- Get link

- X

- Other Apps

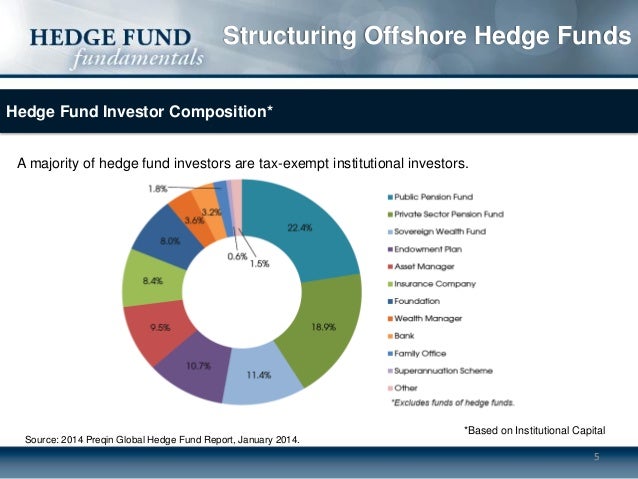

Tax-exempt persons establishing an offshore incubator fund may be desirable from a long-term perspective. The International Mutual Funds Act No.

Structuring Offshore Hedge Funds

Structuring Offshore Hedge Funds

The emerging manager platforms business model allows you to start trading in your hedge fund and seeking investors while building an audited track record within its larger legal structure.

