- Get link

- X

- Other Apps

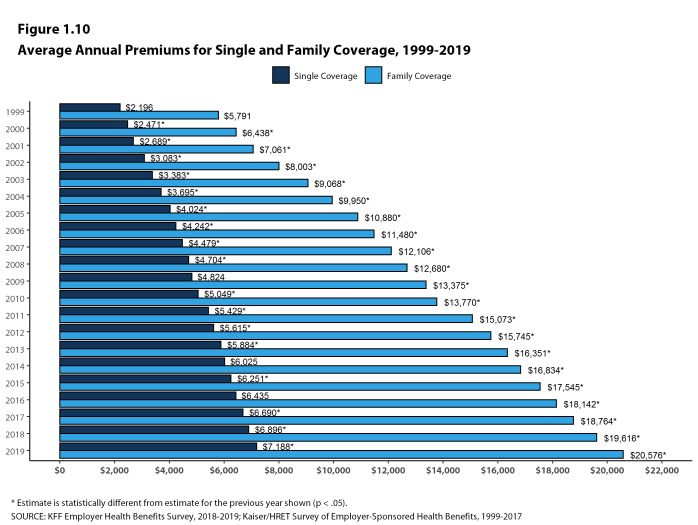

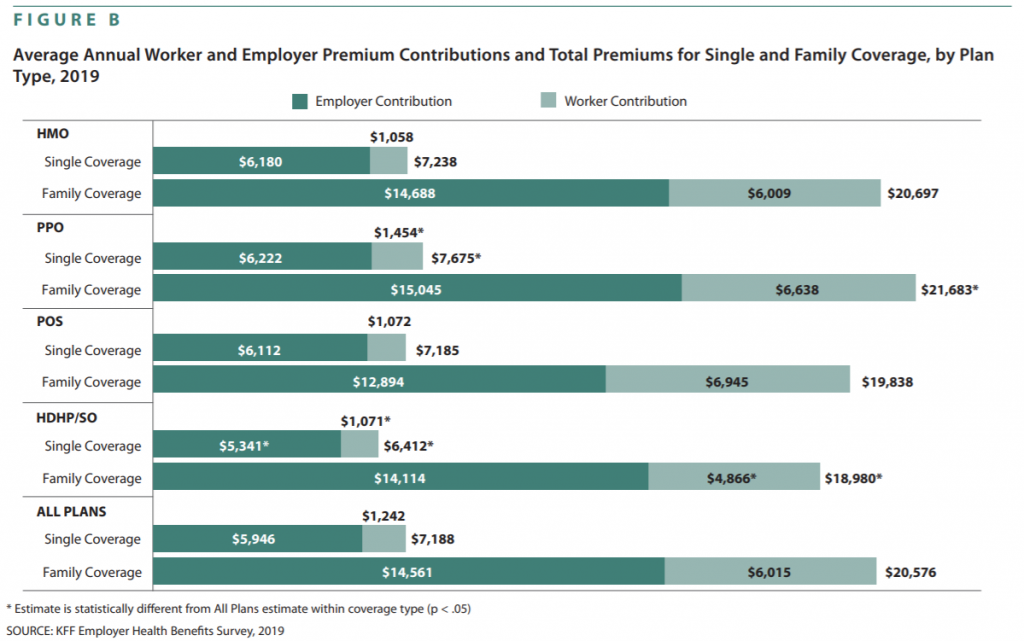

Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority. The total amount was 5946 out of an average premium of 7188.

