- Get link

- X

- Other Apps

LendingTree is an online marketplace that can connect customers with most types of small business loans. OnDeck provides short-term business loans of 5000 to 250000 with loan terms of 3 to 18 months.

Lendingtree Wo Wird Die Aktie Interessant Sharedeals De

Lendingtree Wo Wird Die Aktie Interessant Sharedeals De

And we all know-when lenders compete for your business you win.

Lendingtree business loans. No penalty for lump sum payments. Construction business loans can also be taken out for multiple homes at a time and also cover the cost of materials and permits. LendingTree is an online loan market place which allows users to view loan offers and compare options.

Loan amounts as high as 250000 to 500000. No more than two years in business required. QuickBridges additional eligibility requirements include.

Whether youre a first time homebuyer looking for a mortgage or youre in the market for a small business loan weve got you covered. Banks are known to loan larger amounts compared to alternative online business lenders. However LendingTree is not a direct lender.

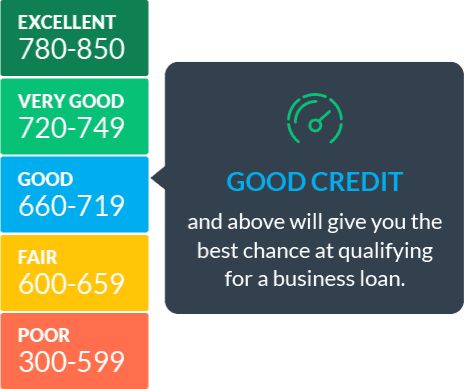

LendingTree connects you with lenders who offer different. Hear what Business Owners are Saying. QuickBridge offers working capital loans bridge loans and equipment financing between 5000 and 500000 to business owners with credit scores as low as 525.

Our corporate business loans are specially designed to work for businesses like yours. Average business loan amounts range from 13000 to more than 1 million depending on the lender. APRs start at 1189 though the weighted average is 4906.

No Collateral No Down payment. Business Loans Working Capital Small Business Loans Expansion Loans Inventory Loans Equipment Loans. LendingTree is an online lending marketplace headquartered in the United States.

Small business lenders that appear on this list meet the following criteria. In some cases a construction loan may include acquisition costs. The agreement for your construction loan would describe the terms of your loan and when youd be expected to pay back your debt Booth said.

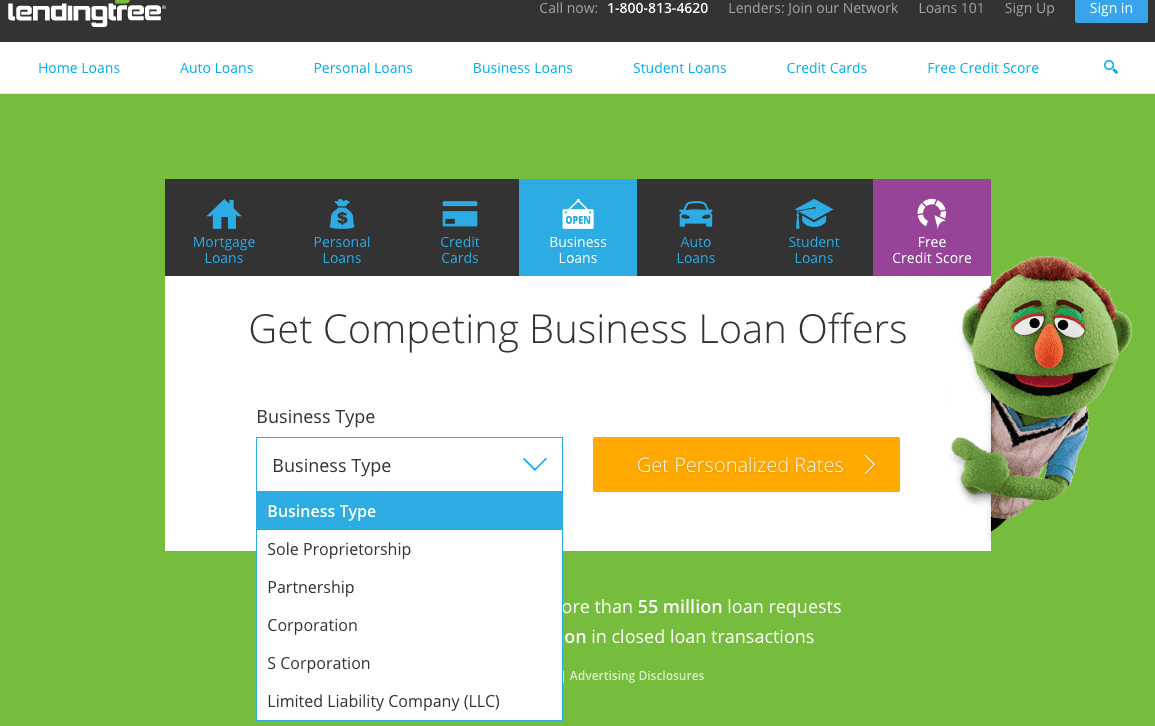

The platform can retrieve quotes for short and long term loans equipment financing invoice financing SBA loans and business lines of credit. Every business needs financial resources in order to operate grow. An unsecured loan sometimes referred to as a signature loan or a merchant loan is a special type of financing available to business that is different from traditional lending.

