- Get link

- X

- Other Apps

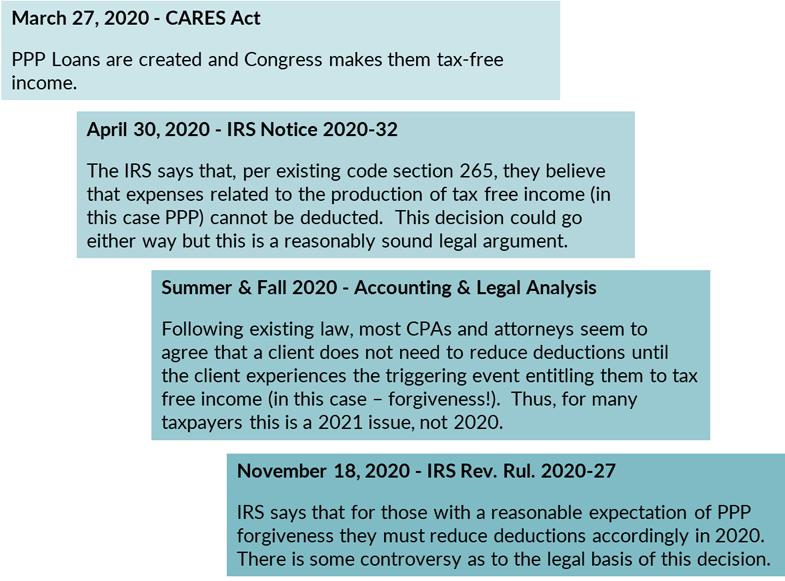

PPP loan forgiveness application. Yesterday the IRS and Treasury issued guidance to formalize the allowance of federal tax deductions related to PPP expenses.

Expenses With Ppp Money Are Tax Deductible Congress Reverses Irs

Expenses With Ppp Money Are Tax Deductible Congress Reverses Irs

The IRS said no to tax deductions with PPP money but Congress reversed the IRS.

Ppp tax deduction. If the business took a PPP loan after Jan. PPP loan forgiveness update. Michael Cohn has IRS clarifies deductibility of PPP loan expenses as AICPA criticizes forgiveness questionnaire on accountingtoday.