What Percent Of Health Insurance Is Paid By Employers

What Percent Of Health Insurance Is Paid By Employers

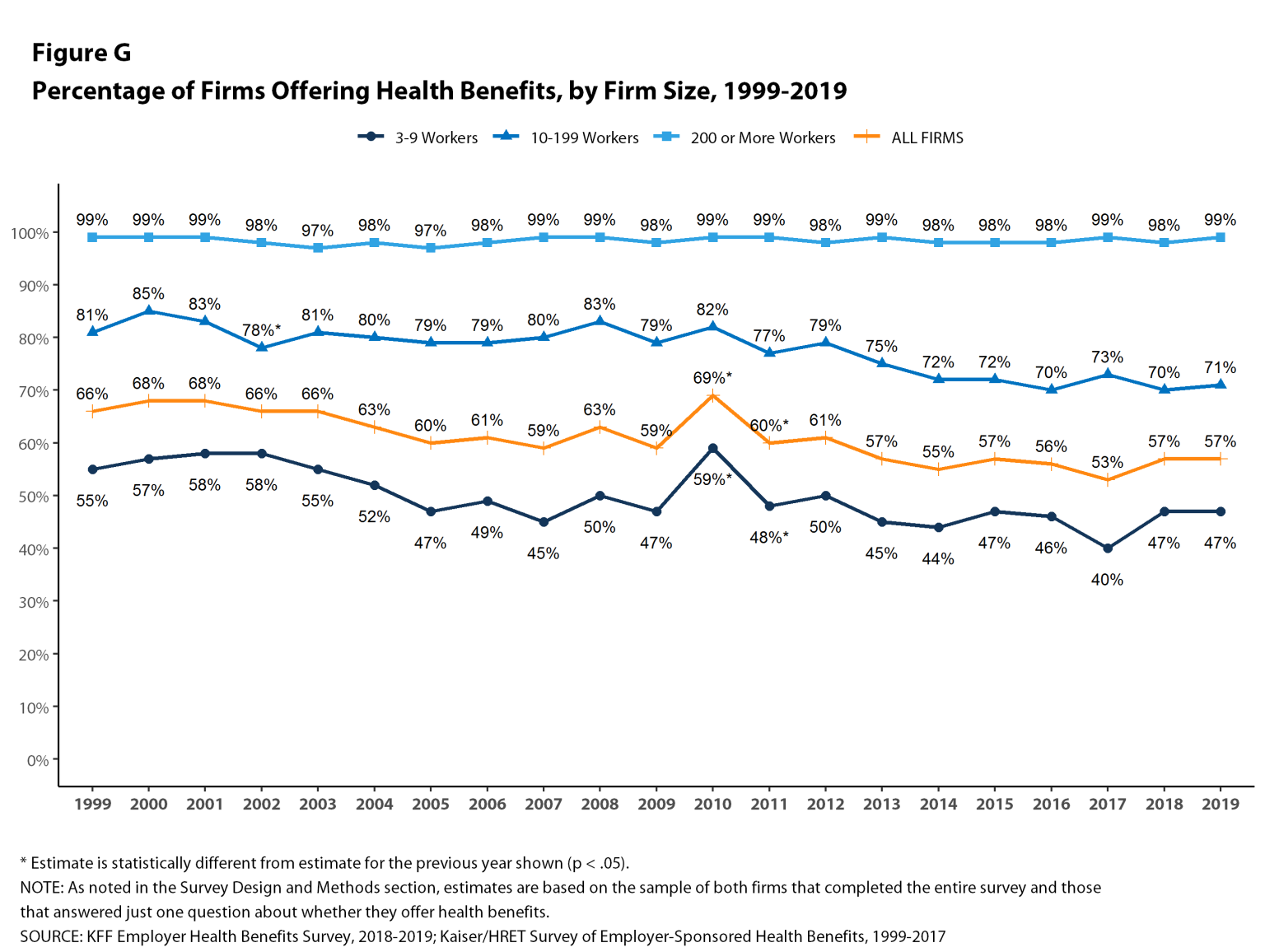

Many state legislatures have passed regulations that require employers to contribute at least 50 of employee health insurance costs but in 2019 the Kaiser Family Foundation found that 15 of employees paid for more than half of their family coverage premiums.