But it may be easier to qualify for an online loan than a bank loan. Processing time varies from 1-3 days. Instead of requiring collateral to obtain financing unsecured lending uses several other factors to judge the eligibility of a loan applicant.

Apply today today and find out how a corporate loan from Lending Tree can help you take your business to the next level. Borrowers may receive funds the same day that the loan is approved. It is a lending platform that connects borrowers in the United States with an extensive network of lenders.

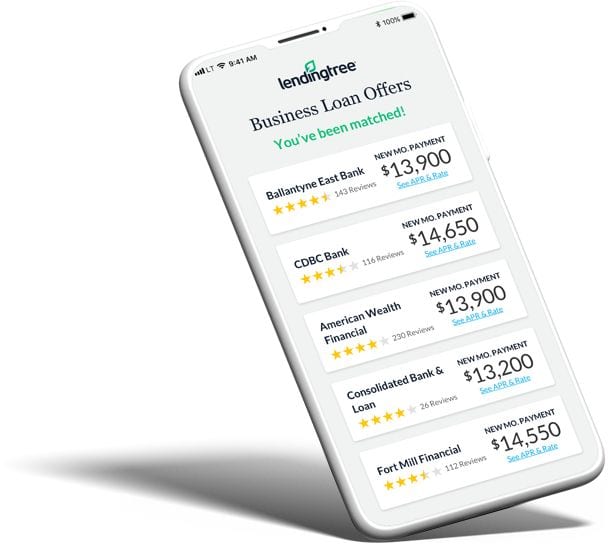

Business owners who received an EIDL advance in 2020 of less than 10000 or were denied because of lack of program funding can apply. LendingTree allows borrowers to shop and compare competitive rates and terms across an array of financial products. The business platform allows potential borrowers to connect with multiple loan operators to find optimal terms for loans credit cards deposit accounts insurance etc.

We chose business loansfrom online lenders that could be available within a week of approval and cover small medium or large business expenses. 5 Zeilen What are Lendingtree business loans. 7 Zeilen Need a business loan.

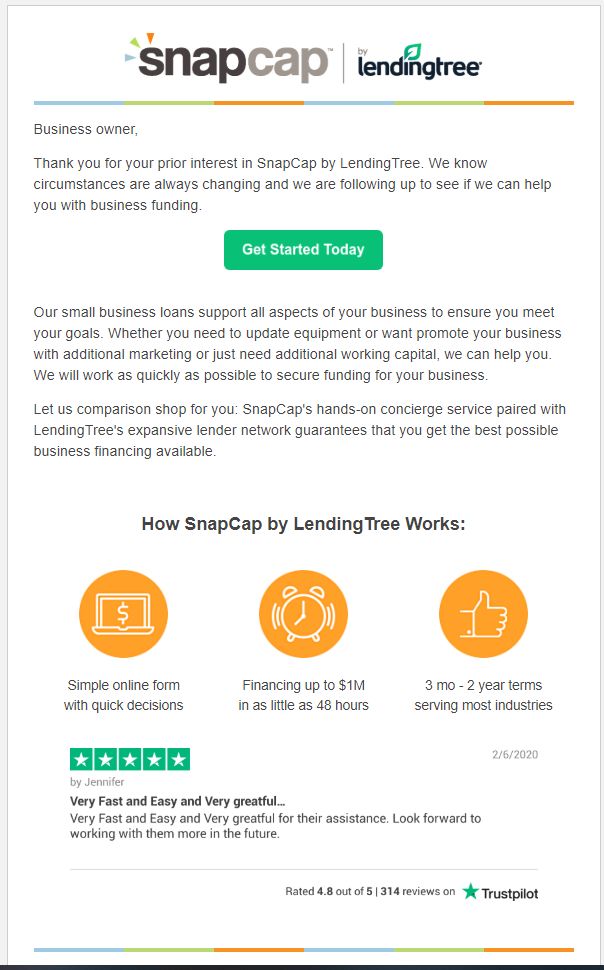

This grant is specifically for small businesses and nonprofits that have experienced a loss of revenue due to the coronavirus pandemic. Meet some of the entrepreneurs who have used SnapCap loans to support and grow their businesses. Take the first step.

LendingTree is a leading online loan marketplace with one of the largest networks of lenders in the nation. The type of business loan you.

