- Get link

- X

- Other Apps

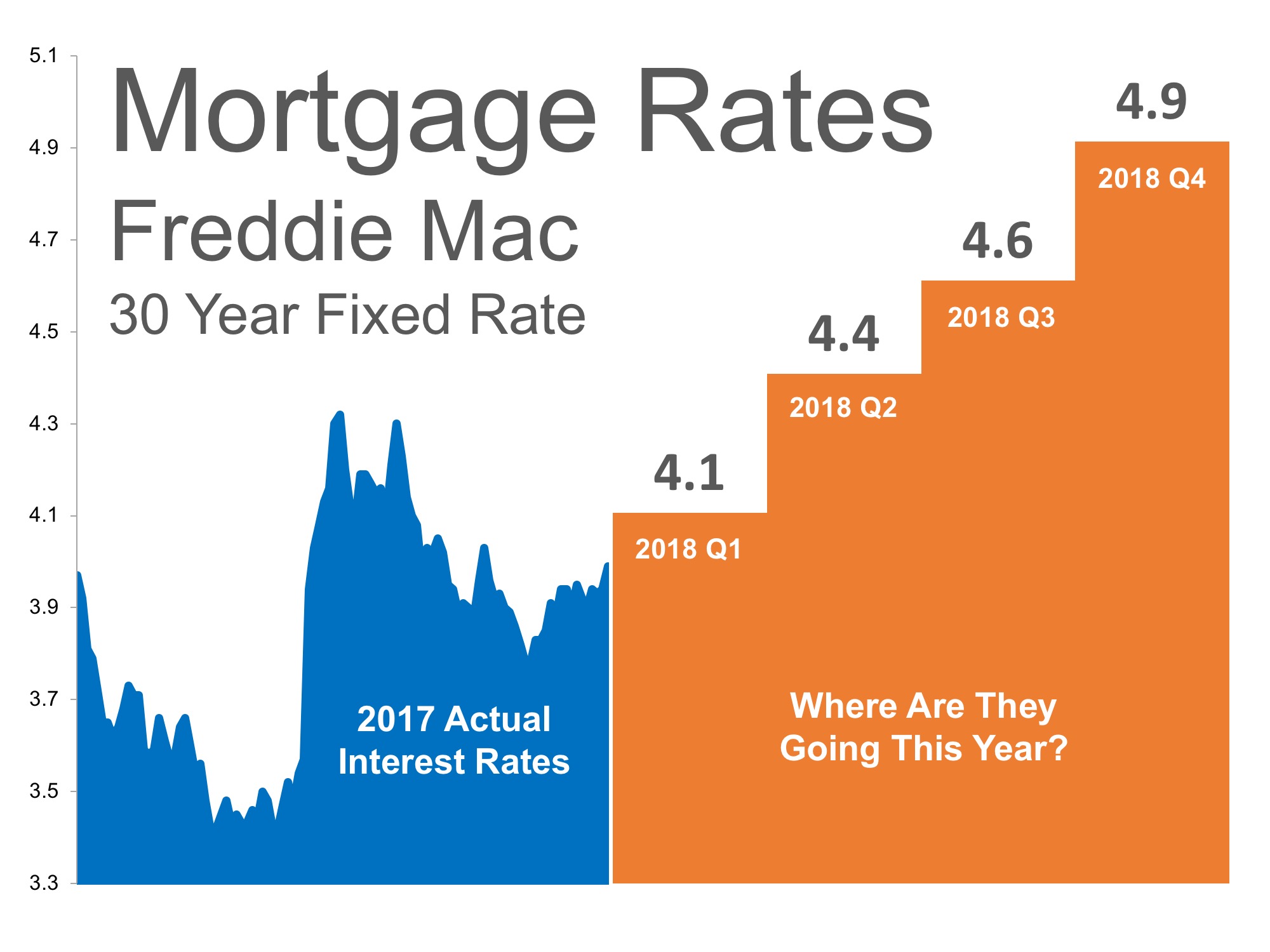

Starting from January 2005 51 hybrid ARM rates are available. In other words if rates go from the 4 range to 5 or so well likely see 350000 fewer home sales.

