- Get link

- X

- Other Apps

Die vier neuen Vanguard-ETFs sollen bereits ab einer Jahresgebühr von 022 Prozent zu haben sein. Why Vanguards Smart-Beta Bet May Unsettle Its Rivals Julie Segal November 06 2017 This content is from.

Vanguard To Launch 6 Factor Based Etfs Financial Planning

Vanguard To Launch 6 Factor Based Etfs Financial Planning

Vanguard Value Index Fund ETF Shares NYSEArca.

Vanguard smart beta. Here are 5 smart beta ETFs to consider. Smart-Beta Die Prunkstücke in Vanguards Sortiment sind zweifelsohne die großen Basis-ETFs wie der Vanguard SP 500 UCITS ETF oder der Vanguard FTSE All-World UCITS ETF. Vanguard itself avoided the label but the industrys reaction does highlight evolving notions of what smart beta is.

New Vanguard research demystifies smart beta success. As a factor value has been a winner in recent months Kashner says and VTV has. Vanguard based on data from Morningstar Inc FTSE Russell and FactSet.

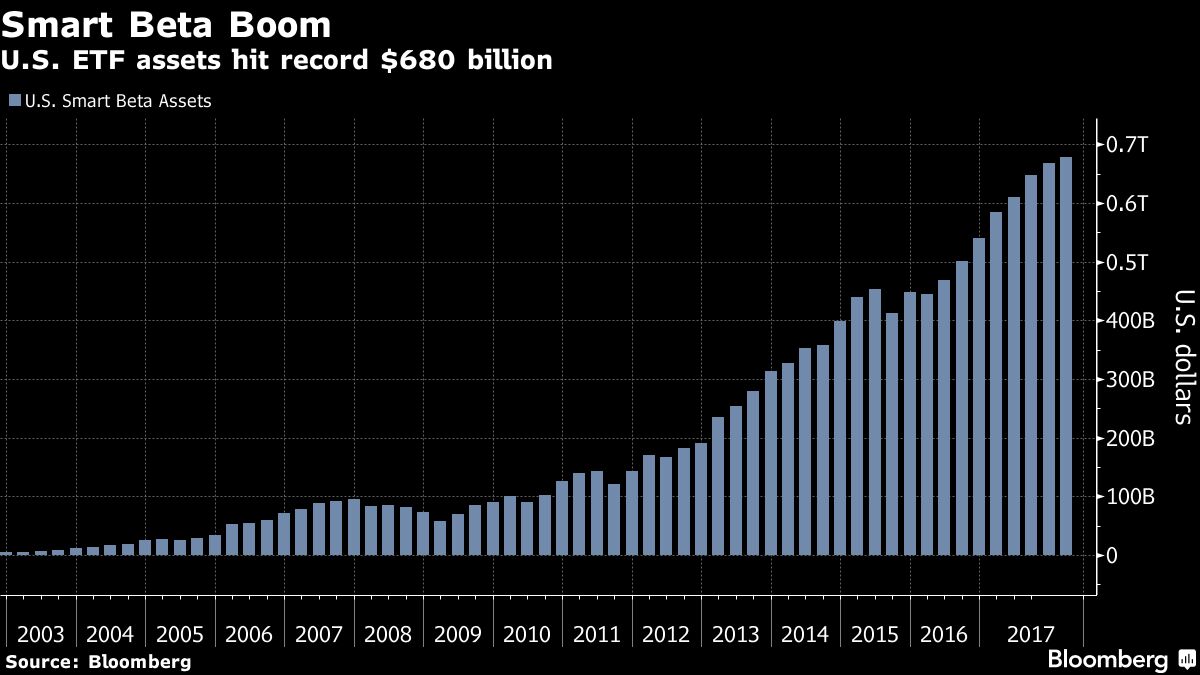

18092020 - 1917. Although smart beta portfolio construction processes dont provide explicit exposure to market-risk factors using such proxies in a style analysis can shed light on a portfolios tilts or biases over time. Still smart beta is cheaper than traditional active and investors have noticed making it one of the fastest-growing fund categories.