Average employer contribution to health insurance 2019. The Affordable Care Act ACA states that employers with 50 or more employees need to offer health plans that meet the minimum value standard. Anzeige Compare 50 Health Insurance Plans Designed for Expatriates. Overall the national average of employer contribution to individual healthcare plans has risen by 4 since our last report.

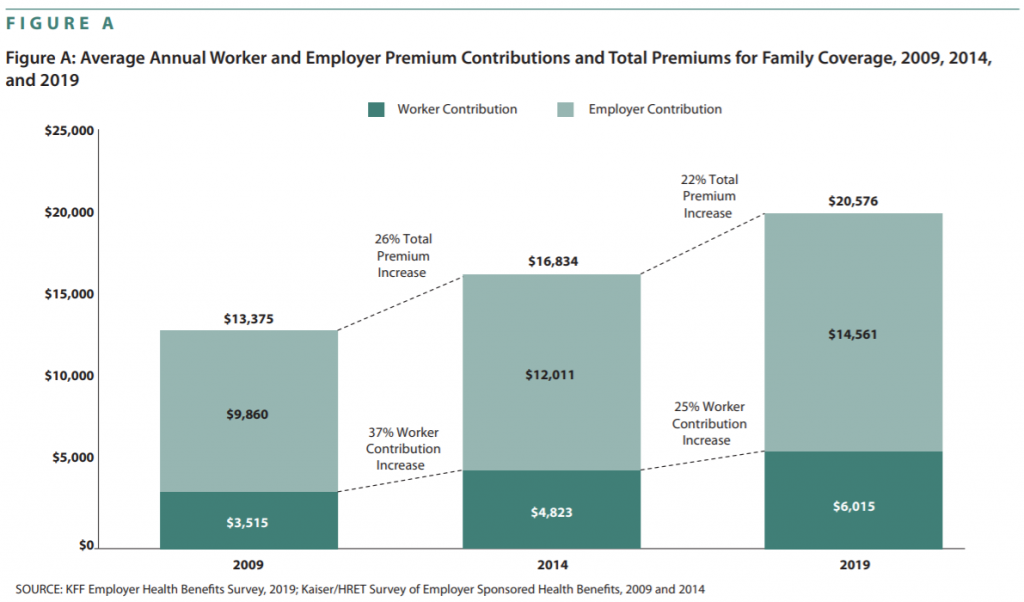

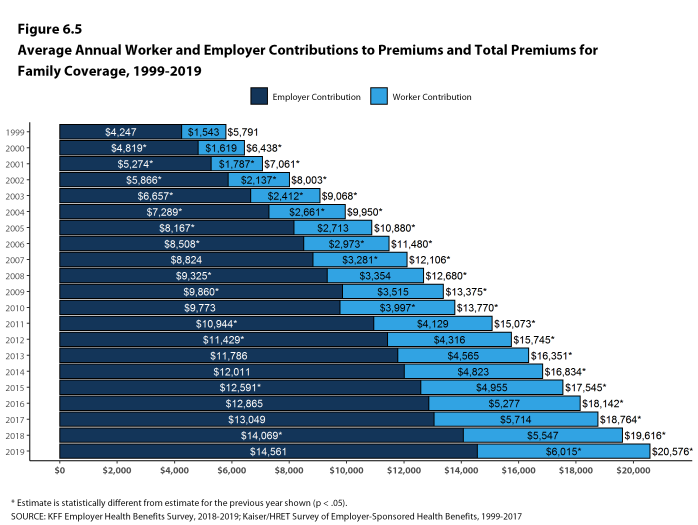

Get a Free Quote. Anzeige Health Insurance Designed For Individuals Living Outside Their Home Country. Contributions to family plans averaged 5726 in 2019 and ranged from a low of 3685 in Michigan to a high of 8202 in South Carolina Table 3b.