Long Term Business Loans Free Offers On A Term Loan Lendingtree

Long Term Business Loans Free Offers On A Term Loan Lendingtree

Lendingtree Review Updated Jan 2020 Thecreditreview

Lendingtree Review Updated Jan 2020 Thecreditreview

Lendingtree Business Loans Review Business Financing By Lendingtree Compared

Lendingtree Business Loans Review Business Financing By Lendingtree Compared

Lendingtree Lendingtree Twitter

Lendingtree Lendingtree Twitter

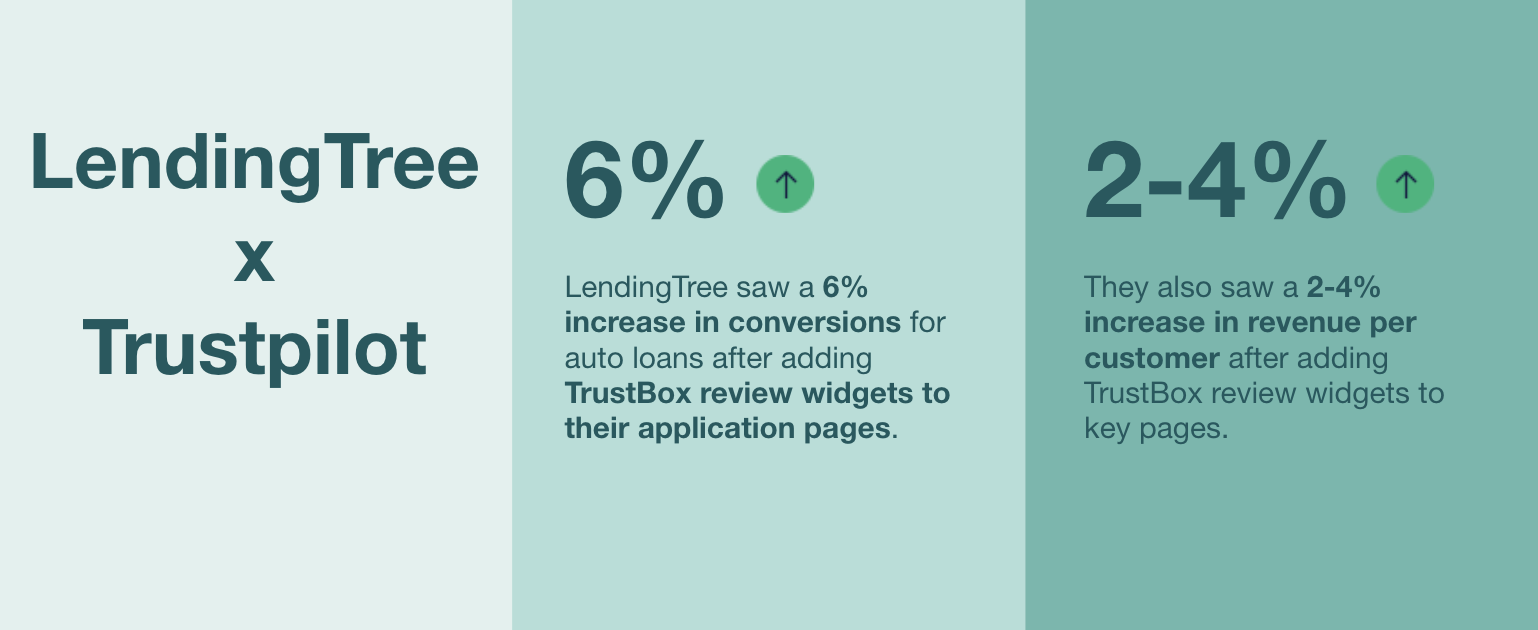

Lendingtree Builds Trust To Make The Loan Process Feel More Secure For Their Customers Trustpilot Business Blog

Lendingtree Builds Trust To Make The Loan Process Feel More Secure For Their Customers Trustpilot Business Blog

Lendingtree Reviews With Costs Retirement Living

Lendingtree Reviews With Costs Retirement Living

Lendingtree Business Loans Review April 2021 Finder Com

Lendingtree Business Loans Review April 2021 Finder Com

Small Business Loans 2021 Compare Your Options Lendingtree

Small Business Loans 2021 Compare Your Options Lendingtree

Lendingtree Builds Trust To Make The Loan Process Feel More Secure For Their Customers Trustpilot Business Blog

Lendingtree Builds Trust To Make The Loan Process Feel More Secure For Their Customers Trustpilot Business Blog

Lendingtree Com Personal Loans Review 2021 Rates Comparison

Lendingtree Com Personal Loans Review 2021 Rates Comparison

Lendingtree Launches Free Credit Monitoring Finovate

Lendingtree Launches Free Credit Monitoring Finovate

Lendingtree Small Business Loans 2021 Review

Lendingtree Small Business Loans 2021 Review

Lendingtree Debuts Small Business Loan Marketplace

Comments

Post a Comment