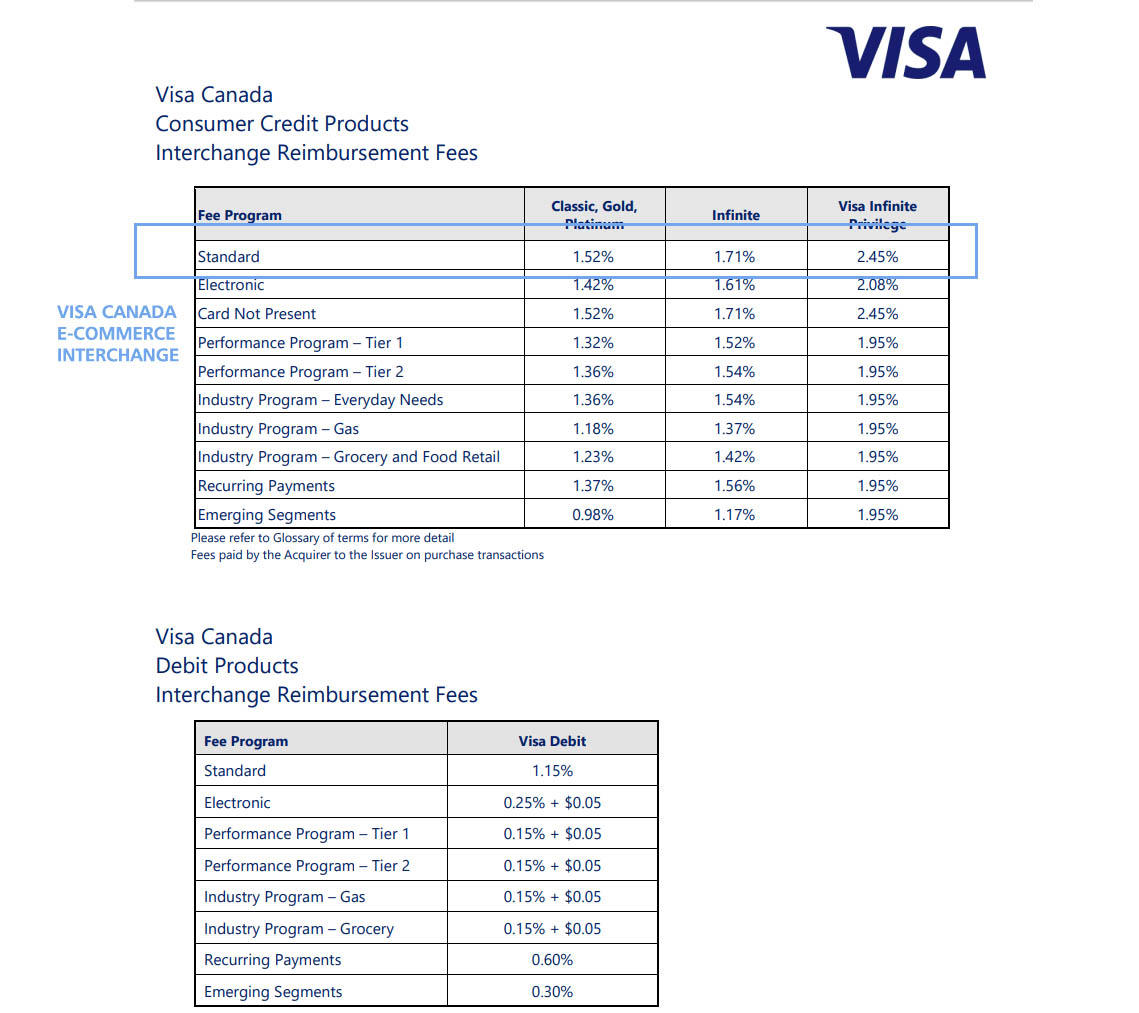

These rates are set by Visa each year and apply to every processor in the payments industry.