Smart Beta-Indizes nutzen fundamentale Faktoren Preisbewegungen und Informationen wie Dividendenzahlungen um das Beste aus der passiven und der aktiven Investmentwelt zu vereinen. Die meisten dieser Strategien streben Mehrrenditen gegenüber dem Markt an oder sollen Risiken reduzieren. Was Sie auf jeden Fall über Smart Beta.

The biggest smart-beta ETF in the market today is the Vanguard Value ETF VTV with 47 billion in total AUM. According to Joel Dickson a senior strategist in The Vanguard Group Incs Investment Strategy Group indexing strategies have evolved greatly. Smart Beta-ETFs bilden Märkte anders ab als die bekannten ETFs auf liquide Märkte wie DAX oder SP 500.

Vanguard which has 11 trillion in active strategies and. There are many new. Mit der nächsten ETF-Generation den sogenannten Smart Beta Fonds will die Fondsgesellschaft bei Investoren in Europa punkten.

In a new whitepaper. The investment seeks to track the performance of a benchmark. Vanguard Growth Index Fund ETF Shares NYSEArca.

Seeks to track the performance of a benchmark index that measures the investment return of large-capitalization. Figure 2 uses a returns-based style analysis of both alternatively weighted and market-cap-weighted indices to show their respective exposures across a suite of market-cap. Vanguard believes they are active bets and not substitutes for traditional index funds.

Investors should think less about chasing higher returns and more about their investment goals when considering factor-based active equity funds often labelled by product issuers as smart beta according to new research from Vanguard. Smart Beta à la Vanguard. 47000 EUR-280 EUR-059.

Goldman Sachs Ignites New ETF Price War Julie Segal September 14 2017. Preiskampf mit Smart-Beta-ETFs Die Vanguard-Marktoffensive ist eine Antwort auf diese steigende Nachfrage nach ETFs. Vanguard one of the worlds largest mutual fund managers is closely watching the development of smart beta strategies as a complement to its index fund mainstays its CEO said.

Vanguard Global Liquidity Factor ETF. BlackRocks smart beta assets have ballooned by almost 180 per cent to 288bn over the past five years leaving rival asset managers scrambling. But investors should be careful to discern smart beta strategies for what they are.

Most of the early batch of smart beta funds presented themselves as the name suggests as a more intelligent way to gain passive market exposure. Indices focused on specific risk factors iShares MSCI USA Minimum Volatility Index iShares MSCI USA Momentum Index iShares MSCI USA Quality Index iShares MSCI USA Value Weighted Index. Seeks to track the performance of a benchmark index that measures.

