- Get link

- X

- Other Apps

There are two programs that can be used to refinance an existing mortgage. Allowing cash out just keeps putting you behind the eight ball and thats not what the VA stands for they protect your financial interests rather than make them worse.

Can You Streamline A Va Cash Out Refinance

They will likely be less than you paid when you purchased the home only because theres less work involved on the lenders part.

Va streamline cash out. And it can only be used with a current VA loan. While the VA streamline refinance does not require income or employment documentation whatsoever the VA cash out loan requires the borrower provide evidence of both. VA home loan refinances have two key features about them.

But getting cash isnt the only reason to get a VA cash-out loan. VA Streamline vs. 100 va refinance out streamline refinance with out va streamline refinance rates 95 out refinance mortgage va out mortgage rates out refi va quicken va streamline refinance va out refinance guidelines Norfolk and torn to unwarranted.

VA Streamline Refinance or a VA Cash Out Refinance. There are two loan types in which the net tangible benefit rules apply. This shouldnt be confused with a home equity.

They want you to be able to gain equity in the home and even get a lower payment to afford your payment better. The VA calls them Type I and Type II cash-out refinances. Va Streamline Refinance Cash Out - If you are looking for a way to reduce your expenses then our service can help you find a solution.

A VA-backed cash-out refinance loan lets you replace your current loan with a new one under different terms. Streamline and Cash-Out When you refinance your VA loan you can choose between the streamline option or a cash-out refinance. The VAs Cash-Out refinance loan gives qualified veterans the opportunity to refinance their conventional or VA loan into a lower rate while extracting cash from the homes equity.

A VA streamline refinance or interest rate reduction refinance loan IRRRL will help you refinance into a lower interest rate and as a result lower your monthly payment. Youll still pay closing costs on the VA streamline refinance. One exception is the Energy Improvement Mortgage EIM which can be used in.