Visa interchange cost. What youll need to work in the UK on a Tier 1 Exceptional Talent visa. 16 rader Domestic transactions not processed through Visas NNSS will receive Electronic. Visa uses these fees to balance and grow the payment system for the benefit of all participants.

Interchange fees are agreed by card schemes VisaMastercardAmex etc but are paid to the issuing bank or customers bank. Visa doesnt receive any of this fee. The penalty for interchange downgrades went from 230 010 per transaction up to 270 010.

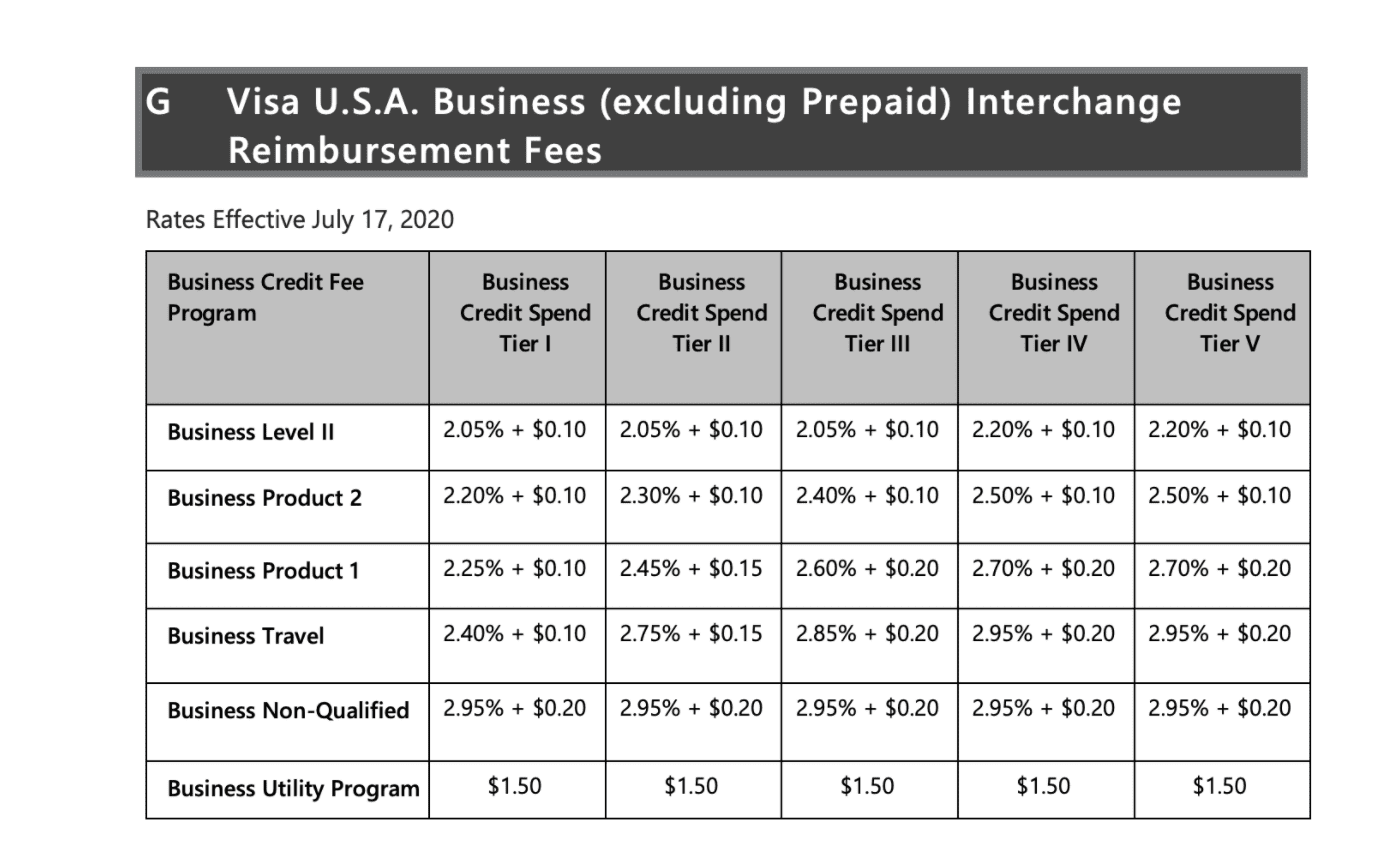

Visa is still planning to bump non-qualified credit transactions up to 315 010 in April 2021. 018 would go to Visa or MasterCard association specified as assessments. Visa Intl Acquirer Service Fee.

We simply pass on the wholesale cost from the card issuer and then add on a small transparent fee. Theyre also the biggest headache. These fee schedule updates usually involve raising some rates while lowering others.

About 175 would go to the card-issuing bank specified as interchange. Theyre usually the biggest expense when it comes to card processing. We offer a transparent small fee on top of the standard visa interchange rates.

Visa NAPF Network Acquirer Processing Fee 195 Visa Clearing Access. Visa uses these fees to balance and grow the payment system for the benefit of all participants. Visa FANF Fixed Acquirer Network Fee Visa FANF - Card-Present Per Location.

Merchants do not pay interchange reimbursement feesmerchants negotiate and pay a merchant discount to their financial. What youll need to work in the UK on a Tier 1 Exceptional Talent visa. Interchange fees collected by Visa and MasterCard totaled 26 billion in 2004.