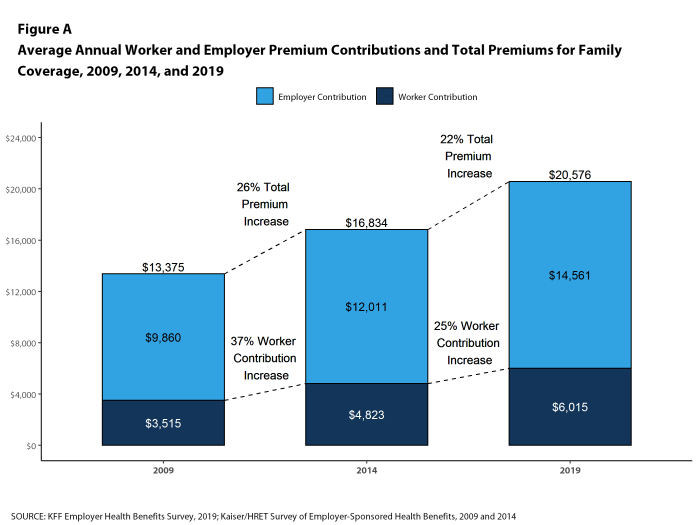

The average annual contribution workers paid for single coverage was in contrast 1242. Employers cover most of the average family coverage premiums of 20576 too. In 2019 the average annual employer contribution for single premiums was nearly 6000.