Where Are Mortgage Interest Rates Headed In 2018 The Gold Standard Group

Where Are Mortgage Interest Rates Headed In 2018 The Gold Standard Group

The average for the month 320.

Mortgage interest rates 2018. Date Month 15 Year FRM 30 Year FRM. The interest rate you pay on your home mortgage has a direct impact on your monthly payment. Use our mortgage calculator to see how interest rates can affect your home purchase.

Averaged 51-yr ARM at 347. However those who want to lower their interest rate while still having plenty of time to pay off a loan can take advantage of 20-year fixed rate loans offered with an interest rate of about 42. Recently the 30-year conventional mortgage rate has been around 5.

Depending on the amount of the loan that you secure a half of a percent 5 increase in interest rate can increase your monthly mortgage payment significantly. This 3 difference in interest rates would cost a home buyer with a 250000 mortgage an extra 443 PER MONTH on their monthly payment. Such a decline will mean less demand and less pressure to raise prices.

There are many different kinds of mortgages that homeowners can decide on which will have varying interest rates and monthly payments. Averaged 51-yr ARM at 336. Thirty-year mortgage rates have risen in 15 of the.

The higher the rate the greater the payment will be. Mortgage interest rates in July 2019. A history of mortgage rates with charts for multiple time frames.

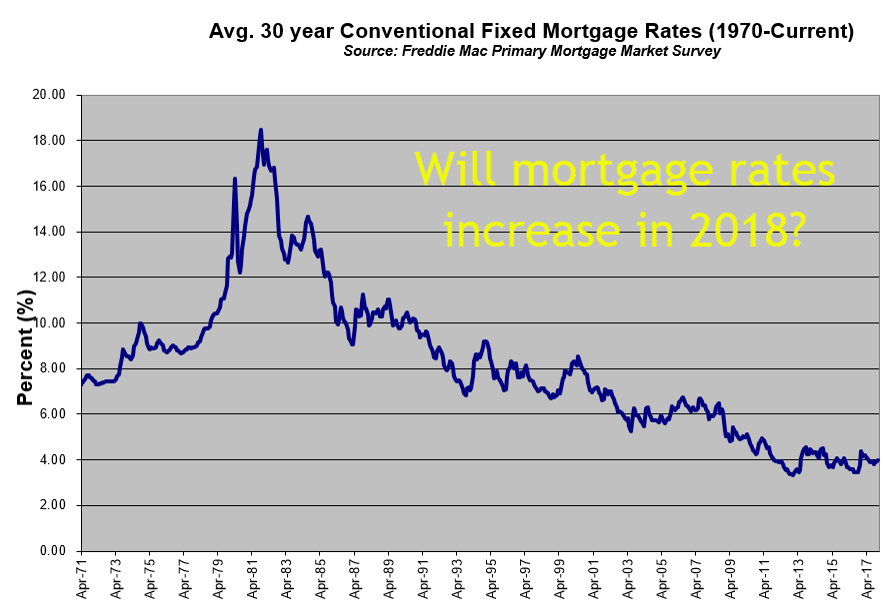

30 Year Mortgage Rate forecast for May 2022. Maximum interest rate 329 minimum 309. Historically the 30-year mortgage rate reached upwards of 186 in 1981 and went as low as 33 in 2012.

The current 30 year mortgage fixed rate as of April 2021 is 298. Averaged 30-year mortgage interest rate at 377. October 2018 Mortgage Rates.

Depending on the amount of the loan that you secure a half of a percent 5 increase in interest rate can increase your monthly mortgage payment significantly. Each week Freddie Mac surveys 125 lenders and the mix of lender types thrifts commercial banks and mortgage lending companies is roughly proportional to the level of mortgage business that each type. The average rate on a 15-year fixed rate mortgage moved up five basis points to 349 05 points The average rate on a 5-year adjustable rate mortgage stayed flat at 346 03 points This is the first time the average rate on a 30-year fixed has crept over 400 since July.