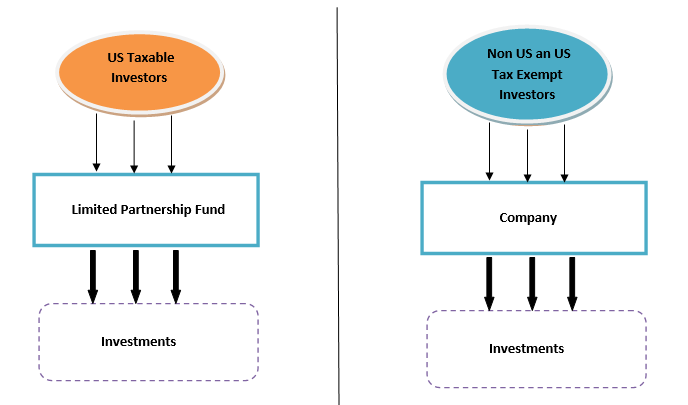

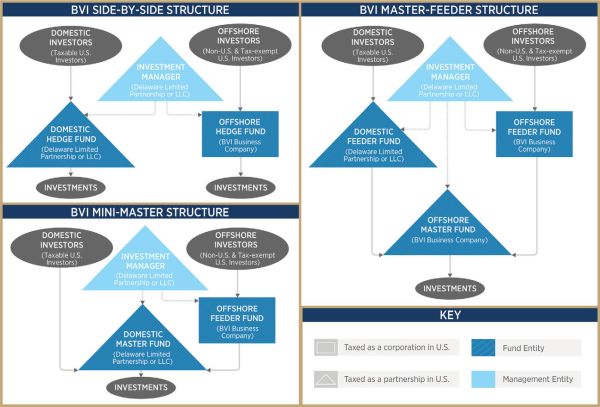

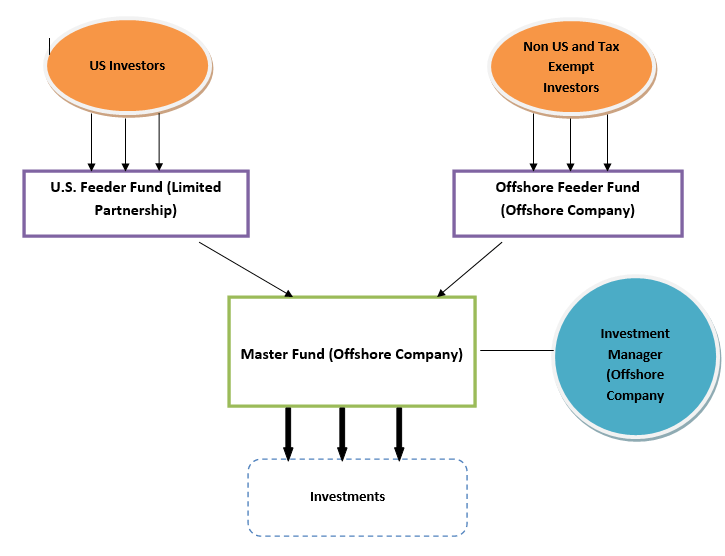

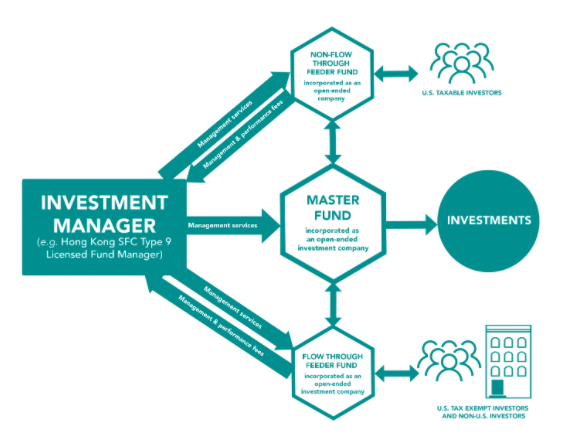

Start an offshore hedge fund. Setting up an offshore fund if you manage money for clients outside of your home country. If your hedge fund has an offshore feeder fund you can setup an offshore IRA LLC and an offshore UBIT blocker to enter the fund through the offshore feeder. The type of vehicle used is based on investor requirements.

These service providers should be independent to avoid conflicts of interest and assure investors that adequate checks and balances exist. If you invest in a US fund through an offshore feeder you will pay no UBIT. In order to launch an offshore hedge fund in Kazakhstan the entrepreneur has to obtain a single license.

Launching a hedge fund and gainfully operating the fund requires the assistance of a number of key service providers. The two jurisdictions are the BVI and the Cayman Islands. Tax-exempt investors to invest in the fund ie such as an IRA ERISA-type retirement plan foundation endowment etc should set up an offshore hedge fund set up as a corporation ie a blocker entity when leverage is required to execute the hedge funds trading program.

While offshore funds provide sponsors with greater flexibility to raise capital from different investors offshore funds also present a range of complicated formation and regulatory issues separate from those facing domestic. A prime broker can provide many helpful services to assist you in starting and managing your hedge fund. Although some people try to go about this kind of investment strategy on their own unless you are working on a very small scale it will be very important to get some kind of assistance in your financial venture.

BVI Complete Fund Package to establish an Incubator or Approved Fund. It is that simple. Why would an invest or that does not live in your home country want to pay taxes there or have to worry about paying taxes there.

There are two main jurisdictions to establish an offshore hedge fund either as a single hedge fund or as part of a master-feeder structure. This approach allows the US. UBTI Blocker Funds Hedge fund managers expecting US.

FUND SERVICES FOR OFFSHORE FUNDS AND HEDGE FUNDS. The two jurisdictions are the BVI and the Cayman Islands. If you invest in a US fund through their US structure youll pay UBIT on distributions.

Offshore Hedge Funds In the offshore arena hedge funds make use of three main vehicles. For a manager seeking to launch an offshore hedge fund startup costs typically average 75000 to 125000 with ongoing operational costs ranging from 100000 to 175000 per year depending on the complexity of the fund. Offshore Companies The vast majority of companies are incorporated with limited liability.

Our offshore hedge fund formation services provide our clients with a complete solution to start a hedge fund domiciled in any preferred offshore jurisdiction. 44 of 1999 the Act defines a Mutual Fund and allows for mutual funds to be established as - a unit trust. An offshore hedge fund is simply a structure used by hedge fund managers as a way to attract offshore investors non-US.