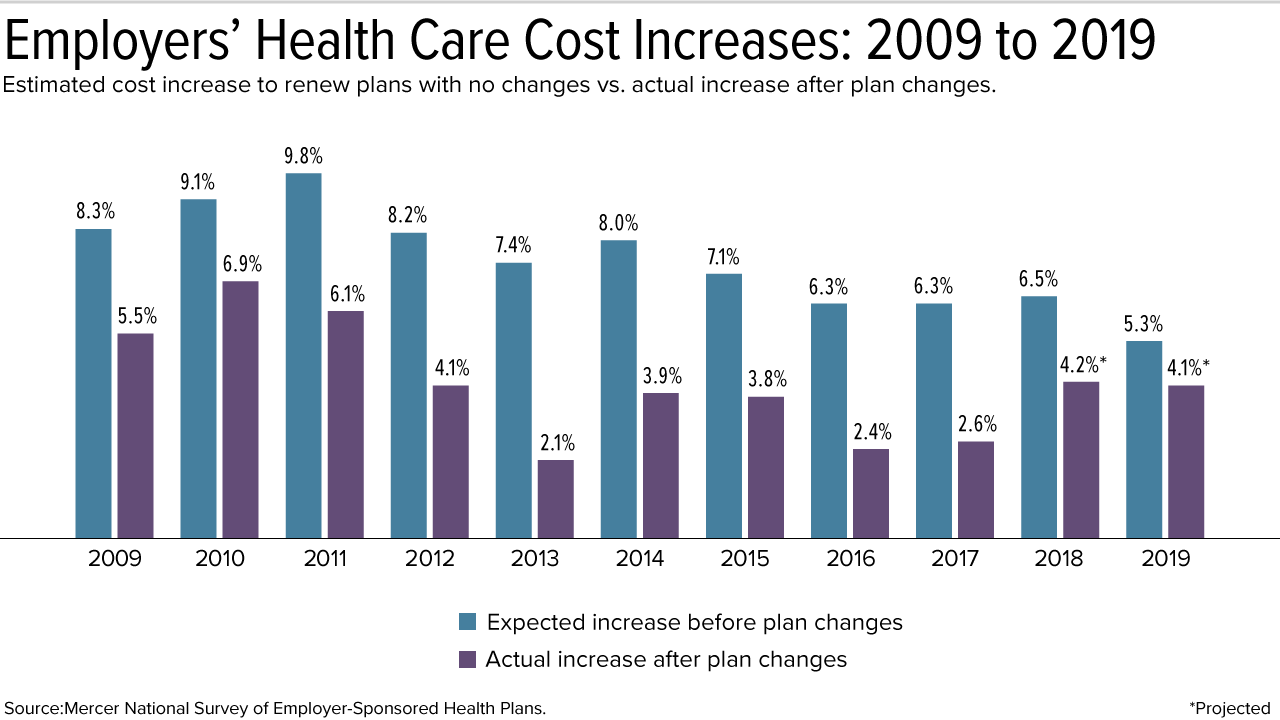

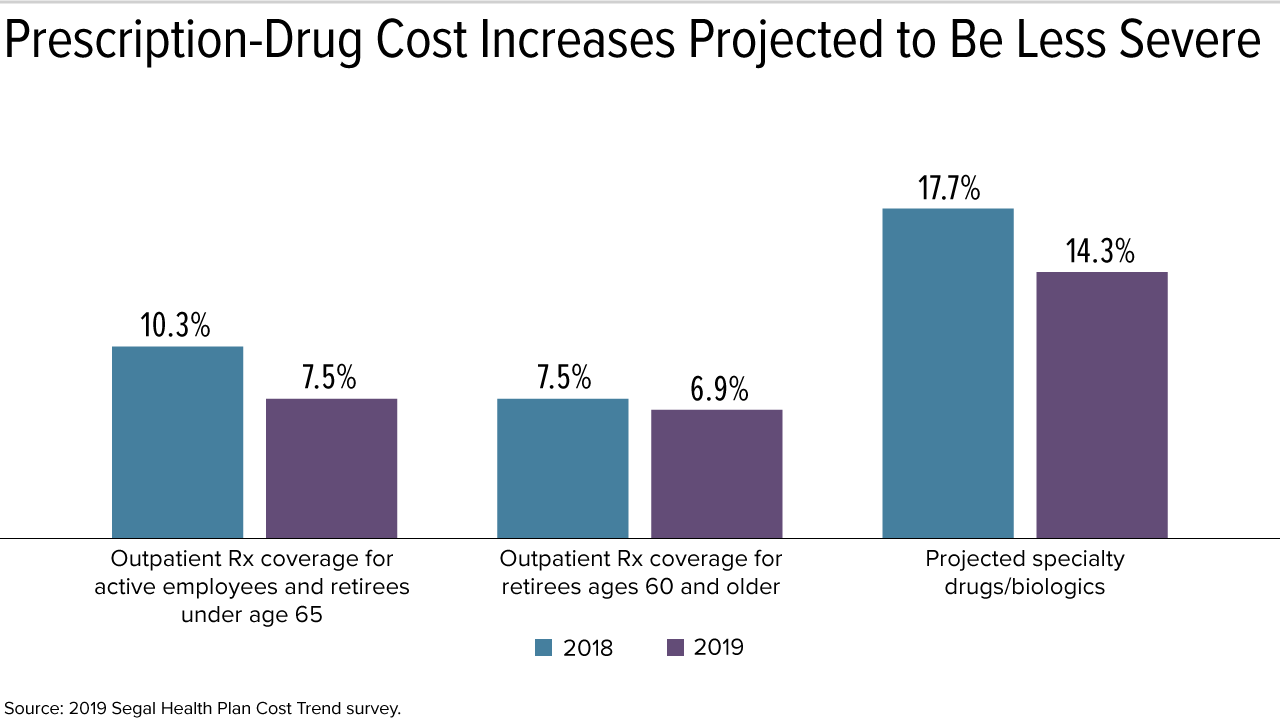

Anzeige Compare 50 Health Insurance Plans Designed for Expatriates. The total cost of health care including premiums and out-of-pocket costs for employees and dependents is estimated to average 14800 per employee in 2019 up from 14099 this year. This means employers have to provide health insurance thats economical comprehensive and covers on average at least 60 percent of their employees medical care.