The 30 Year Mortgage Rate forecast at the end of the month 319. The higher the rate the greater the payment will be. Yun expects rates to reach 45 in 2018.

National average rates on conventional conforming 30- and 15-year fixed and 1-Year CMT-indexed adjustable rate mortgages. Averaged 15-year mortgage rate at 320. Mortgage interest rates in August 2019.

The average 30-year fixed mortgage rate fell 6 basis points to 321 from a week ago. Mortgage interest rates in June 2019. According to CoreLogics latest Home Price Index national home prices have appreciated 70 from this time last year and are predicted to be 42 higher next year.

Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971. Lastly the economy could slow down causing interest rates. To put it into perspective the monthly payment for a 100000 loan at the historical peak rate of 1863 in 1981 was 155858 compared to 43851 at the historical low rate of 331 in 2012.

January of 2018. Averaged 30-year mortgage interest rate at 362. Averaged 15-year mortgage rate at 308.

Maximum interest rate 333 minimum 313. That is why it is important to know where rates are headed when deciding to start your home search. This year interest rates are expected to stay around 38 according to Freddie Mac.

30 Year Mortgage Rate is at 298 compared to 297 last week and 333 last year. The rate is up from 395 at the start of the year and a recent low of 378 last September. 30-Year Fixed Rate Mortgage - Historical Annual Yield Data.

What are todays mortgage rates. Mortgage Interest Rates 2018 How Will This Impact Your Mortgage Payment. The average for the month 322.

The 15-year fixed mortgage rate fell 9 basis points to 248 from a. That is why it is important to know where rates are headed when deciding to start your home search. Ten-year fixed rate loans have a current interest rate of 385 while 15-year loans have an interest rate of 387.

The interest rate you pay on your home mortgage has a direct impact on your monthly payment.

Mortgage Rates Rise To Nearly Four Year High On Inflation Concerns Marketwatch

Mortgage Rates Rise To Nearly Four Year High On Inflation Concerns Marketwatch

2018 Mortgage Rate Forecast Overall It S Looking Pretty Good The Truth About Mortgage

2018 Mortgage Rate Forecast Overall It S Looking Pretty Good The Truth About Mortgage

Blog Articles Top Stories Nathan Neubauer

Blog Articles Top Stories Nathan Neubauer

A Look Ahead To 2018 Will Rates And Home Prices Move Higher Swanson Home Loans

A Look Ahead To 2018 Will Rates And Home Prices Move Higher Swanson Home Loans

Rising Mortgage Rates Will Begin To Impact Home Sales By Mid 2016 Zillow Research

Rising Mortgage Rates Will Begin To Impact Home Sales By Mid 2016 Zillow Research