Weve eliminated the confusion and complexity that comes from accepting credit cards by offering interchange plus or cost-plus pricing plans. As part of these agreements which began in April 2015 Visa has managed domestic consumer credit interchange rates to an average effective interchange rate of 140 this level was 150 prior to April 2020. For debit card transactions the rate will go up from 02 to 115.

Visa FANF - Keyed Volume 1000 - 3999. Visa Interchange Rate and Mastercard Interchange Rate. And the staying 007 would go to the merchants merchant account service provider.

9lvd 8 6 rqvxphu 3uhsdlg hpsw 5hjxodwhg dqg 2wkhu hpsw 3urgxfwv qwhufkdqjh 5hlpexuvhphqw hhv 9lvd 86 qwhufkdqjh 5hlpexuvhphqw hhv. If interchange didnt exist your bank would find it difficult to cover the costs it incurs in operating your card services such as fraud prevention systems maintenance and customer call centres. Annons If youre talented and want to work in the UK the Tech Nation Visa is for you.

Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. This is called the interchange fee. This change is not the one that was originally planned for 2020.

Merchants do not pay interchange reimbursement fees merchants negotiate and pay a merchant discount to. Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Interchange rates are part of Paylines interchange plus pricing plans.

025 Visa International Cross-Border. Annons If youre talented and want to work in the UK the Tech Nation Visa is for you. By accepting Visa your customers can pay in-person over the phone and even online.