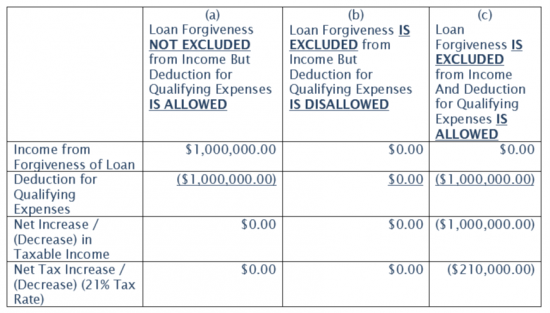

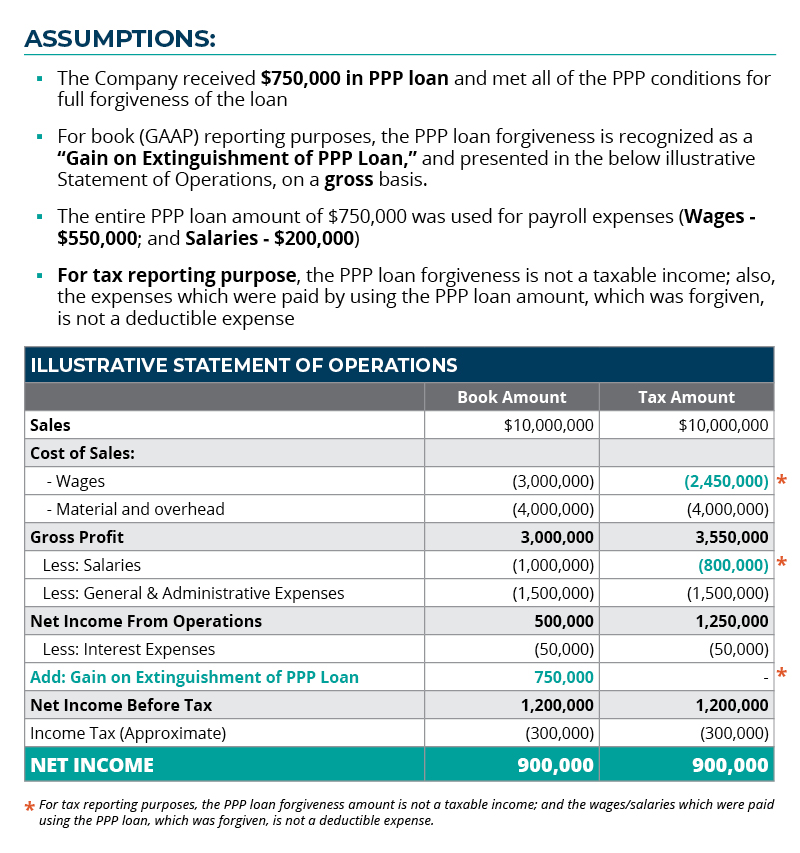

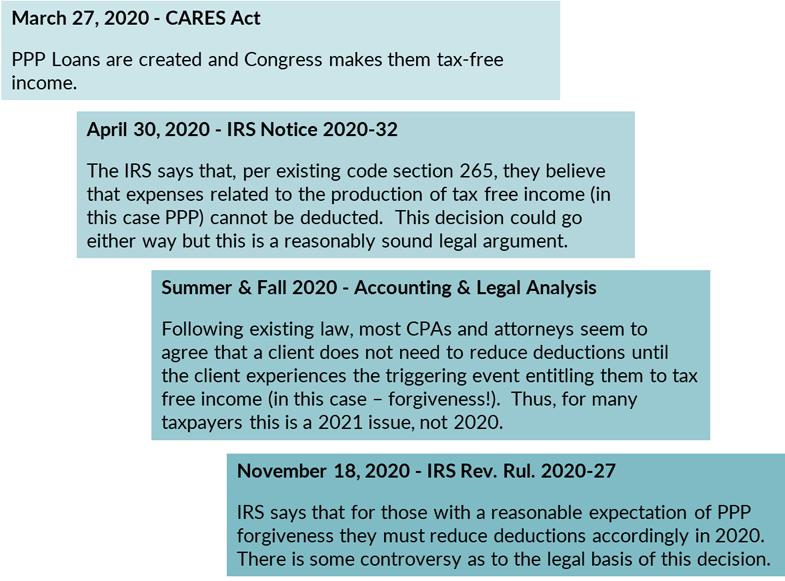

Congress chose to exempt forgiven Paycheck Protection Program PPP loans from federal income taxation. This law uncategorically says that all expenses that were paid to meet the requirements of having the PPP loans forgiven are now deductible said Evan Morgan director of tax services at Kaufman Rossin which does tax and accounting work for many professional services clients including law firms and doctors offices. With the recent passage of the COVID-related Tax Relief Act of 2020 part of the Consolidated Appropriations Act 2021 PPP borrowers will now be permitted to deduct eligible loan expenses when such payments resulted in or are expected to result in the forgiveness of the loan.

Gavin Newsom on April 29 signed legislation that will provide a 62 billion tax. The IRS is essentially saying that PPP borrowers cannot have the PPP expenses qualify for loan forgiveness and then turn around and claim those same expenses as tax deductions. How to apply for PPP loan forgiveness.

PPP loans are forgivable and despite normal tax. The bill does not include an employee limit. The provision part of the year-end coronavirus relief bill expected to soon clear Congress would ensure that PPP recipients can deduct the payroll costs and other expenses covered by forgiven.

Now you can still claim normal tax deductions. Rosenthal in comments to The Intercept estimates that the PPP deduction provision could reduce the taxes of the highest-income taxpayers by at least 100 billion without. California business owners whose PPP loans are forgiven can deduct the qualifying expenses paid for with the loan funds from their state income taxes if they can show at least a 25 reduction in gross receipts for at least one quarter as a result of the pandemic.