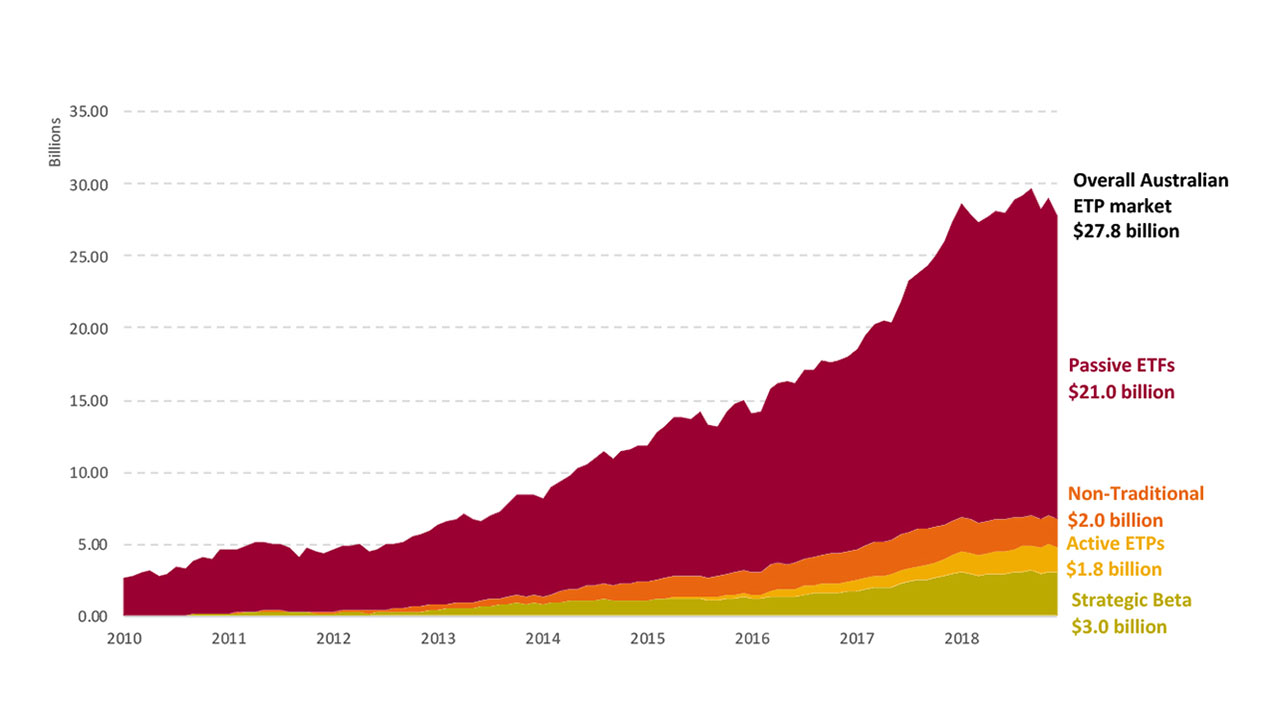

Smart-beta indices SP 500 Equal Weighted Index and FTSE RAFI US 1000 Index. In den letzten Jahren sind jedoch auch immer mehr aktive ETFs dazugekommen darunter regelbasierte alternativ gewichtete ETFs oftmals als Smart Beta oder Strategic Beta bezeichnet die einen nicht-kapitalgewichteten Index abbilden sollen. Vanguard Value Index Fund ETF Shares.

Vanguard 26 April 2017 Print E-mail. Here are 5 smart beta ETFs to consider. The European Federation of Investors and Financial Services Users.

Sie eignen sich hervorragend um den Grundstein eines Portfolios zu bilden um welchen herum anschließend weitere ETFs hinzugekauft werden.

Wealthfront S Smart Beta Wealthfront Whitepapers

Wealthfront S Smart Beta Wealthfront Whitepapers

5 Vanguard Smart Beta Etfs To Consider For Your Portfolio

5 Vanguard Smart Beta Etfs To Consider For Your Portfolio

Smart Beta Factor Correlations To The S P 500 Etf Strategy Etf Strategy

Smart Beta Factor Correlations To The S P 500 Etf Strategy Etf Strategy

Why Vanguard S Smart Beta Bet May Unsettle Its Rivals Institutional Investor

Why Vanguard S Smart Beta Bet May Unsettle Its Rivals Institutional Investor

Vanguard Is Finally Bringing Its Active Smart Beta Etfs To The U S Bloomberg

Vanguard Is Finally Bringing Its Active Smart Beta Etfs To The U S Bloomberg

Smart Beta Funds For Expats Investments For Expats

Smart Beta Funds For Expats Investments For Expats

Smart Beta Beyond The Hype Etf Com

Smart Beta Beyond The Hype Etf Com

Vanguard Moves Into Smart Beta With Actively Managed Factor Etfs Etf Strategy Etf Strategy

Vanguard Moves Into Smart Beta With Actively Managed Factor Etfs Etf Strategy Etf Strategy

Investors Smart Money Piles Into Smart Beta Etfs Financial Times

Investors Smart Money Piles Into Smart Beta Etfs Financial Times

Investing Basics What S So Smart About Smart Beta Etfs Morningstar Com Au

Investing Basics What S So Smart About Smart Beta Etfs Morningstar Com Au

Smart Beta Factor Correlations To The S P 500 Etf Strategy Etf Strategy

Smart Beta Factor Correlations To The S P 500 Etf Strategy Etf Strategy

How To Allocate Smartly To Smart Beta

How To Allocate Smartly To Smart Beta

Comments

Post a Comment