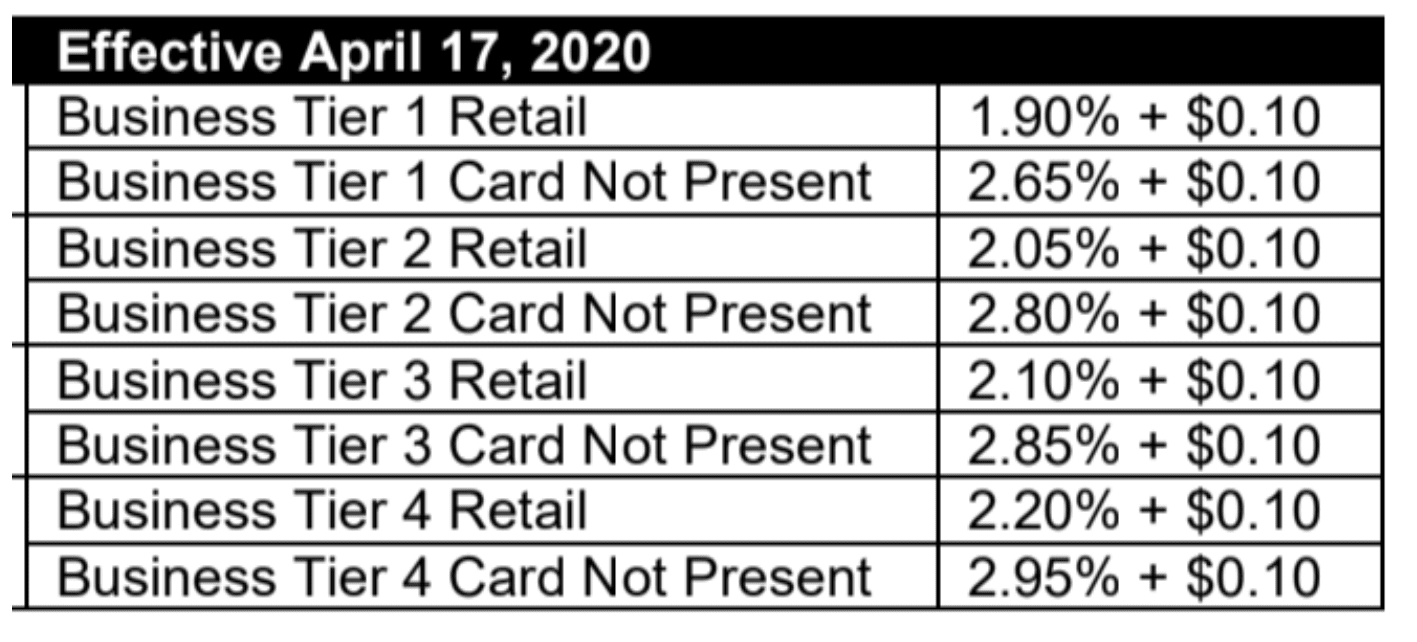

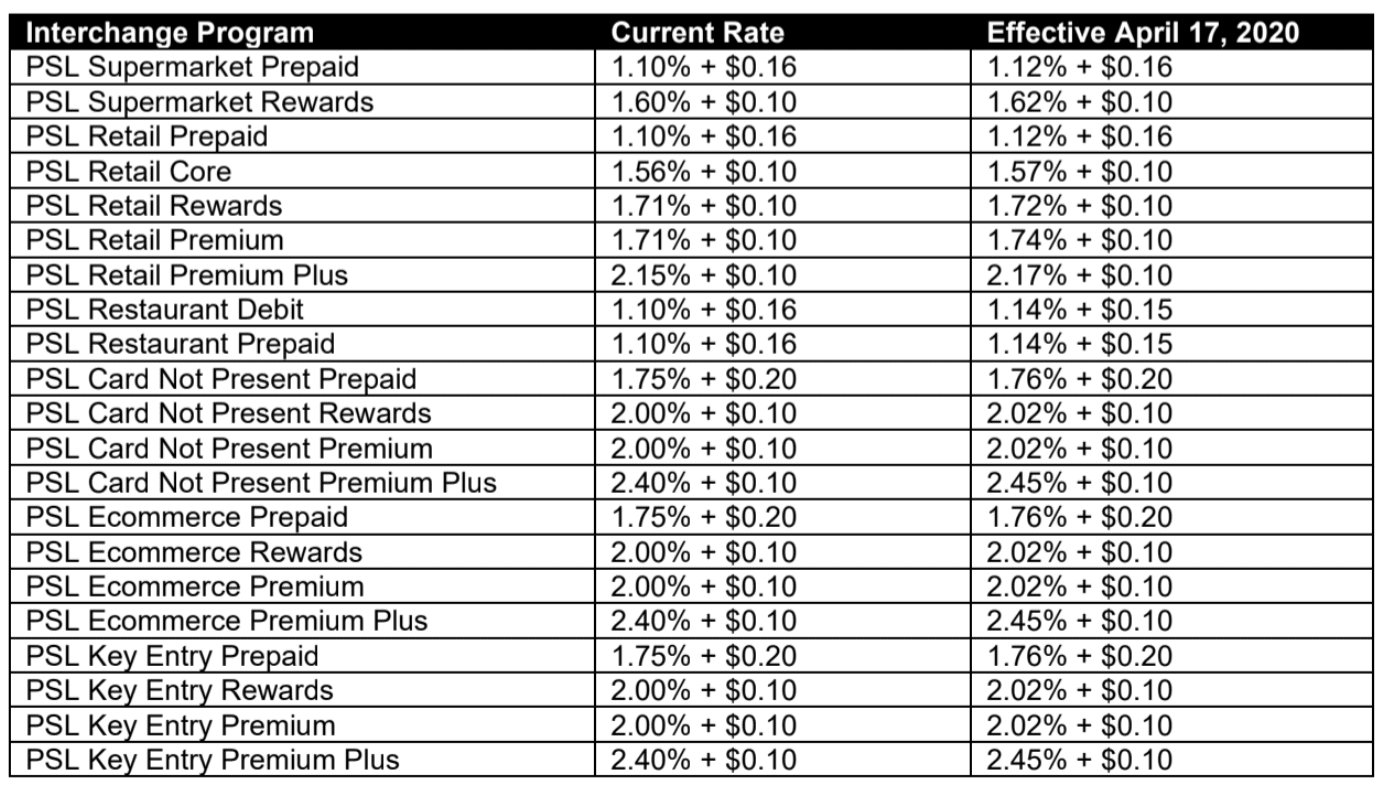

The origins of the interchange fee are a matter of some controversy. Visa and Mastercard typically update their interchange fee schedules twice each year in April and October. As a result the rates have increased for those transactions.

Visa was scheduled to introduce the most sweeping changes to its interchange fees in October 2020. Visa Association Fees Interchange Rate. Interchange Fees Are Adjusted from Time to Time by Visa and Mastercard Interchange is adjusted periodically often in April and October of of each year.

In Canada merchants must be advised of these changes before they go into place and if there is an interchange cost decrease the savings must be passed onto merchants or the merchant can. In 2005 the number was 307 billion and the increase totals 85 percent compared to 2001. Sky News has learnt that Visa plans to inform its roughly 4000 clients later this week that so-called interchange fees will increase to 15 for online credit card payments - a fivefold increase.

Interchange Pass Through Pricing What You Need To Know

Interchange Pass Through Pricing What You Need To Know

Should The Us Reform Interchange Fees On Credit Cards The Atlantic

Mail Order Telephone Interchange Rates

Mail Order Telephone Interchange Rates

How Visa Interchange Rates Are Changing In 2020 And What That Means For Merchants

How Visa Interchange Rates Are Changing In 2020 And What That Means For Merchants

Interchange Fees Increasing April 2020 Merchant Cost Consulting

Interchange Fees Increasing April 2020 Merchant Cost Consulting

Credit Card Processing Basics Understanding Interchange Fees

Credit Card Processing Basics Understanding Interchange Fees

Interchange Fees Increasing April 2020 Merchant Cost Consulting

Interchange Fees Increasing April 2020 Merchant Cost Consulting

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

Why Is Walmart Really Fighting Visa Podcast

Why Is Walmart Really Fighting Visa Podcast

Interchange Rates Card Not Present Cenpos Credit Card Processing

Interchange Rates Card Not Present Cenpos Credit Card Processing

Interchange Rates What Is Interchange Fee How To Calculate It In 5 Steps

Interchange Rates What Is Interchange Fee How To Calculate It In 5 Steps

Should The Us Reform Interchange Fees On Credit Cards The Atlantic

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

Visa Interchange Rates Increased July 2020 Merchant Cost Consulting

Visa Interchange Rates Increased July 2020 Merchant Cost Consulting

Comments

Post a Comment