Many states however remain on track to tax them by either treating forgiven loans as taxable income denying the deduction for expenses paid for using forgiven loans or both. Congress will also allow PPP borrowers to take tax deductions for. On December 27 2020 when President Trump signed the Consolidated Appropriations Act expenses paid with a PPP loans proceeds became deductible on federal income tax returns assuming the expenses are otherwise deductible.

Small businesses that took a PPP loan and saw their revenues fall by 25 will be able for a second loan. Laura Davison and David Hood has Congress Blasts IRS for Limits on Forgiven PPP Loan Tax Breaks on Bloomberg. IR-2021-04 January 6 2021 The Treasury Department and the Internal Revenue Service issued guidance today allowing deductions for the payments of eligible expenses when such payments would result or be expected to result in the forgiveness of a loan covered loan under the Paycheck Protection Program PPP.

The PPP Flexibility Act which was enacted on June 5 2020 changed the rules so employers can still defer these taxes even after a PPP loan is forgiven. The provision part of the discussions over the year-end coronavirus relief bill would ensure that PPP recipients can deduct the payroll costs and. Yes employers are allowed to defer payroll taxes as specified in the CARES Act from March 27 2020 through December 31 2020.

1 2021 the business may include the fourth quarter of 2020 to compare revenue loss. To take the deductions on PPP loan taxes businesses must demonstrate a 25 reduction in first second and third respective quarters from 2019 to 2020. On your individual return youd find yourself paying tax on a total of 175000 of income before deductions the 100000 from the S corporation and the 75000 of salary you paid yourself.

In defending the IRS position Treasury Secretary Steven Mnuchin said that businesses arent allowed to double dip Business groups oppose the IRS position.

No Deduction For Business Expenses Paid Out Of Forgivable Paycheck Protection Program Loans Lexology

No Deduction For Business Expenses Paid Out Of Forgivable Paycheck Protection Program Loans Lexology

People Who Received Ppp Loans Are Not Qualified For Tax Deductions Pugh Cpas

People Who Received Ppp Loans Are Not Qualified For Tax Deductions Pugh Cpas

Irs Clarifies Tax Deduction Eligibility For Ppp Expenditures Mfa Insights

Irs Clarifies Tax Deduction Eligibility For Ppp Expenditures Mfa Insights

Expenses Paid With Forgiven Ppp Loan Proceeds Are Not Tax Deductible Dalby Wendland Co P C

Expenses Paid With Forgiven Ppp Loan Proceeds Are Not Tax Deductible Dalby Wendland Co P C

![]() No Tax Deduction For Payments That Result In Ppp Loan Forgiveness Jmf

No Tax Deduction For Payments That Result In Ppp Loan Forgiveness Jmf

Expenses Paid With A Forgiven Ppp Loan Are Deductible Irs Is Wrong

Irs Denied Ppp Write Offs Congress May Restore Tax Deductions

Irs Denied Ppp Write Offs Congress May Restore Tax Deductions

Deductible Expenses With Ppp Loans The 2nd Round Of Ppp Loans A2z Cfo

Deductible Expenses With Ppp Loans The 2nd Round Of Ppp Loans A2z Cfo

Ppp Reporting Period Net Income Management Tax Considerations For Manufacturers Sikich Llp

Ppp Reporting Period Net Income Management Tax Considerations For Manufacturers Sikich Llp

Irs Rules That Expenses Used For Ppp Loan Forgiveness Are Not Deductible Cerini Associates Llp Blogs

Irs Rules That Expenses Used For Ppp Loan Forgiveness Are Not Deductible Cerini Associates Llp Blogs

Ppp Guidance Impact 2020 Taxes Ppp Forgiveness Consulting

Ppp Guidance Impact 2020 Taxes Ppp Forgiveness Consulting

The Reason Ppp Loans Are Tax Deductible Prestamos Ppp Son Deducibles De Impuestos Community Tax Youtube

The Reason Ppp Loans Are Tax Deductible Prestamos Ppp Son Deducibles De Impuestos Community Tax Youtube

Ppp Loan Tax Deduction Restrictions Dallas Business Income Tax Services

Ppp Loan Tax Deduction Restrictions Dallas Business Income Tax Services

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

Comments

Post a Comment