Mortgage Interest Rate Sweden 2016 2020 Statista

Mortgage Interest Rate Sweden 2016 2020 Statista

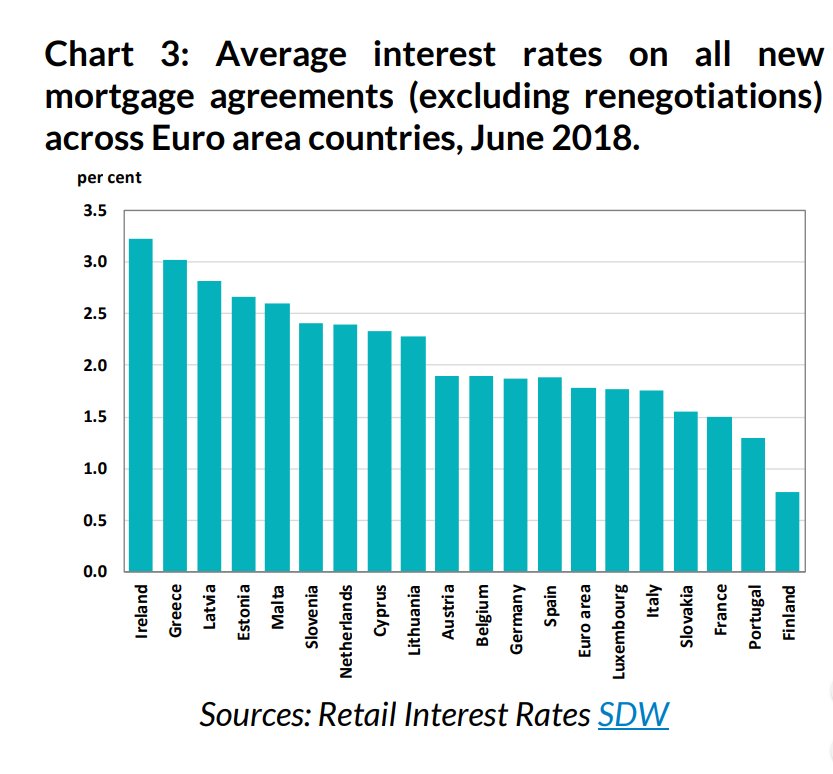

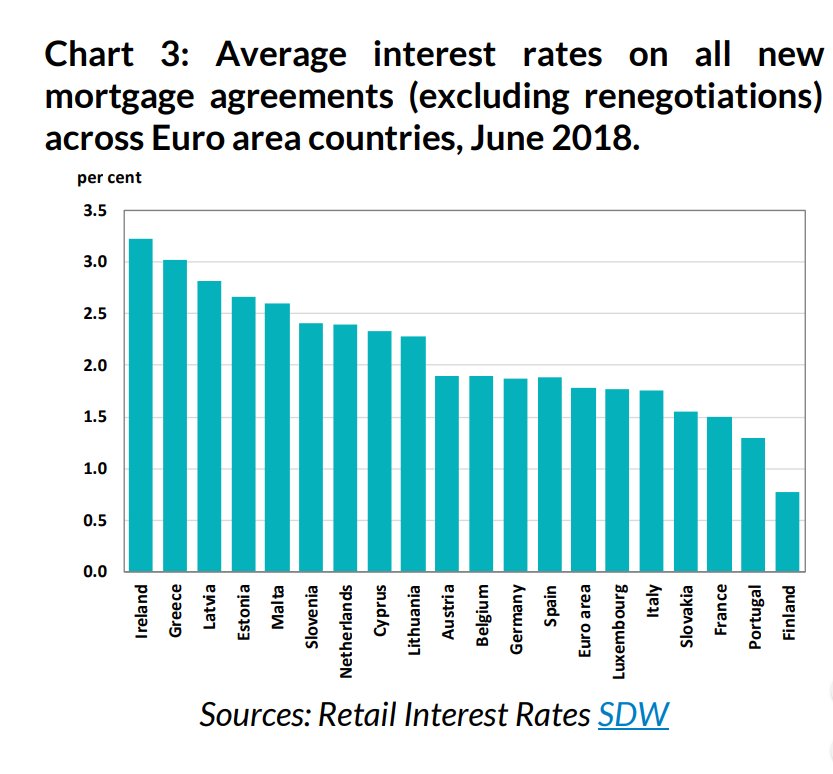

Average Interest Rates On All New Mortgage Agreements Across Euro Area Countries June 2018 Ireland

Average Interest Rates On All New Mortgage Agreements Across Euro Area Countries June 2018 Ireland

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Nowhere To Go But Up How Increasing Mortgage Rates Could Affect Housing Freddie Mac

Bne Intellinews Russia S Government Subsidised Mortgages Come To Rescue Of The Construction Sector

Blog Adashun Jones Real Estate

2018 Mortgage Rate Forecast Overall It S Looking Pretty Good The Truth About Mortgage

2018 Mortgage Rate Forecast Overall It S Looking Pretty Good The Truth About Mortgage

Mortgage Rate Forecasts For 2018 Predictions From The Experts

Compare New York 30 Year Fixed Mortgage Rates

Compare New York 30 Year Fixed Mortgage Rates

Comments

Post a Comment