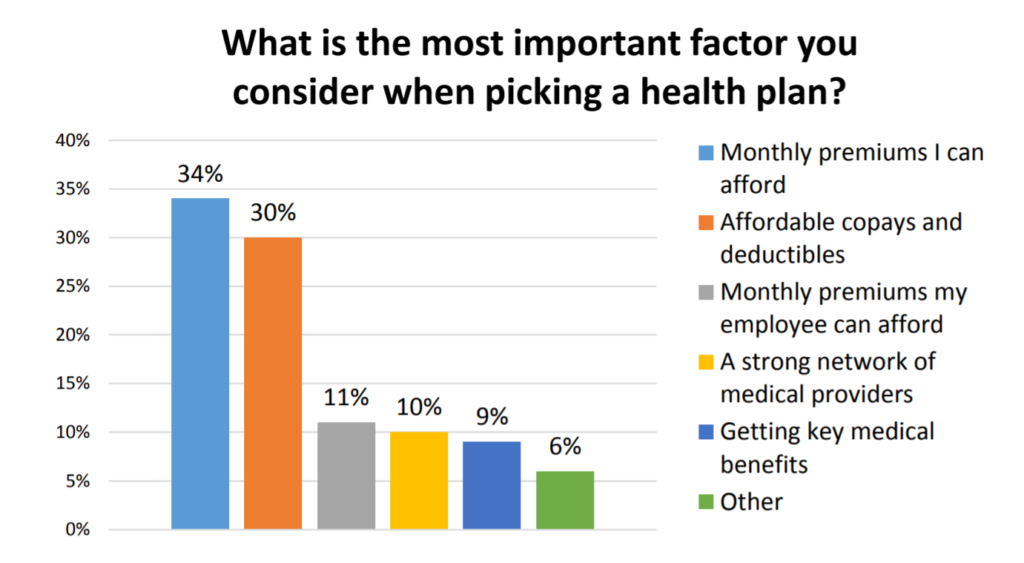

These are the highlights of the contribution data. The average employer covers about 76 of individual monthly premiums while the remaining 24 falls on the employee. The 2019 survey included 2012 interviews with nonfederal public and private firms.

That averages out to 11618 per year when it comes to company contribution to employee health insurance. Anzeige Health Insurance Designed For Individuals Living Outside Their Home Country. There is no national rule determining the minimum employer contribution for health insurance.