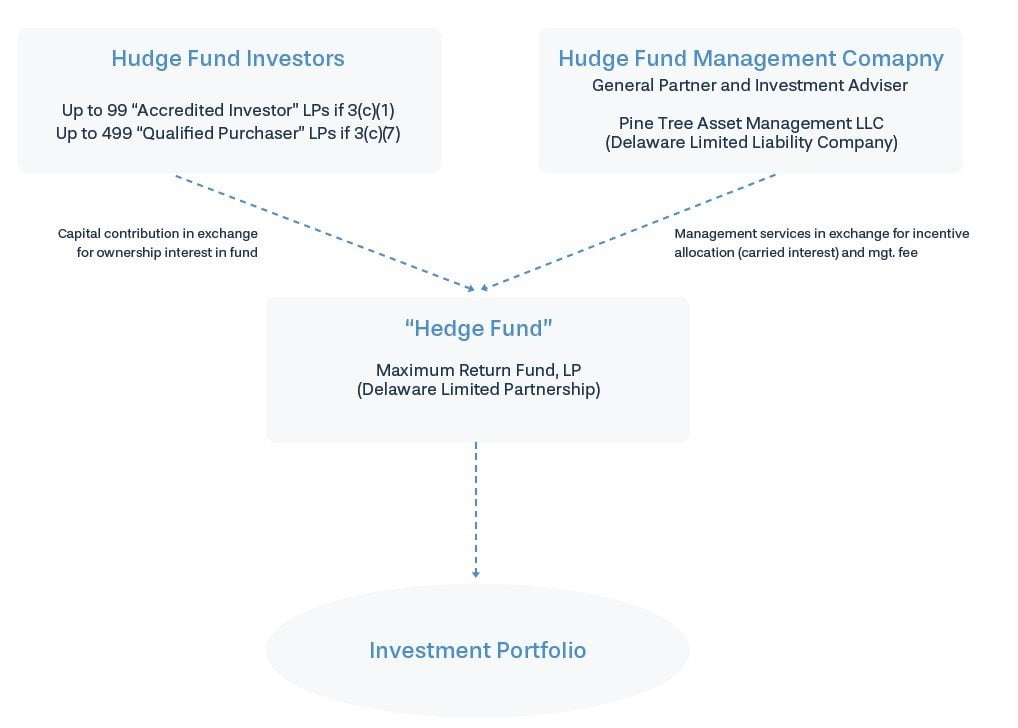

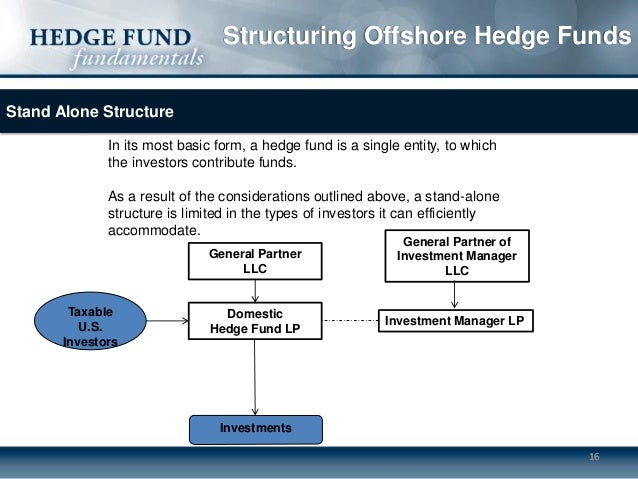

Starting a Hedge Fund Service Providers and Independence. Annual Fee starting 1 year after fund approval. In order to start a hedge fund in the United States two business entities typically need to be formed.

The Act does not prescribe any limits on the investment policy of a St Lucia Mutual Fund nor does it dictate portfolio requirements. Hedge Funds meet the needs of sophisticated investors who are able to make a large initial deposit and commit to investments for a relatively long period. If your prospective hedge fund investors will likely be non-US.

An Offshore is a preferred investment vehicle for a number of high value investors. Some companies may have. Tax-exempt investors explained later in this article.

Is an investment fund consulting firm providing investment fund set up formation administration marketing. A company or as. Based fund managers also consider setting up an offshore fund if your US.

The cost to establish an offshore incubator is typically higher than establishing a domestic incubator depending on the jurisdiction. Our offshore hedge fund formation services provide our clients with a complete solution to start a hedge fund domiciled in any preferred offshore jurisdiction. The first entity is created for the hedge fund itself and the second entity is created for.

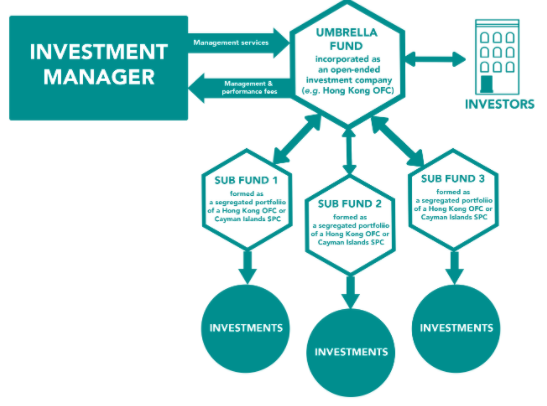

The offshore hedge fund will generally be established in various jurisdictions through a variety of structures that is as a single entity structure a side by side structure or a master-feeder. Companies unit trusts and limited partnerships. Opening an Offshore Hedge Fund in Kazakhstan is a preferred choice as it is a rapidly emerging investment destination.

Includes offshore incorporation license application Registered Agent and all government filings and fees as well as the establishment of a bank and investment account for the fund.

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

How Does A Hedge Fund Work Wallstreetmojo

How Does A Hedge Fund Work Wallstreetmojo

How To Start A Hedge Fund In The Us 2018 The Offshore Dimension Wealth Management British Virgin Islands

How To Start A Hedge Fund In The Us 2018 The Offshore Dimension Wealth Management British Virgin Islands

Fundworld Set Up An Investment Fund Anywhere In The World

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Fund Structure Quick Tips For Starting A Hedge Fund

Fund Structure Quick Tips For Starting A Hedge Fund

Master Feeder Structure Rnd Compliance

How Does A Hedge Fund Work Wallstreetmojo

How Does A Hedge Fund Work Wallstreetmojo

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

Structuring Offshore Hedge Funds

Structuring Offshore Hedge Funds

Https Www Conyers Com Wp Content Uploads 2018 06 2018 Cay How To Start A Hedge Fund In The Us The Offshore Dimension Pdf

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Structuring Offshore Hedge Funds

Structuring Offshore Hedge Funds

Comments

Post a Comment