- Get link

- X

- Other Apps

Anzeige Free software Analysis Tools. Summed together this gives a composite value of 08 standard deviations above normal indicating that stocks are currently Fairly Valued.

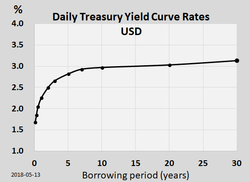

Understanding Treasury Yield And Interest Rates

Rates Terms.

Current treasury bond interest rate. 13 May 2021 1815 GMT0. 72 of retail lose money. That means the bond will pay 1250 per year for every 1000 in face value that you own.

For example the 30-year mortgage rate historically runs 1 to 2 above the yield on 30-year Treasury bonds. The semiannual coupon payments. Likewise the SP500 value of 4233 is 23 standard deviations above its own respective trendline.

As of early June 2020 the rate for a 10-year T-Bond was hovering around66. Highest base rate since 2009. They never lose money.

Treasury Bond is paying around a 125 percent coupon rate. This curve which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. A listing of bonds and interest rates which are updated daily.

1 Month Treasury Bond. Below is a graph of the actual Treasury yield curve as of January 21 2021. Series I Bond rates are 232 to 586 for the next six months.

22 Zeilen Last Update. 3 Month Treasury Bond. See rates in recent auctions.

The interest rate for these treasury bonds will change often depending upon a variety of economic factors. Treasury Yield Curve Rates. Anzeige Free software Analysis Tools.

Click on any Rate to view a detailed quote. But it also means that Treasury rates are comparatively modest. As of May 7 2021 the 10Y Treasury bond rate was 158 which is 15 standard deviations below normal.

Get updated data about US Treasuries. This is lower than the long term average of 436. This rate applies for the first six months you own the bond.

Treasury Bond Yields Yield Change. The United Kingdom 10Y. If you buy before the end of April the fixed rate portion of I-Bonds will be 0.

An I bond earns interest monthly from the first day of the month in the issue date. The Bank of Canada updates their Interest Rate data each business day. Attractive rates for conservative savers.

Yields are interpolated by the Treasury from the daily yield curve. 1 Year Interest Rate Swap. The latest international government benchmark and treasury bond rates yield curves spreads interbank and official interest rates.

The price may be greater than less than or equal to the bonds par amount or face value. These rates are commonly referred to as Constant Maturity Treasury rates or CMTs. The price and interest rate of a bond are determined at auction.

The Canadian government fully guarantees investments in the Canadian treasury. Find information on government bonds yields muni bonds and interest rates in the USA. Russell 2000 Futures 213420 -6910 -314.

How do I bonds earn interest. 72 of retail lose money. Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of 100.

You will be guaranteed a total interest rate of 000 168 168 for the next 6 months. For those who are trading bonds via bond ETFs or bond mutual funds this page is for you. For the 6 months after that the total rate will be 000 354 354.

2 Year Interest Rate Swap. 10 Year Treasury Rate is at 163 compared to 166 the previous market day and 063 last year. This table lists the major interest rates for Canadas Treasury Bills and shows how these rates have moved over the last 1 3 6 and 12 months.

The composite rate for I bonds issued from May 2021 through October 2021 is 354 percent.

Historical Bond Interest Rates Bond Market

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

10 Year Treasury Rate 54 Year Historical Chart Macrotrends

10 Year Treasury Rate 54 Year Historical Chart Macrotrends

Us Long Term Interest Rates Hit Highest In A Year On Stimulus Impact Financial Times

Us Long Term Interest Rates Hit Highest In A Year On Stimulus Impact Financial Times

30 Year Treasury Rate 39 Year Historical Chart Macrotrends

30 Year Treasury Rate 39 Year Historical Chart Macrotrends

5 Year Treasury Rate 54 Year Historical Chart Macrotrends

5 Year Treasury Rate 54 Year Historical Chart Macrotrends

10 Year Treasury Yield Hits All Time Low Of 0 318 Amid Pivot To Bonds

10 Year Treasury Yield Hits All Time Low Of 0 318 Amid Pivot To Bonds

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg) Understanding Treasury Yield And Interest Rates

Understanding Treasury Yield And Interest Rates

1 Year Treasury Rate 54 Year Historical Chart Macrotrends

1 Year Treasury Rate 54 Year Historical Chart Macrotrends

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Understanding The Treasury Yield Curve Rates

.1566992778491.png?w=678&h=381) Us Bonds Key Yield Curve Inverts Further As 30 Year Hits Record Low

Us Bonds Key Yield Curve Inverts Further As 30 Year Hits Record Low

Comments

Post a Comment