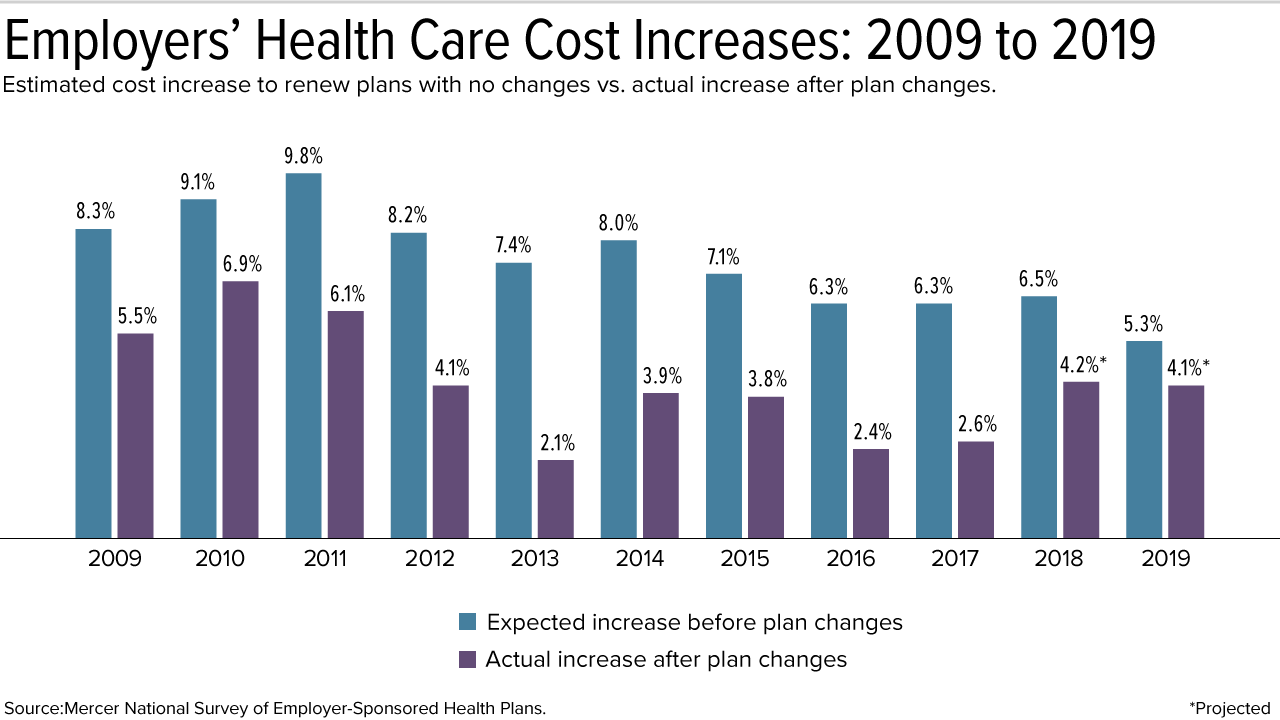

What is the minimum employer contribution for health insurance. Cost the Main Driver of Company Contribution to Employee Health Insurance The cost of providing health insurance benefits for regular employees increases each year for approximately 90 percent of American employers. They ranged from a low of 718 in Hawaii to a high of 1793 in Massachusetts Table 3a.

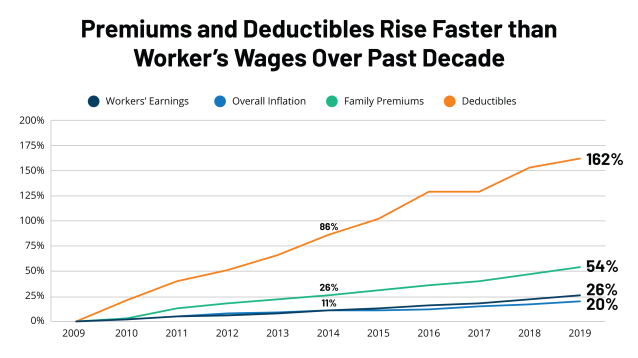

Worker contributions to single-plan premiums averaged 1489 in 2019. Annual family premiums for employer-sponsored health insurance rose 5 to average 20576 this year according to the 2019 benchmark KFF. Get a Free Quote.

Annual premiums for employer sponsored family health coverage reached 20576. What does the Affordable Care Act require. Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority.

Here are some of the other developments. Annual family premiums for employer-sponsored health insurance rose 5 to average 20576 this year according to the 2019 benchmark KFF Employer Health Benefits Survey released today.

Annual Health Insurance Costs Hit Record High Above 20 000 روزانا الإخباري

Annual Health Insurance Costs Hit Record High Above 20 000 روزانا الإخباري

Section 6 Worker And Employer Contributions For Premiums 9335 Kff

Section 6 Worker And Employer Contributions For Premiums 9335 Kff

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Section 1 Cost Of Health Insurance 9335 Kff

Section 1 Cost Of Health Insurance 9335 Kff

How Employees Employers Get Bled By Health Insurance Wolf Street

How Employees Employers Get Bled By Health Insurance Wolf Street

Average Cost Of Employer Sponsored Health Insurance

Average Cost Of Employer Sponsored Health Insurance

Health Insurance Premiums And Increases

2019 Iowa Employer Benefits Study C Employers Report 7 1 Increase In Health Premiums

2019 Iowa Employer Benefits Study C Employers Report 7 1 Increase In Health Premiums

Section 6 Worker And Employer Contributions For Premiums 9335 Kff

Section 6 Worker And Employer Contributions For Premiums 9335 Kff

Comments

Post a Comment