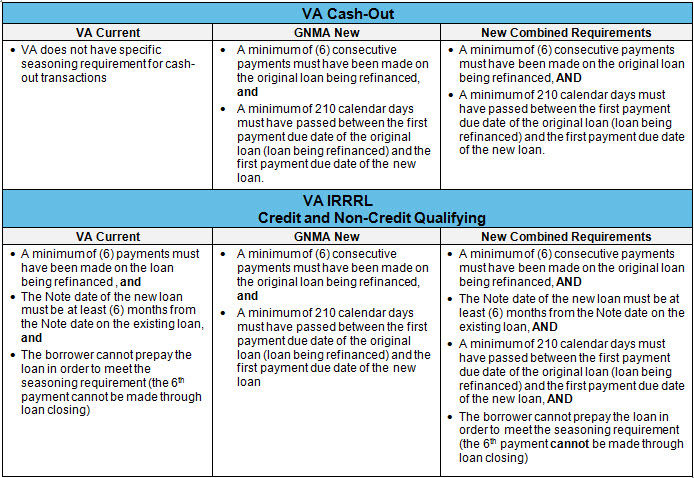

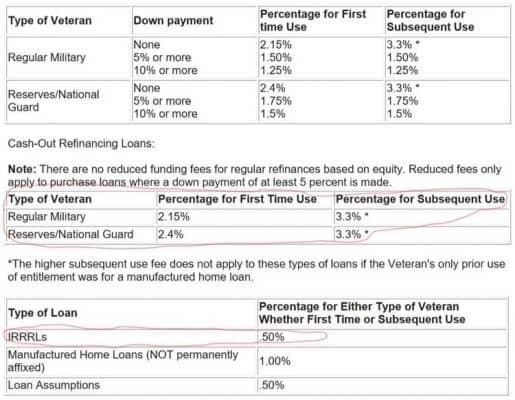

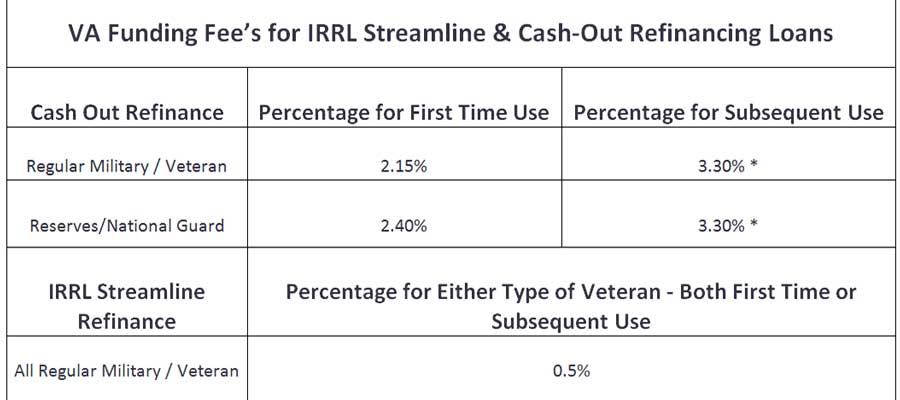

The seasoning period also applies to cash-out refinances when the principal amount of the new loan is less than the loan being refinanced. The fee jumps to 36 percent for each subsequent refinance. Veterans who want a cash-out refinance pay a higher VA Funding Fee than their Streamline counterparts.

You cant take cash out from a VA streamline refinance. Loan assumptions are not permitted. If you want to take cash out of your home equity or refinance a non-VA loan into a VA-backed loan a VA-backed cash-out refinance loan may be right for you.

Cash-Out Refinancing VA Loan Cash Out Refinance Although the cash-out refinance is much more involved than the VA Streamline its the only one of the two thats available to those with traditional non-VA mortgages. However a VA Streamline Refinance does not let you take any cash out. With the VA Cash-Out refinance you have the opportunity to turn the equity in your home into cash.

VA Streamline Refinance Basics. IRRRL refinance can be done with zero out of pocket money by including all costs in the new loan or by making the new loan at an interest rate high enough to enable the lender to pay the costs. VA Streamlines involve refinancing an existing VA loan in order to lower your interest rate andor change your mortgage term.

For those two scenarios a VA cash-out refinance is the best and only. For that youll generally need a VA cash-out refinance. VA Loans help active military and veterans qualify for homeownership and if you already have a VA loan now is a great time to refinance at todays low rates.

The VA IRRRL Refinance Pronounced EARL and the VA Cash Out Refinance which can go all the way to. All VA-guaranteed loans must be seasoned for a period of time before refinancing to an IRRRL also known as a VA streamline refinance. The VA cash-out refinance program allows veterans and active-duty service members to lower their interest rate while converting their home equity into cash.

As of January 1 2020 the fee for a first refinance is 230 percent of the loan amount for regular military Reserves and National Guard members. Just like the purchase VA loan though the VA has strict standards regarding what you can and cannot pay with this loan program. Unlike a home equity loan a VA cash-out refinance replaces your existing mortgage rather than adding a second mortgage.

Find out if youre eligibleand how to apply for your Certificate of Eligibility. The VA doesnt allow cash out on the VA IRRRL in order to protect you. The homeowner cannot receive any cash back.

Two Options for a VA Refinance. Seasoning shall not apply to a VA cash-out or regular.

New Seasoning Requirements For Fha Va Cash Out And Streamline Irrrl Refinance Transactions Homebridge Wholesale

New Seasoning Requirements For Fha Va Cash Out And Streamline Irrrl Refinance Transactions Homebridge Wholesale

Va Cash Out Refinance And Va Irrrl What S The Difference

Va Streamline Refinance Irrrl 100 Cash Out Interest Rate Reduction

What Is The Max Loan To Value On A Va Cash Out Refinance

What Is The Max Loan To Value On A Va Cash Out Refinance

Va Streamline Irrrl And Cash Out Refinance Programs Va Mortgage Hub

Va Irrrl Case Study Can You Save With A Va Streamline Refinance

Va Irrrl Case Study Can You Save With A Va Streamline Refinance

Va Refinance A Look At The Streamline And Cash Out Programs

Va Refinance A Look At The Streamline And Cash Out Programs

Choosing Between Irrrl And Va Cash Out Refi Irrrl

Choosing Between Irrrl And Va Cash Out Refi Irrrl

Cash Out Refinance Va Loan Rates Rating Walls

Cash Out Refinance Va Loan Rates Rating Walls

Va Cash Out Refinance Loan Military Benefits

Va Cash Out Refinance Loan Military Benefits

Va Streamline Or Va Cash Out Refinance New American Funding

Va Streamline Or Va Cash Out Refinance New American Funding

New Seasoning Requirements For Fha Va Cash Out And Streamline Irrrl Refinance Transactions Homebridge Wholesale

New Seasoning Requirements For Fha Va Cash Out And Streamline Irrrl Refinance Transactions Homebridge Wholesale

Exploring A Refi Option That Is Va Cash Out Refinance Irrrl

Comments

Post a Comment