- Get link

- X

- Other Apps

A mutual fund gives an investor instant diversification. Like bonds they are subject to interest-rate and credit risk.

The Difference Between Stocks And Bonds For Investors

The Difference Between Stocks And Bonds For Investors

Like any other kind of bond they provide a guaranteed.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

What are stocks and bonds. The four allocation samples below are based on a strategic approach meaning you are looking at the outcome over 15 years or more. The bond market is where investors go to buy and sell debt securities issued by corporations or governments. Companies like to raise money when they have several profitable business ideas but only have so much money in their bank account.

In a mutual fund money collected from various investors is taken together to buy a large variety of securities. Convertible bonds are hybrid securities that offer investors the best of both stocks and bonds. Whereas Bonds are financial instruments that highlight the loans from the government or any company.

Simply put stocks and bonds are ways for companies to raise money. Stocks on the other hand are issued by sole proprietors. You essentially lend money to a bond issuer typically a corporation local government or the federal government and they typically make regular interest payments.

Stocks also called capital stock are equity instruments that represent ownership in a company. While bonds are issued by all types of entities including governments corporations nonprofit organizations etc. Well they each do it a little bit differently.

On the other hand mutual funds are pooled investment vehicles. Bonds are commonly referred to as fixed income securities and are one of three asset classes individual investors are usually familiar with along with stocks equities and cash equivalents. For example stocks have historically had a higher rate of return than bonds when measured over the long-term but have more volatility in the short-term.

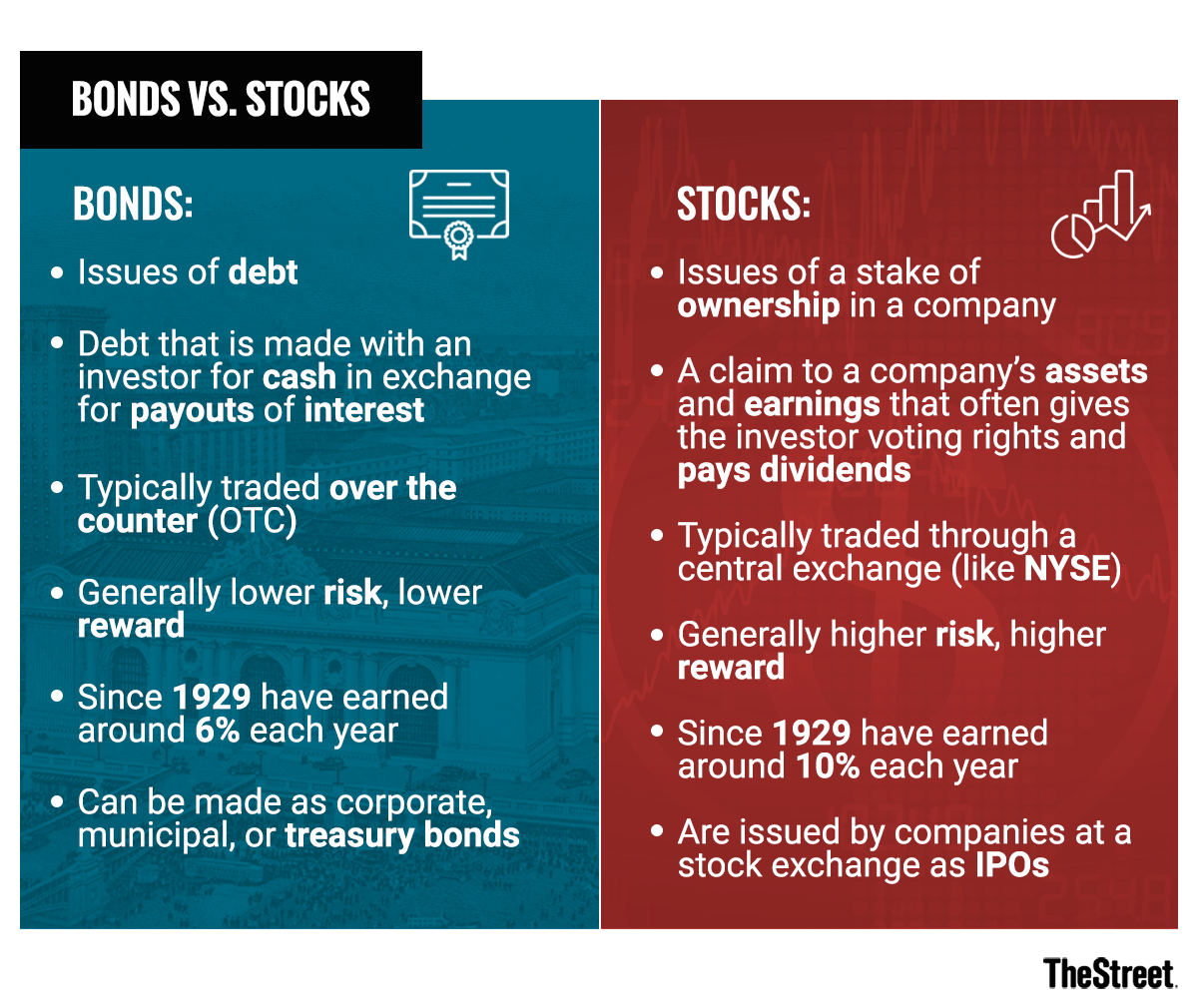

Stocks are equity instruments and can be considered as taking ownership of a company. Its important to understand that bonds and stocks work a little differently from each other as you learn how to invest money. In the battle of Bonds vs Stocks stocks are considered a riskier investment in the short run because of the riskier nature of the stock market.

Preferred stocks are riskier than bonds and ordinarily carry lower credit ratings but usually offer higher yields. A stock represents a collection of shares in a company which is entitled to receive a fixed amount of dividend at the end of relevant financial year which are mostly called as Equity of the company whereas bonds term is associated with debt raised by the company from outsiders which carry a fixed ratio of return each year and can be earned as they are. Differences Between Stocks and Bonds.

Stocks and bonds are characterized by asset classes. Stocks typically trade on various exchanges while bonds are mainly sold over the. So how exactly do stocks and bonds help companies raise money.

Stocks Vs Bonds Top 8 Useful Differences To Learn With Infographics

Stocks Vs Bonds Top 8 Useful Differences To Learn With Infographics

Nse 7 Understanding Stocks And Bonds Productivity Tips Ms Excel And Inspiration

Nse 7 Understanding Stocks And Bonds Productivity Tips Ms Excel And Inspiration

Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

What S The Difference Between Bonds And Stocks Youtube

What S The Difference Between Bonds And Stocks Youtube

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

Stocks Vs Bonds Top 7 Differences Between Stocks And Bonds

Stocks Vs Bonds Top 7 Differences Between Stocks And Bonds

Bonds Vs Stocks What S The Difference Thestreet

Bonds Vs Stocks What S The Difference Thestreet

Stocks Vs Bonds What S The Smarter Choice The Sage Millennial

Stocks Vs Bonds What S The Smarter Choice The Sage Millennial

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

Bonds Vs Stocks Overview Characteristics Example

Bonds Vs Stocks Overview Characteristics Example

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

Investing In Stocks Vs Bonds Differences To Consider

Investing In Stocks Vs Bonds Differences To Consider

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Differences Between Stocks And Bonds

Differences Between Stocks And Bonds

Comments

Post a Comment